Flagship indices the Sensex and the Nifty ended lower on June 9 owing to profit-booking in select heavyweights in the second half of the session.

After opening in the green, Nifty hit a fresh record high of 15,800.45 but failed to hold altitude.

The Sensex closed 334 points, or 0.64 percent, lower at 51,941.64 while the Nifty settled with a loss of 105 points, or 0.67 percent, at 15,635.35. Nifty Bank suffered a loss of 285 points, or 0.81 percent, to close at 34,800.50.

The Nifty formed a strong bearish candle on the daily scale as it engulfed the price recovery of the last four sessions and negated its formation of higher lows of the last four trading sessions.

As per Chandan Taparia, Vice President and Derivatives Analyst at Motilal Oswal Financial Services, the index has to cross and hold above 15,600 to witness an up-move towards 15,750 and a fresh lifetime high of 15,800 while on the downside, support exists at 15,550 and 15,400.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,534.63, followed by 15,433.97. If the index moves up, the key resistance levels to watch out for are 15,768.23 and 15,901.17.

Nifty Bank

The important pivot level which will act as crucial support for Bank Nifty is placed at 34,493.66, followed by 34,186.83. On the upside, key resistance levels are placed at 35,254.86 and 35,709.23.

Call option data

Maximum Call open interest of 23.67 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 15,700 strike, which holds 12.82 lakh contracts, and 15,800 strike, which has accumulated 12.3 lakh contracts.

Call writing was seen at 15,800 strike, which added 1.74 lakh contracts, followed by 15,600 strike which added 86,250 contracts, and 15,700 strike which added 83,325 contracts.

Call unwinding was seen at 15,500 strike, which shed 1.27 lakh contracts, followed by 15,400 strike which shed 38,400 contracts, and 16,000 strike which shed 27,750 contracts.

Put option data

Maximum Put open interest of 21.38 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the June series.

This is followed by 15,400 strike, which holds 16.2 lakh contracts, and 15,300 strike, which has accumulated 14.11 lakh contracts.

Put writing was seen at 15,500 strike, which added 2.72 lakh contracts, followed by 15,400 strike which added 1.6 lakh contracts, and 15,100 strike which added 1.06 lakh contracts.

Put unwinding was seen at 15,200 strike which shed 3.72 lakh contracts, followed by 16,000 strike, which shed 63,525 contracts.

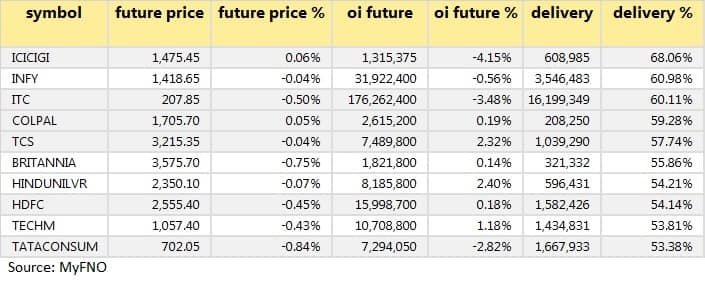

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

14 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

70 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

55 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

20 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

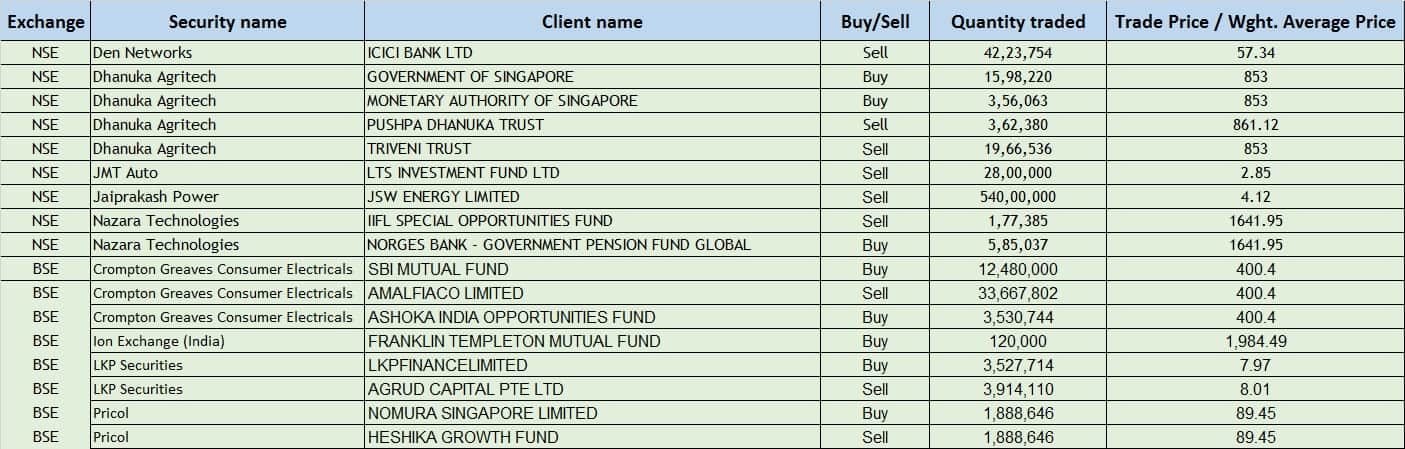

Bulk deals

(For more bulk deals, click here)

Results on June 10

Century Plyboards, Mazagon Dock Shipbuilders, NHPC, Parle Industries, SAIL, GP Petroleums and Dhoot Industrial Finance are among the companies that will announce their quarterly earnings on June 10.

Stocks in News

Coral India Finance & Housing: Navin Bachubhai Doshi, promoter of the company, proposed to sell up to 18,67,170 equity shares of Coral India Finance & Housing. The floor price for the offer shall be Rs 35.

Accelya Solutions India: Accelya Group Bidco Limited, promoter of the company, proposed to sell up to 21,81,773 equity shares. The floor price for the offer shall be Rs 910.

lndraprastha Medical Corporation: The company posted a net profit of Rs 15 crore in Q4FY21 against Rs 6.4 crore in a year-ago period.

TCI Express: The company's new sorting centre at Pune has become operational after receiving relevant regulatory approvals.

LT Foods: The company has incorporated a wholly-owned subsidiary LT Foundation.

PTC India Financial Services: The company has reported a loss of Rs 53.66 crore against a profit of Rs 7 crore.

Amtek Auto: The company posted a loss of Rs 145.77 crore in Q4FY21 against a loss of Rs 78.42 crore in Q4FY20.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 846.37 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 271.7 crore in the Indian equity market on June 9, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - BHEL, Canara Bank, National Aluminium, SAIL and Sun TV Network - are under the F&O ban for June 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!