The market fell more than two percent on May 4, especially after the Reserve Bank of India acted in line with other central banks by hiking repo rate by 40 bps and cash reserve ratio by 50 bps, extending losses for third consecutive session. Weak global cues ahead of outcome of Federal Reserve policy meeting also weighed on the sentiment.

The BSE Sensex plunged more than 1,300 points to 55,669, while the Nifty50 has decisively broken crucial support levels of 16,800-16,900 and tanked nearly 400 points to 16,678, forming Long Black Day kind of pattern on the daily charts.

"The present chart pattern indicates a downside breakout of the broader high low range movement of around 17,400-16,900 levels. This could be considered as a downside breakout of crucial lower support in the market. This is not a good sign and could have more weakness for the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He further said having broken again below the important support of 16,800, there are chances of further steep weakness in the near term. "This anticipated market action could open a possibility of larger degree of lower bottom formation below 15,670 levels in the next few weeks."

Any upside bounce from here could find strong resistance around 16,800-17,000 levels, while immediate downside targets to be watched for the Nifty are around 16,200 levels, Shetti said.

All sectoral indices finished the Wednesday's trade lower, while the broader markets fell more than 2 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,490, followed by 16,303. If the index moves up, the key resistance levels to watch out for are 16,999 and 17,320.

Bank Nifty fell 899 points or 2.5 percent to end at 35,265 on Wednesday. The important pivot level, which will act as crucial support for the index, is placed at 34,825, followed by 34,386. On the upside, key resistance levels are placed at 36,007 and 36,749 levels.

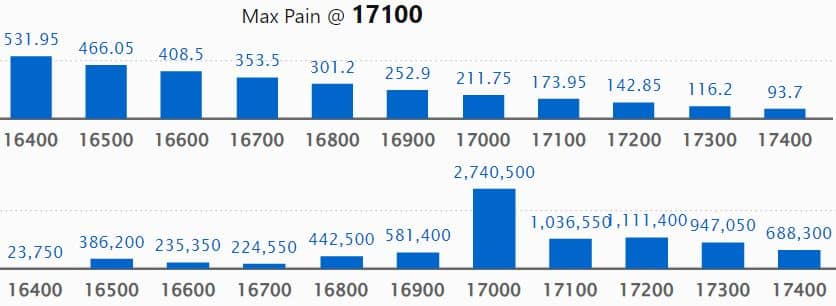

Maximum Call open interest of 27.4 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 17,500 strike, which holds 20.67 lakh contracts, and 18,000 strike, which has accumulated 19.54 lakh contracts.

Call writing was seen at 17,000 strike, which added 6.79 lakh contracts, followed by 16,900 strike which added 3.41 lakh contracts and 17,100 strike which added 3.15 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 1.9 lakh contracts, followed by 17,900 strike which shed 4,850 contracts.

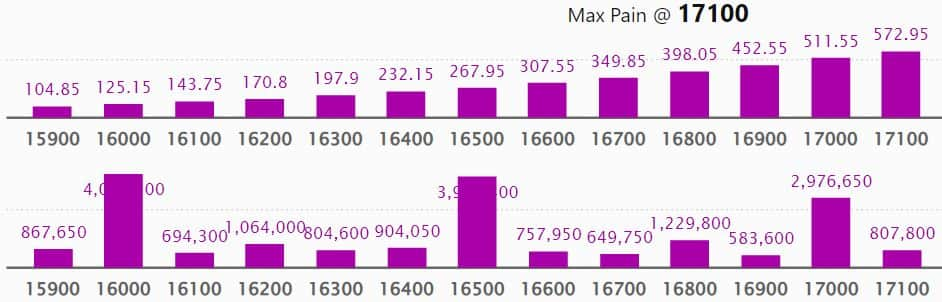

Maximum Put open interest of 40.12 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the May series.

This is followed by 16,500 strike, which holds 39.19 lakh contracts, and 17,000 strike, which has accumulated 29.76 lakh contracts.

Put writing was seen at 16,800 strike, which added 2.03 lakh contracts, followed by 16,600 strike, which added 1.92 lakh contracts and 16,000 strike which added 1.79 lakh contracts.

Put unwinding was seen at 17,000 strike, which shed 1.36 lakh contracts, followed by 17,300 strike which shed 96,950 contracts, and 17,200 strike which shed 44,900 contracts.

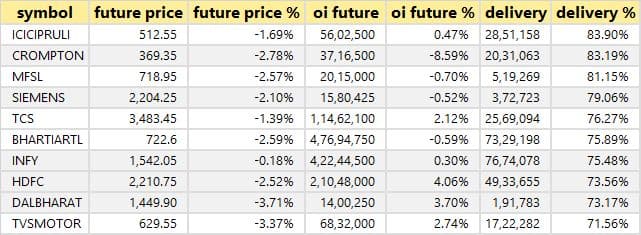

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ICICI Prudential Life Insurance, Crompton Greaves Consumer Electricals, Max Financial Services, Siemens, and TCS, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the six stocks including Rain Industries, Britannia Industries, Tata Chemicals, NTPC, and Exide Industries, in which a long build-up was seen.

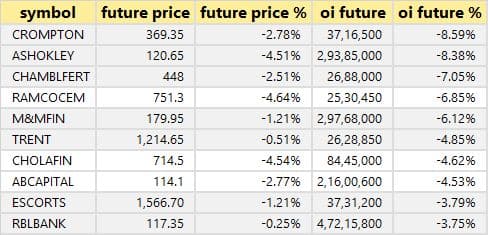

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Crompton Greaves Consumer Electricals, Ashok Leyland, Chambal Fertilizers, The Ramco Cements, and M&M Financial Services, in which long unwinding was seen.

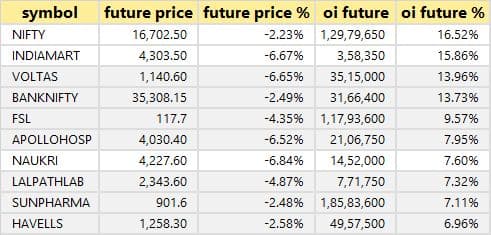

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty50, IndiaMART InterMESH, Voltas, Bank Nifty, and Firstsource Solutions, in which a short build-up was seen.

6 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the six stocks including Gujarat Gas, Petronet LNG, ONGC, Hindustan Aeronautics, and Power Grid Corporation, in which short-covering was seen.

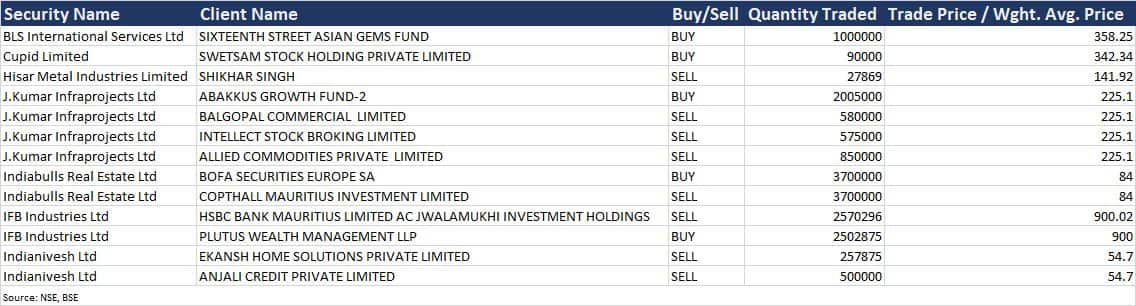

BLS International Services: Sixteenth Street Asian Gems Fund bought 10 lakh equity shares in the company via open market transactions at an average price of Rs 358.25 per share.

J Kumar Infraprojects: Ace investor Sunil Singhania-owned Abakkus Growth Fund-2 bought 20.05 lakh equity shares in the company via open market transactions at an average price of Rs 225.1 per share. However, Balgopal Commercial sold 5.8 lakh shares, Intellect Stock Broking sold 5.75 lakh shares and Allied Commodities offloaded 8.5 lakh shares in the company at an average price of Rs 225.1 per share.

Indiabulls Real Estate: BofA Securities Europe SA purchased 37 lakh shares in the company via open market transactions at an average price of Rs 84 per share. However, Copthall Mauritius Investment was the seller.

IFB Industries: HSBC Bank Mauritius Limited AC Jwalamukhi Investment Holdings offloaded 25,70,296 equity shares in the company at an average price of Rs 900.02 per share. However, Plutus Wealth Management LLP bought 25,02,875 shares at an average price of Rs 900 per share.

(For more bulk deals, click here)

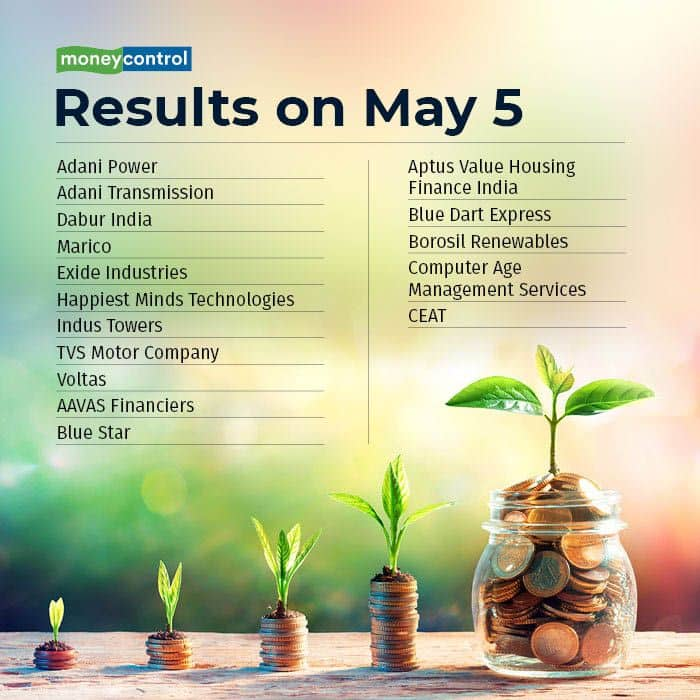

Adani Power, Adani Transmission, Dabur India, Marico, Exide Industries, Happiest Minds Technologies, Indus Towers, TVS Motor Company, Voltas, AAVAS Financiers, Blue Star, Aptus Value Housing Finance India, Blue Dart Express, Borosil Renewables, Computer Age Management Services, CEAT, Cholamandalam Investment and Finance Company, DCM Shriram, Firstsource Solutions, Intellect Design Arena, Jindal Stainless (Hisar), MMTC, Punjab Alkalies & Chemicals, Procter & Gamble Health, PNB Gilts, Quick Heal Technologies, Sona BLW Precision Forgings, and Tribhovandas Bhimji Zaveri will release quarterly earnings on May 5.

Stocks in News

SIS: The company recorded consolidated profit at Rs 97.4 crore for the quarter ended March 2022, down 4.7 percent compared to year-ago period on moderate growth in EBITDA and sharp downtick in other income. Revenue during the quarter grew by 8.3 percent YoY to Rs 2,648 crore and EBITDA increased by 0.9 percent to Rs 124.4 crore in Q4FY22, while the company crossed Rs 10,000 crore on full year basis in FY22, for the first time in its history.

Tata Consumer Products: The company clocked 304 percent year-on-year growth in consolidated profit at Rs 217.54 crore in the quarter ended March 2022 driven by growth in underlying profitability and lower exceptional costs. Revenue grew by 4.5 percent YoY to Rs 3,175.4 crore during the quarter, with 4 percent growth in topline in constant currency, supported by India branded business. Sivakumar Sivasankaran is appointed as Chief Financial Officer, India and as key managerial personnel of the company, in place of John Jacob, who is retiring from the services of the company.

ABB India: The company reported solid performance during the quarter ended March 2022, with profit growing 145 percent YoY to Rs 370 crore on strong topline and operating performance. Revenue during the first quarter of 2022 grew by 21 percent to Rs 1,968 crore compared to year-ago period. The company won orders worth Rs 2,291 crore in Q1CY22, up 25.5 percent YoY.

Havells India: The electrical equipment manufacturer clocked 16 percent year-on-year growth in Q4FY22 profit at Rs 352.48 crore driven by lower tax cost and higher topline. Revenue increased by 33 percent to Rs 4,426.3 crore compared to corresponding period last fiscal.

Dilip Buildcon: The company in a BSE filing said the road project 'four laning of Sangli- Solapur section of NH-166' in Maharashtra on Hybrid Annuity Mode' has been provisionally completed. The authority has issued Provisional Completion Certificate for the said project, saying the project fit for entry into commercial operation as on April 25, 2022.

Adani Total Gas: The Adani Group company reported a 44 percent year-on-year decline in consolidated profit at Rs 81 crore in quarter ended March 2022 impacted by higher cost of natural gas prices. However, revenue grew by 73 percent YoY to Rs 1,065.5 crore during the quarter on higher volume coupled with increase in sales price.

Cyient: The company has completed acquisition of 100 percent stake in Grit Consulting, Singapore.

CarTrade Tech: The company posted loss of Rs 21.39 crore for the quarter ended March 2022 against profit of Rs 15.95 crore in corresponding period last fiscal as there was a loss of Rs 25.94 crore at EBITDA level, against EBITDA profit of Rs 15.95 crore in same period last year. Revenue grew by 13.4 percent to Rs 93.1 crore during the same period.

Fund Flow

Foreign institutional investors (FIIs) have net offloaded shares worth Rs 3,288.18 crore, whereas domestic institutional investors (DIIs) were net buyers to the tune of Rs 1,338 crore worth of shares on May 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The NSE has not put any stock under the F&O ban for May 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!