Bears retained their dominance at Dalal Street for the fourth consecutive session on May 11, despite positive sentiment in global counterparts. The selling in technology, auto, FMCG stocks, L&T, and Bajaj Finance weighed down the market, though banks and HDFC capped losses.

The benchmark indices recouped around one percent loss from the day's low with the Nifty50 strongly defending the psychological 16,000 mark. The BSE Sensex fell 276 points to 54,088, while the Nifty50 declined 73 points to 16,167 and formed a bearish candle that resembles the Hammer kind of pattern on the daily charts.

"The short-term trend of Nifty continues to be negative," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Shetti further said Wednesday's sharp upside recovery could some bring hopes for bulls to make a comeback, but, the recent display of lack of strength to sustain the highs could mean a presence of strong resistance around 16,250-16,300 levels for another round of sell on rise opportunity. Immediate support is placed at 16,000 levels, the analyst added.

The broader markets also traded lower as more than four shares declined for every share rising on the NSE. The Nifty Midcap 100 index declined 0.4 percent and Smallcap 100 index fell nearly 3 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,000, followed by 15,833. If the index moves up, the key resistance levels to watch out for are 16,326 and 16,486.

Nifty Bank extended gains for yet another session and outperformed the broader space, rising 210 points to close at 34,693 on Wednesday. The important pivot level, which will act as crucial support for the index, is placed at 34,293, followed by 33,893. On the upside, key resistance levels are placed at 34,943 and 35,193 levels.

Maximum Call open interest of 30.15 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 17,500 strike, which holds 21.88 lakh contracts, and 16,500 strike, which has accumulated 20.82 lakh contracts.

Call writing was seen at 16,100 strike, which added 8.91 lakh contracts, followed by 16,000 strike which added 5.13 lakh contracts and 16,200 strike which added 3.23 lakh contracts.

Call unwinding was seen at 17,500 strike, which shed 2.03 lakh contracts, followed by 16,900 strike which shed 1.82 lakh contracts and 16,800 strike which shed 1.36 lakh contracts.

Maximum Put open interest of 50.14 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the May series.

This is followed by 15,500 strike, which holds 26.1 lakh contracts, and 16,500 strike, which has accumulated 24.02 lakh contracts.

Put writing was seen at 16,100 strike, which added 7.92 lakh contracts, followed by 16,000 strike, which added 5.75 lakh contracts and 15,000 strike which added 2.6 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 3.98 lakh contracts, followed by 16,300 strike which shed 2.01 lakh contracts, and 16,400 strike which shed 1.85 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Crompton Greaves Consumer Electricals, Infosys, Honeywell Automation, ICICI Lombard, and HDFC, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Bank Nifty, SRF, AU Small Finance Bank, Hindalco Industries, and Indraprastha Gas, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Chambal Fertilizers, Persistent Systems, Syngene International, Delta Corp, and Cummins India, in which long unwinding was seen.

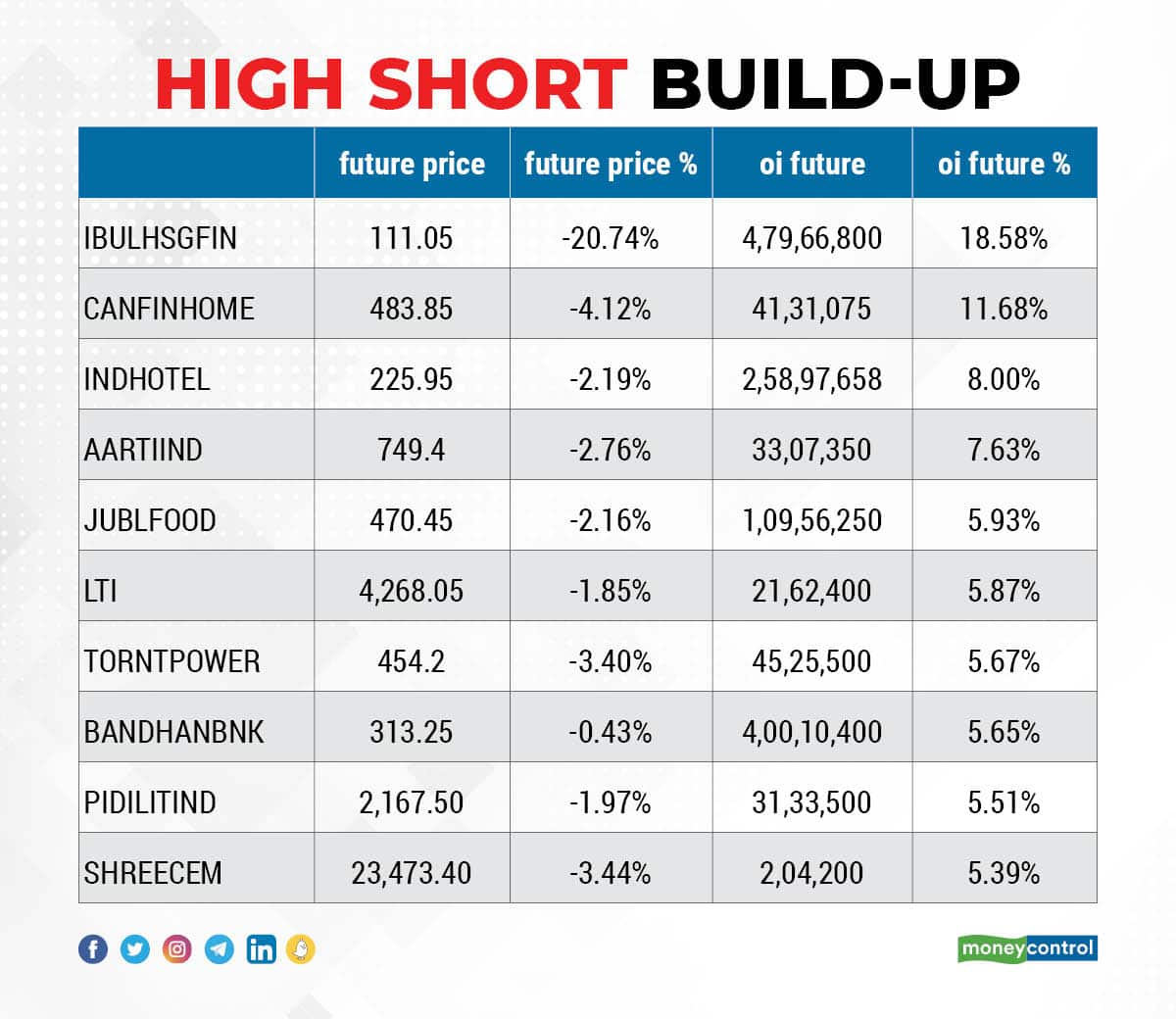

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Indiabulls Housing Finance, Can Fin Homes, Indian Hotels, Aarti Industries, and Jubilant Foodworks, in which a short build-up was seen.

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Gujarat Gas, ABB India, Nippon Life, Dalmia Bharat, and TVS Motor, in which short-covering was seen.

Man Industries: Investor Vikas Vijaykumar Khemani has acquired 4 lakh equity shares in the company via open market transactions, at an average price of Rs 73.79 per share.

Vaxtex Cotfab: Nomura Singapore has purchased 2.65 lakh equity shares in the company via open market transactions at an average price of Rs 35.6 per share.

Alliance Integrated Metaliks: Resonance Opportunities Fund has bought 8.8 lakh equity shares in the company via open market transactions at an average price of Rs 33.63 per share.

(For more bulk deals, click here)

Larsen & Toubro, Tata Motors, RBL Bank, Siemens, Aditya Birla Capital, Anupam Rasayan India, Apollo Tyres, Coforge, Greaves Cotton, Gujarat State Petronet, Honeywell Automation India, Poonawalla Fincorp, Ujjivan Small Finance Bank, Windlas Biotech, Avanti Feeds, Brigade Enterprises, CreditAccess Grameen, Genus Power Infrastructures, HP Adhesives, ICRA, Jammu & Kashmir Bank, JMC Projects, Lumax Auto Technologies, Matrimony.com, Mindspace Business Parks REIT, South Indian Bank and Spencers Retail will release their quarterly earnings on May 12.

Stocks in News

Birla Corporation: The company reported a 55.4 percent year-on-year decline in consolidated profit at Rs 111 crore for the quarter ended March 2022, impacted by higher power & fuel, input cost, and exceptional loss. Revenue grew by 6 percent to Rs 2,264.2 crore as compared to the year-ago period.

Petronet LNG: The liquefied natural gas importer clocked a 24 percent year-on-year growth in consolidated profit at Rs 791 crore in Q4FY22, driven largely by strong topline. Revenue grew by 47.3 percent to Rs 11,160.4 crore compared to year-ago period.

Lakshmi Machine Works: The company recorded a healthy 218 percent year-on-year growth in consolidated profit at Rs 82.72 crore in quarter ended March 2022, driven by strong topline and operating income. Revenue increased by 46 percent to Rs 998.5 crore compared to same period last year.

Pfizer: Life Insurance Corporation of India acquired 2.03 percent equity stake in the company via open market transactions. With this, its shareholding in the company stands increased to 6.05 percent, up from 4.02 percent earlier.

NCC: The construction company recorded a 97.4 percent year-on-year growth in consolidated profit at Rs 234 crore in quarter ended March 2022 despite weak operating income that was hit by higher input cost. Profitability was supported by entire stake sale in subsidiary NCC Virag Urban Infrastructure. Revenue grew by 23.5 percent to Rs 3,477 crore compared to same period last year.

Hindalco Industries: Subsidiary Novelis Inc recorded a 21 percent year-on-year growth in net income at $217 million in March 2022 quarter driven by topline and lower tax cost. Net sales increased 34 percent to $4.8 billion compared to year-ago period, primarily driven by higher average aluminum prices and local market premiums. But adjusted EBITDA at $431 million fell 15 percent YoY primarily due to short-term operational cost challenges.

Skipper: The power transmission & distribution structures manufacturer clocked a 177 percent year-on-year growth in profit at Rs 25.12 crore in quarter ended March 2022 led by higher operating income and margin performance (up 260 bps YoY). Revenue grew by 11 percent to Rs 552.65 crore and EBITDA increased by 44 percent to Rs 61.67 crore compared to year-ago period. Order inflow in Q4FY22 stood at Rs 271 crore, and the closing order book as on March 2022 stood at Rs 2,115 crore.

Macrotech Developers: The real estate developer in partnership with Bain Capital and Ivanhoé Cambridge will develop a next-generation green digital infrastructure platform. The platform will jointly invest around $1 billion to create ~30 million square feet of operating assets to serve India's digital economy.

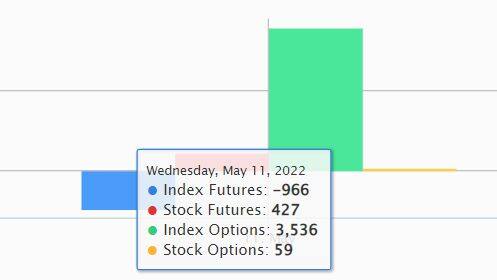

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 3,609.35 crore, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 4,181.20 crore worth of shares on May 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Indiabulls Housing Finance - is under the F&O ban for May 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!