Friday's session witnessed modest gains for equity benchmarks as concerns over the deteriorating health of the domestic economy persisted.

Nifty closed above its crucial 5-days EMA which is a positive sign, but for the week, it closed flat with a negative bias.

The S&P BSE Sensex rose 0.08 percent while the Nifty50 fell 0.1 percent for the week that ended on November 15.

"We reiterate our consolidation view on Nifty and suggest focusing more on stock selection and position management," said Ajit Mishra, Vice President - Research, Religare Broking.

Mazhar Mohammad, Chief Strategist – Technical Research and Trading Advisory, Chartviewindia.in said that in the next session, if the Nifty slips below 11,891, then initially it should head towards the 11,802-mark, and a breach of this shall further accelerate selling pressure with ideal targets placed around 11,700.

Nifty remained volatile throughout the week in a wider trading range of 11,800-12,000 and faced stiff resistance at 12,000-mark which has been acting as a crucial resistance level.

"The short-term trend for Nifty continues to be rangebound with a slight negative bias. We expect a soft start on Monday with some rangebound trade. As long as Nifty trades below 12,050 levels, we expect some consolidation in the range of 11,800-12,000 zone," said Nilesh Jain, derivatives and technical analyst at Anand Rathi.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, key support level for Nifty is placed at 11,858.57, followed by 11,821.63. If the index continues moving up, key resistance levels to watch out for are 11,953.07 and 12,010.63.

Nifty Bank

Nifty Bank closed 0.84 percent up at 31,008.40. The important pivot level, which will act as crucial support for the index, is placed at 30,857.6, followed by 30,706.8. On the upside, key resistance levels are placed at 31,162.3 and 31,316.2.

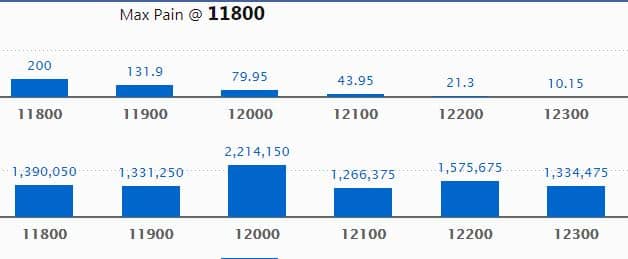

Call options data

Maximum call open interest (OI) of 22.14 lakh contracts was seen at the 12,000 strike price. It will act as a crucial resistance level in November series.

This is followed by 12,200 strike price, which holds 15.76 lakh contracts in open interest, and 11,800, which has accumulated 13.90 lakh contracts in open interest.

Significant call writing was seen at the 12,300 strike price, which added 1.43 lakh contracts, followed by 12,200 strike price that added 1.18 lakh contracts and the 12,100 strike, which added 62,400 contracts.

Call unwinding was witnessed at the 12,400 strike price, which shed 45,225 contracts, followed by 11,800 that shed 30,675 contracts.

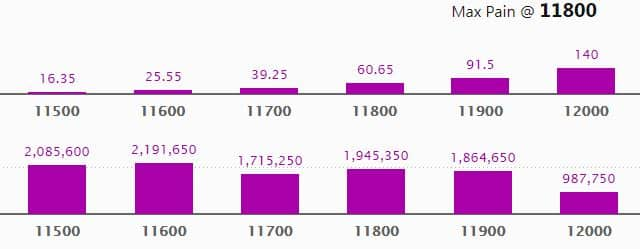

Put options data

Maximum put open interest of 21.92 lakh contracts was seen at 11,600 strike price, which will act as crucial support in the November series.

This is followed by the 11,500 strike price, which holds 20.86 lakh contracts in open interest, and 11,800 strike price, which has accumulated 19.45 lakh contracts in open interest.

Put writing was seen at the 11,900 strike price, which added nearly 3.69 lakh contracts, followed by 12,000 strike, which added 1.42 lakh contracts and 11,800 strike, which added 1.15 lakh contracts.

There was no put unwinding.

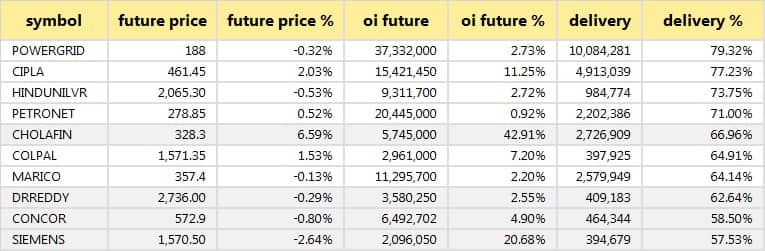

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

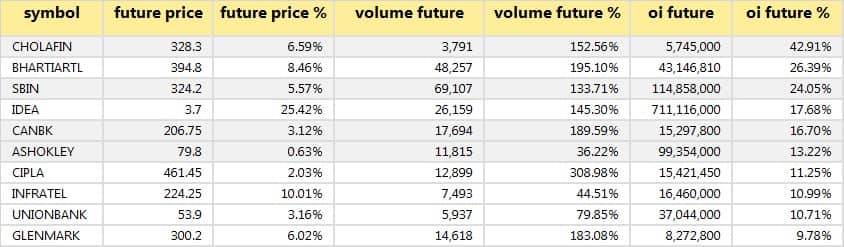

75 stocks saw long buildup

Overall, 75 stocks witnessed a long buildup on November 15. Based on open interest (OI) future percentage, here are the top 10 stocks in which long buildup was seen.

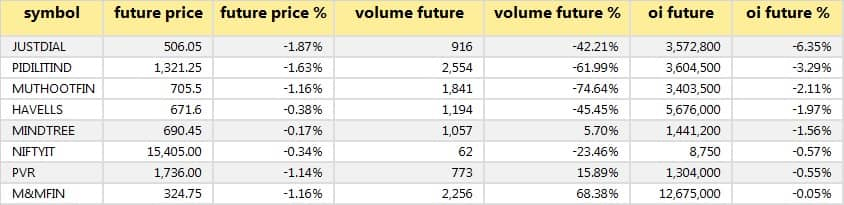

8 stocks saw long unwinding

57 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

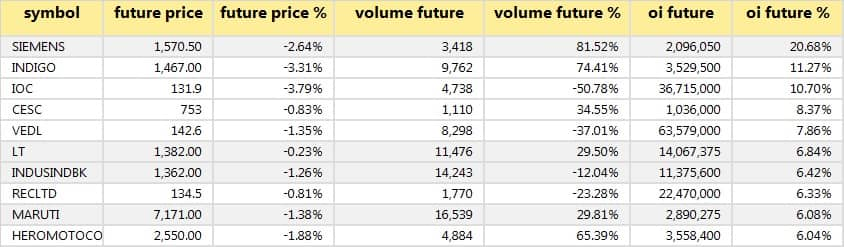

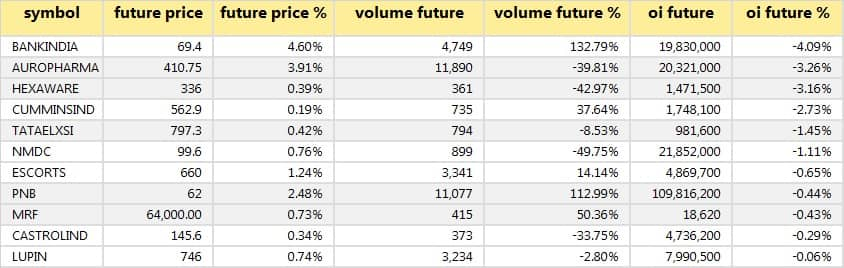

11 stocks witnessed short-covering

As per available data, 11 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering.

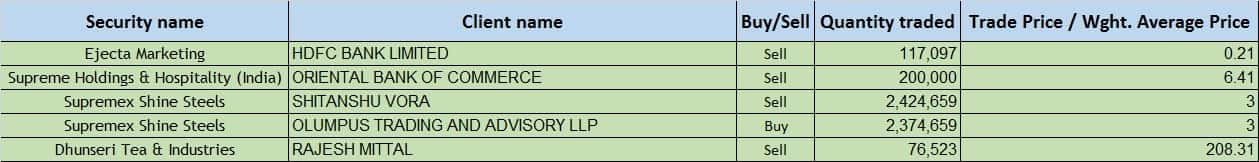

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

The respective boards of Alexander Stamps And Coin, Amtek Auto, Gujarat Apollo Industries, Mysore Paper Mills and Ok Play India will meet on November 18 to announce their quarterly results.

The respective boards of Frontier Informatics and Som Datt Finance will meet on November 18 for general purposes.

Stocks in news

Wockhardt: Cipla, Dr Reddy's Labs, Carlyle & Asian Investment Fund PAG are in the fray to acquire select business segments of the company, said sources.

HIL: The company added additional capacities and commences production of pipes at the Telangana plant.

Tata Steel: S&P revised the company's rating outlook to stable from positive.

Asian Oilfield Services: The company acquired an additional 51 percent stake in Optimum Oil & Gas, making it a subsidiary.

HCL Infosystems: Subsidiary HCL Learning sold entire shareholding in its subsidiary HCL Insys, Singapore, to PCCW Solutions, Hong Kong, for SGD 57,628,787.

FII & DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,008.37 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 537.74 crore in the Indian equity market on November 15, provisional data available on the NSE showed.

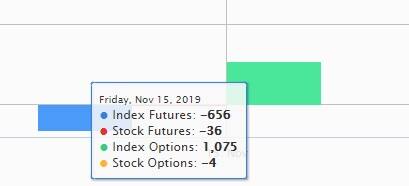

Fund flow

Stock under F&O ban on NSE

Just Dial is under F&O ban for November 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.