After a consistent run-up for the last seven consecutive sessions and the formation of a Dragonfly Doji kind of candlestick pattern (indicating the possibility of trend reversal) along with a bearish crossover in hourly charts and increasing volatility, experts expect some kind of consolidation with the index facing resistance at 21,000 mark while taking support at 20,800-20,500 area.

On December 5, the BSE Sensex climbed 358 points to 69,654, and the Nifty50 jumped 83 points to 20,938, taking the total seven-day gains to 3,684 points and 1,143 points, respectively.

"The bearish formation around the crucial resistance of 21,000 amplifies the bearish sentiment. The support lies at 20,850, below which the market may witness a healthy correction in the short term," Rupak De, senior technical analyst at LKP Securities said.

On the other hand, he feels a move above 21,000 might trigger a resumption of the bullish trend.

According to Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas, the psychological 21,000 mark can provide some resistance for the Nifty50 over the next few trading sessions.

"Also, on the hourly charts, the momentum indicator has a negative crossover which indicates a loss of momentum on the upside. Considering the sharp runup in the previous few trading sessions a consolidation is highly likely," Jatin said.

On the upside, he feels 21,000-21,060 shall act as an immediate hurdle zone and 20,800-20,730 shall act as a crucial support zone.

The market breadth largely remained equal on the NSE, while India VIX, which measures the expected volatility for the next 30 days in the Nifty50, rose by 2.09 percent to 13.74, the highest closing level since March 28 this year.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 20,959, followed by 20,985 and 21,027, while on the lower side, it can take support at 20,875 followed by 20,849 and 20,808 levels.

On December 6, the Bank Nifty underperformed the benchmark index Nifty50 and formed a Bearish Belt Hold kind of candlestick pattern on the daily scale, the bearish reversal pattern, forming at the uptrend. The index fell 178 points to 46,835.

The banking index seems to have experienced profit booking at higher levels in anticipation of the upcoming key RBI policy event. "Despite this, the overall market sentiment remains bullish. It is advisable to adopt a buy-on-dip strategy, maintaining a positive outlook as long as the index sustains above the critical level of 46,400," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

He feels the immediate hurdle is positioned at 47,250 and a successful breach beyond this level is anticipated to pave the way for further upside momentum towards the 48,000 level.

As per the pivot point calculator, the index is expected to see resistance at 47,143, followed by 47,263 and 47,458, while on the lower side, it may take support at 46,754, followed by 46,633 and 46,439.

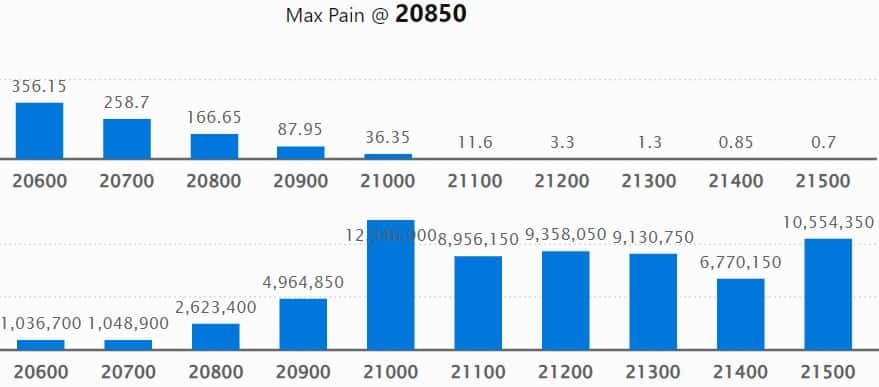

On the weekly options data front, the maximum Call open interest (OI) remained at 21,000 strike with 1.23 crore contracts, which can act as a key resistance level for the Nifty. It was followed by the 21,500 strike, which had 1.05 crore contracts, while the 21,200 strike had 93.58 lakh contracts.

Meaningful Call writing was seen at the 21,100 strike, which added 47.31 lakh contracts followed by 21,300 and 21,200 strikes, which added 43.07 lakh and 40.39 lakh contracts.

The maximum Call unwinding was at the 20,800 strike, which shed 21.11 lakh contracts followed by 20,700 and 20,600 strikes, which shed 13.01 lakh and 6.18 lakh contracts.

On the Put front, the 20,800 strike has the maximum open interest, which can act as a key support area for the Nifty, with 1.01 crore contracts. It was followed by 20,500 strike comprising 95.79 lakh contracts and 20,900 strike with 90.59 lakh contracts.

Meaningful Put writing was at 20,900 strike, which added 76.5 lakh contracts followed by 20,800 strike and 20,500 strike, which added 25.74 lakh contracts and 20.28 lakh contracts.

Put unwinding was at 20,100 strike, which shed 26.08 lakh contracts followed by 19,900 strike, which shed 9.16 lakh contracts and 19,800 strike which shed 8.88 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. United Spirits, Hindustan Unilever, Max Financial Services, Berger Paints and Dr Reddy's Laboratories saw the highest delivery among the F&O stocks.

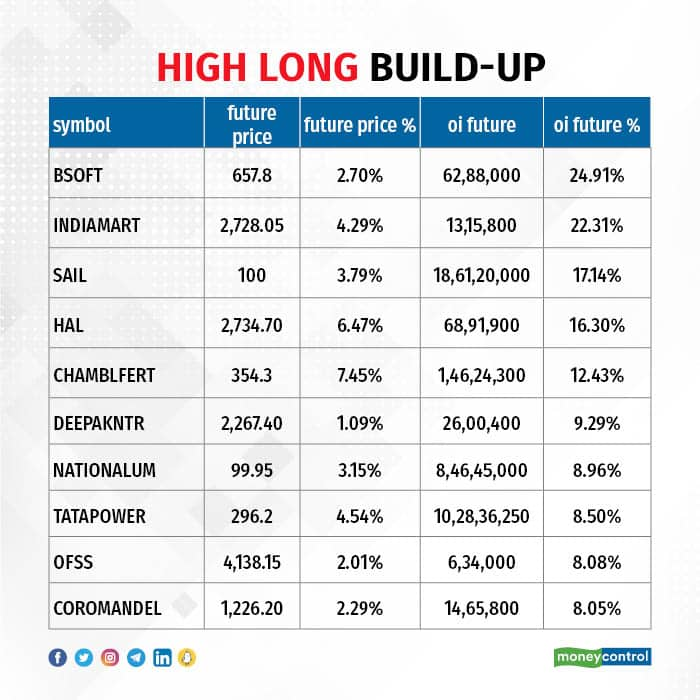

A long build-up was seen in 73 stocks, which included Birlasoft, IndiaMART InterMESH, SAIL, Hindustan Aeronautics and Chambal Fertilisers & Chemicals. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 29 stocks saw long unwinding, including ABB India, State Bank of India, Dr Reddy's Laboratories, Kotak Mahindra Bank and Bajaj Auto. A decline in OI and price indicates long unwinding.

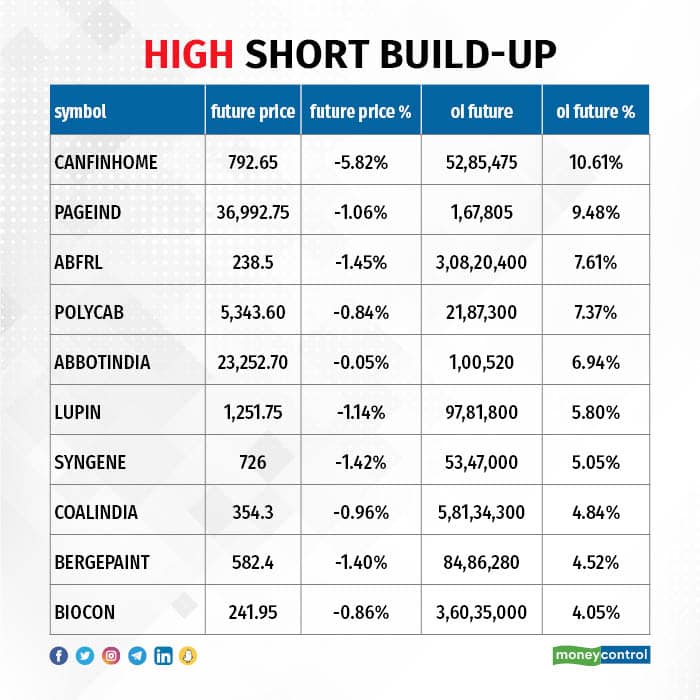

45 stocks see a short build-up

A short build-up was seen in 45 stocks, which were Can Fin Homes, Page Industries, Aditya Birla Fashion & Retail, Polycab India and Abbott India. An increase in OI along with a fall in price points to a build-up of short positions.

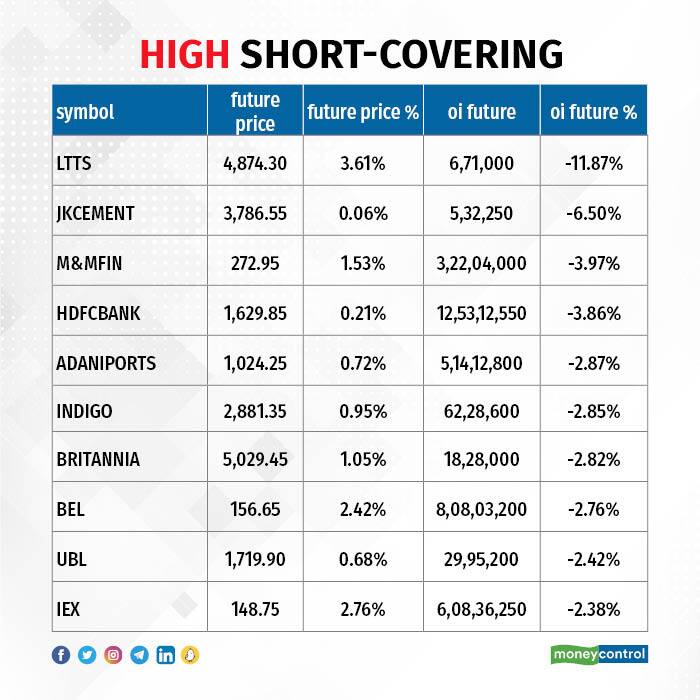

Based on the OI percentage, 39 stocks were on the short-covering list. These include L&T Technology Services, JK Cement, M&M Financial Services, HDFC Bank and Adani Ports & Special Economic Zone. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped further to 1.18 on December 6, from 1.37 levels in the previous session. An above 1 PCR indicates that the traders are buying more Put options than Calls, which generally indicates an increase in bearish sentiment.

For more bulk deals, click here

Stocks in the news

IRCON International: The Government of India will be selling an 8 percent stake or 7.52 crore equity shares in the infrastructure company via offer-for-sale (OFS) on December 7-8, with a floor price of Rs 154 per share.

Dr Reddy’s Laboratories: Subsidiary Dr Reddy's Laboratories SA and Coya Therapeutics Inc entered into a development and license agreement for the development and commercialisation of COYA 302, an investigational combination therapy for the treatment of Amyotrophic Lateral Sclerosis (ALS).

Bharat Electronics: The state-owned defence company has received an order of Rs 580 crore from the Indian Army for AMC of radars. It has also received additional orders worth Rs 3,335 crore since the last disclosure on September 15, 2023. With this, cumulatively BEL has received orders worth Rs 18,298 crore in FY24.

One 97 Communications: The Paytm operator will further expand its business to offer higher-ticket personal and merchant loans, which would be targeted at lower-risk and high credit-worthy customers, in partnership with large banks and NBFCs.

IDFC First Bank: Cloverdell Investment, an affiliate of global private equity firm Warburg Pincus is likely to sell a 1.3 percent stake in IDFC First Bank via a block deal, reports CNBC-TV18 quoting sources. The deal size may be around $100 million, with a floor price of Rs 85.7 per share.

TV18 Broadcast: Network18 Media & Investments and TV18 Broadcast announced a Scheme of Arrangement. As per the scheme, TV18 and e-Eighteen.com (E18, which owns and operates the Moneycontrol website and app) will merge with Network18.

Funds Flow (Rs Crore)

Foreign institutional investors (FIIs) turned net sellers for the first time in the last 10 consecutive sessions, offloading shares worth Rs 79.88 crore, while domestic institutional investors (DIIs) bought Rs 1,372.18 crore worth of stocks on December 6, provisional data from the National Stock Exchange (NSE) showed.

Stock under F&O ban on NSE

The NSE has added SAIL to its F&O ban list for December 7, while retaining Delta Corp, Indiabulls Housing Finance, India Cements and Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.