The market continued its southward journey for yet another session on June 23, falling around half a percent, but took a support at 18,650 on the Nifty50, which is near its 21-day EMA (18,631). Hence, if the said support gets broken then it can see correction up to 18,500-18,450 levels, while the resistance remains at 18,700-18,800 levels, experts said.

The weakness in global counterparts and correction in most of key sectors weighed down the market. The BSE Sensex fell 260 points to 62,979, while the Nifty50 declined 106 points to 18,666 and formed bearish candlestick pattern on the daily scale, while there was Double Top kind of pattern formation on the hourly charts and Dark Cloud Cover candlestick pattern on the weekly timeframe, which is broadly negative.

"For traders, 18,650 would act as a sacrosanct support level. If the index trades above the same then it could retest the level of 18,880 and move up to 19,000. Below the 18,650, the market could slip till 18,500-18,450," said Amol Athawale, Technical Analyst (DVP) at Kotak Securities.

Additionally, the relative strength index (RSI) indicates negative divergence, indicating a weakening bullish momentum. If the index breaks below 18,500, it could potentially drop towards 18,200, Rupak De, Senior Technical analyst at LKP Securities said.

The broader markets also corrected for second straight session, with the Nifty Midcap 100 and Smallcap 100 indices declining over 1 percent each on weak breadth.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

The pivot point calculator suggests that the Nifty may get support at 18,648, followed by 18,622 and 18,580, whereas in case of upside, 18,731 can be a key resistance area for the index, then 18,757 and 18,799.

The Bank Nifty fell over 100 points amid consolidation and closed at 43,623, forming Doji kind of candlestick pattern on the daily charts, while bearish candlestick pattern on the weekly scale.

"Bank Nifty has been moving in a lower high formation since June 8 and consolidating between the 43,400-44,050 zones since last 7 trading sessions. A decisive breakout on either side of the range will set the tone for the next move," said Ashwin Ramani, Derivatives & Technical Analyst at SAMCO Securities.

The pivot point calculator indicated that the Bank Nifty is likely to take support at 43,539, followed by 43,467 and 43,351, whereas 43,772 can be the initial resistance zone for the index, followed by 43,844 and 43,960.

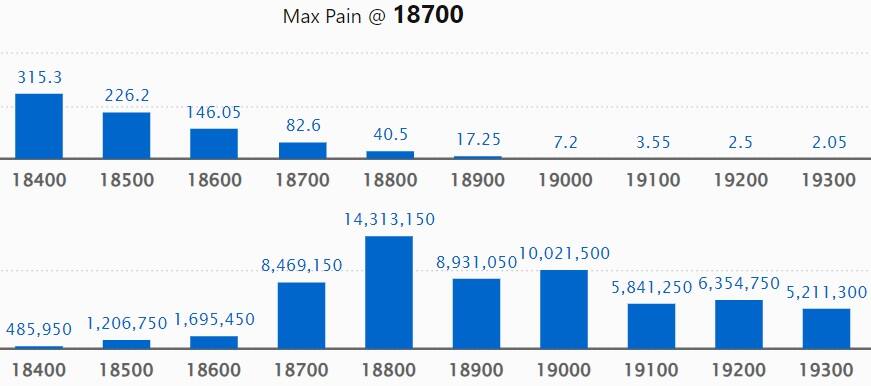

The monthly options data showed that we have maximum Call open interest (OI) at 18,800 strike, with 1.43 crore contracts, which can act as a crucial resistance area for the Nifty50 in coming sessions.

This was followed by 1 crore contracts at 19,000 strike, while 18,900 strike has 89.31 lakh contracts.

We have meaningful Call writing at 18,700 strike, which added 65.38 lakh contracts, followed by 18,800 strike and 19,000 strike, which added 38.8 lakh contracts, and 29.65 lakh contracts, respectively.

Maximum Call unwinding was at 19,600 strike, which shed 38,500 contracts, followed by 17,600 and 18,500 strikes, which shed 30,650 and 24,900 contracts, respectively.

On the Put side, the maximum open interest was at 18,000 strike, with 76.11 lakh contracts, which can be a crucial support level for the Nifty50 in the coming sessions.

This was followed by the 18,800 strike, comprising 75.54 lakh contracts, and the 18,700 strike, which has 75.05 lakh contracts.

Put writing was seen at 18,700 strike, which added 29.6 lakh contracts, followed by 18,400 strike and 18,500 strike, which added 23.6 lakh contracts and 22.95 lakh contracts, respectively.

We have Put unwinding at 18,800 strike, which shed 25.74 lakh contracts, followed by 18,900 strike and 19,000 strike, which shed 9.07 lakh contracts, and 2.94 lakh contracts, respectively.

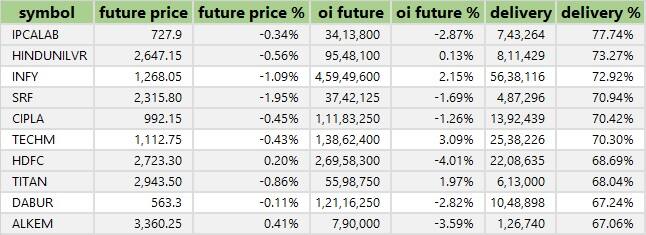

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. We have seen the highest delivery in Ipca Laboratories, Hindustan Unilever, Infosys, SRF, and Cipla among others.

An increase in open interest (OI) and price indicates a build-up of long positions. Based on the OI percentage, we have seen a long build-up in 21 stocks including Aurobindo Pharma, Astral, Bharti Airtel, Dr Reddy's Laboratories, and Trent.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 67 stocks including Oracle Financial, Rain Industries, Hindustan Copper, Coforge, and ACC saw a long unwinding.

90 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, we have seen a short build-up in 90 stocks including Dr Lal PathLabs, Hindustan Aeronautics, Ramco Cements, MCX India, and Mahanagar Gas.

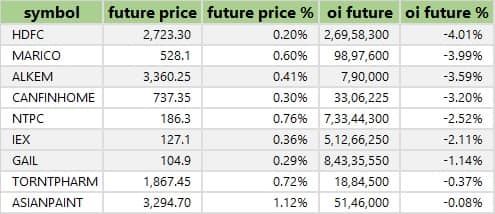

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 9 stocks were on the short-covering list. These included HDFC, Marico, Alkem Laboratories, Can Fin Homes, and NTPC.

Landmark Cars: Global private equity firm TPG Growth II SF Pte Ltd has exited the automotive retailer by selling entire 44.56 shares or 11.25 percent stake at an average price of Rs 658 per share, which amounted to Rs 293.2 crore. Promoter Sanjay Karsandas Thakker (HUF) also offloaded its entire 1.41 percent stake or 5.6 lakh shares at same price. However, Unifi Capital, Societe Generale, ICICI Prudential Life Insurance Company, Goldman Sachs Funds - Goldman Sachs India Equity Portfolio, Abakkus Diversified Alpha Fund, Abakkus Asset Manager LLP, and 3P India Equity Fund 1 bought 38.62 lakh shares or 9.7 percent stake in the company at an average price of Rs 658 per share, which amounted to Rs 254.13 crore.

Indiabulls Housing Finance: Florintree Insurtech LLP has acquired 30.5 lakh equity shares or 0.64 percent stake in the housing finance company via open market transactions at an average price of Rs 115.54 per share.

Parag Milk Foods: Sixth Sense India Opportunities III, a venture capital fund managed by Sixth Sense Ventures, has bought additional 6.8 lakh shares or 0.58 percent stake in the milk products company at an average price of Rs 121.23 per share. Sixth Sense India Opportunities III already held 2.3 percent stake in the company, and Sixth Sense India Opportunities II has 1.54 percent stake as of March 2023.

Sterling and Wilson Renewable Energy: Promoter Shapoorji Pallonji and Company offloaded 35 lakh shares or 1.84 percent stake in the renewable energy company at an average price of Rs 295.25 per share, which was worth Rs 103.33 crore. However, Sahastraa Advisors bought 9.9 lakh shares and Setu Securities purchased 17.1 lakh shares in the company at same price.

Easy Trip Planners: Promoter Nishant Pitti has sold 6.25 crore equity shares or 3.6 percent stake in the travel agency company via open market transactions at an average price of Rs 42.6 per share, which amounted to Rs 266.58 per share. However, Wilson Holdings was the buyer in this deal, acquiring all shares at same price.

Harsha Engineers International: Foreign portfolio investor Abu Dhabi Investment Authority exited the precision bearing cages manufacturer by selling entire 17.76 lakh equity shares or 1.95 percent stake at an average price of Rs 435.02 per share. The stake sale was worth Rs 77.25 crore. However, Plutus Wealth Management LLP bought 16.04 lakh shares in Harsha at an average price of Rs 435 per share.

63 Moons Technologies: The Miri Strategic Emerging Markets Fund LP, the hedge fund owned by US-based Miri Capital Management LLC, has bought 4.46 lakh shares in the 63 Moons via open market transactions at an average price of Rs 190.68 per share.

Antony Waste Handling Cell: The Miri Strategic Emerging Markets Fund LP has bought additional 6.27 lakh shares or 2.2 percent stake in the solid waste collection company at an average price of Rs 318.99 per share. In previous session, Miri already bought 2.5 lakh shares of Antony Waste, taking total stake 3.1 percent in two days.

(For more bulk deals, click here)

Investors Meetings on June 26

Radiant Cash Management Services: Officials of the company will interact with Systematix, Mahindra Manulife Mutual Fund, Alchemy Capital, and ITI Mutual Fund.

Rolex Rings: Officials of the company will be meeting ICICI Prudential Life, Nippon Mutual Fund, SBI Mutual Fund, ICICI Prudential Mutual Fund, and HSBC Mutual Fund.

Uno Minda: Company's senior officials will interact with Phutnam Investments, Singapore.

Five-Star Business Finance: Officials of the company will be meeting Sundaram Mutual Fund, and Nippon Life Insurance.

Finolex Industries: Company's officials will meet Nomura Asset Management, Blackrock Asset Management, Aregence Capital, and Sixteenth Street.

Som Distilleries & Breweries: Senior officials of the firm will interact with Envision Capital.

Stocks in the news

Ipca Laboratories: The US Food and Drug Administration (US FDA) has issued Form 483 with eight observations for company's Pithampur formulations manufacturing facility in Madhya Pradesh. The USFDA conducted the inspection of said facility during June 15-June 23.

Asian Paints: The paint manufacturer has acquired additional 11 percent equity stake in Obgenix Software (brand name White Teak) for Rs 54 crore, from promoters Pawan Mehta, and Gagan Mehta. The company now holds 60 percent stake in White Teak, up from 49 percent earlier and as a result, White Teak has become a subsidiary of Asian Paints.

Rail Vikas Nigam: The state-owned railway company has emerged as the lowest bidder a project of design and construction of elevated metro viaduct, from Maharashtra Metro Rail Corporation. The cost of project is Rs 394.9 crore and the said project is expected to be executed in 30 months.

Cambridge Technology Enterprises: The IT firm received board approval for acquisition of US-based Appshark Software Inc for Rs 41 crore. Appshark is primarily engaged in salesforce consulting and custom software development. The said acquisition is expected to be completed by March 2026. It also acquired RP Web Apps for Rs 3 crore and the said acquisition is expected to be completed by July 30, 2023.

AU Small Finance Bank: The small finance bank said the board members will meet on June 29 to consider raising of funds by issue of equity shares or debt instruments.

HDFC Life Insurance Company: The Insurance Regulatory and Development Authority of India (IRDAI) granted its approval for transfer of shares of HDFC Life, from HDFC to HDFC Bank in view of the proposed amalgamation between HDFC and HDFC Bank. IRDAI also granted approval for HDFC to acquire additional shares in HDFC Life, so the holding to be more than 50 percent of its total share capital.

Godrej Properties: The real estate developer has acquired approximately 15 acres of land in Gurugram, Haryana through an outright purchase, for the development of premium residential apartments.

Zydus Lifesciences: Subsidiary Zydus Animal Health and Investments has entered into a share purchase agreement with Rising Sun Holdings and Mylab Discovery Solutions to acquire 6.5 percent stake in Mylab from Rising Sun Holdings, for Rs 106 crore. The proposed investment in Mylab will help Zydus to participate in growing diagnostics space.

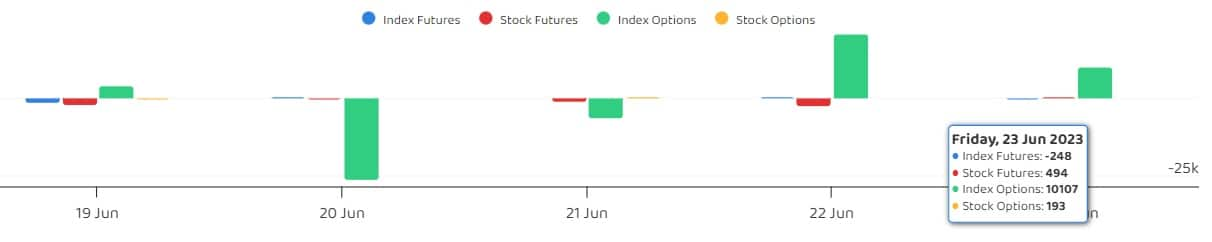

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 344.81 crore, while domestic institutional investors (DII) offloaded shares worth Rs 684.01 crore on June 23, provisional data from the National Stock Exchange shows.

Stocks under F&O ban on NSE

The National Stock Exchange has added Hindustan Aeronautics to its F&O ban list for June 26 and retained Hindustan Copper, L&T Finance Holdings, Punjab National Bank, and RBL Bank on the list. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.