Benchmark indices ended in the green for the third day in a row on April 29 with Sensex closing the session with a gain of 606 points and Nifty settling 172 points higher at 9,553.35.

"Expectations of lockdown measures easing and company-specific news about restarting operations, gave support to the markets," said Vinod Nair, Head of Research, Geojit Financial Services.

"Nifty is expected to test 9,900-10,000 levels in the next few weeks. Broader participation is increasing which is a positive sign. On the downside, trend support is seen only at 8,900. We expect the broader market to remain positive over the next few weeks. Traders can consider buying on dips," said Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,430.52, followed by 9,307.68. If the index continues moving up, key resistance levels to watch out for are 9,638.02 and 9,722.68.

Nifty Bank

The Nifty Bank closed 2.03 percent up at 21,090.20. The important pivot level, which will act as crucial support for the index, is placed at 20,539.87, followed by 19,989.53. On the upside, key resistance levels are placed at 21,494.37 and 21,898.53.

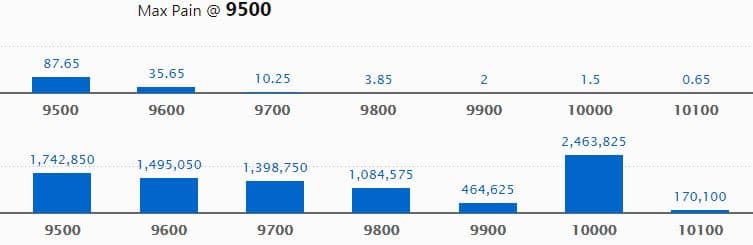

Call option data

Maximum call OI of 24.64 lakh contracts was seen at the 10,000 strike. It will act as crucial resistance in the April series.

This is followed by 9,500, which holds 17.43 lakh contracts, and 9,600 strikes, which has accumulated 14.95 lakh contracts.

Call writing was seen at the 10,000 strike, which added 3.23 lakh contracts, followed by 9,600 strike that added 2.04 lakh contracts.

Call unwinding was witnessed at 9,500, which shed 8.76 lakh contracts, followed by 9,400 strikes, which shed 7.98 lakh contracts.

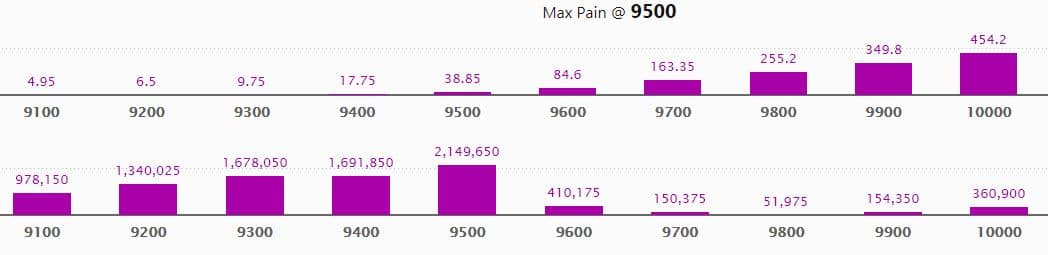

Put option data

Maximum put OI of 21.5 lakh contracts was seen at 9,500 strike, which will act as crucial support in the April series.

This is followed by 9,400, which holds 16.92 lakh contracts, and 9,300 strikes, which has accumulated 16.78 lakh contracts.

Significant put writing was seen at 9,500, which added 13.38 lakh contracts, followed by 9,400 strikes, which added 8.08 lakh contracts.

Put unwinding was seen at 9,200, which shed 3.69 lakh contracts, followed by 9,300 strikes that shed 3.35 lakh contracts.

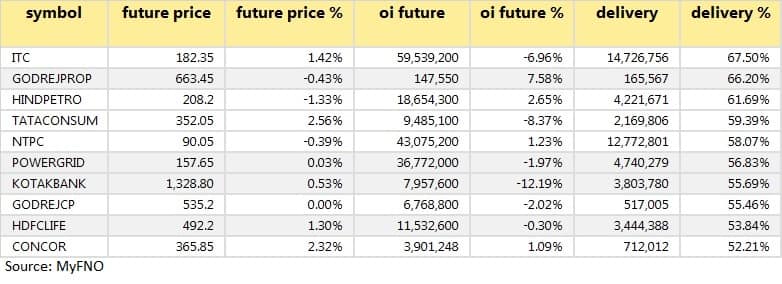

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

29 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

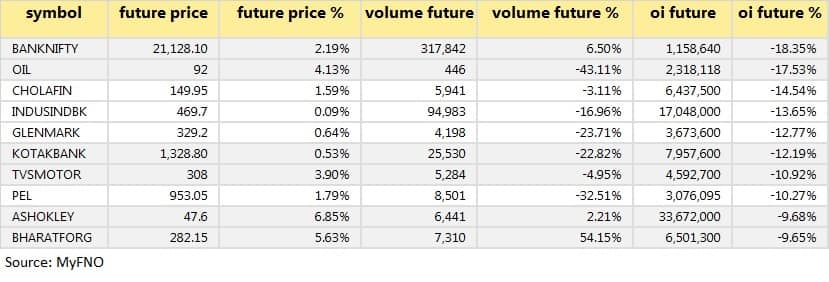

22 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

17 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

75 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

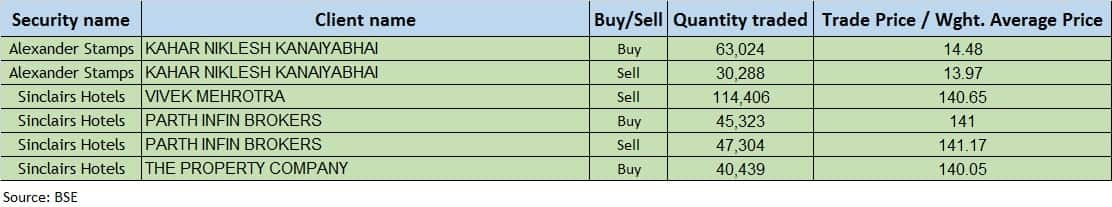

Bulk deals

(For more bulk deals, click here)

Board meetings

Just Dial: The board will meet on April 30 to consider and approve the buyback of shares.

Blue Star: The board will meet on April 30 for general purposes.

Deccan Gold Mines: The board will meet on April 30 for general purposes.

PNB Gilts: The board will meet on April 30 for general purposes.

Sundaram - Clayton: The board will meet on April 30 for general purposes.

Stocks in the news

Results: Reliance Industries, Hindustan Unilever, Tech Mahindra, Apollo Tricoat Tubes, Aditya Birla Money, Laurus Labs, Ecom Infotech and Security and Intelligence Services are among the companies that will release their quarterly numbers on April 30.

Wipro: Company and Nutanix to launch digital database services (DDS) powered by Nutanix Era and Nutanix HCI software.

Polycab India: Board on May 2 to consider the proposal for investment/acquisition of shares.

Sintex Industries: Alpha Leon Enterprises LLP bought 35,27,564 shares of the company at Rs 0.95 per share.

RBL Bank: BNP Paribas Arbitrage purchased 29,79,801 shares of the company at Rs 125.42 per share.

Cyient: Amansa Holdings Pvt Ltd acquired 21,11,780 shares in the company at Rs 205 per share.

GP Petroleums: Company resumed operations at Vasai plant.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 722.08 crore, while domestic institutional investors (DIIs), too, bought shares worth Rs 78.67 crore in the Indian equity market on April 29, provisional data available on the NSE showed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.