Technology stocks played a vital role on January 12, boosting the Nifty 50 to a new high after eight days of consolidation and closing a tad below 21,900 levels. Given the strong momentum in the bull's camp, the index is likely to climb the much-awaited psychological 22,000 mark soon with support at 21,750-21,600 levels, but might get pressure from bears at 22,000, experts said.

On January 12, the benchmark indices ended at a new record closing high with the BSE Sensex rising 847 points to 72,568, while the Nifty 50 surged 247 points or 1.14 percent to 21,895 and formed a bullish candlestick pattern on the daily timeframe. In fact, the index has also seen a strong breakout of downward downward-sloping resistance trendline hurdle of 21,750 with a gap-up opening on the same day.

The positive chart pattern like higher tops and bottoms is intact and the recent swing low of January 10 at 21,448 could be considered as a new higher bottom of the sequence, Nagaraj Shetti, senior technical research analyst, HDFC Securities said.

Even on the weekly chart, the Nifty 50 has formed a reasonable bull candle with a long lower shadow, nullifying the bearish doji pattern implication of the previous week, as Nifty closed above the high of last week (at 21,834 levels). Hence, the next upside level to be watched is around 22,200, while the immediate support is at 21,750, Nagaraj said.

Momentum indicators like RSI (relative strength index) are holding the bullish zones on daily and weekly scales which indicates about ongoing strength of the index. "Now it has to hold above 21,800 area, to make an up move towards 22,000 then 22,222 levels, while on the downside support exists at 21,650 and 21,450 zones," Chandan Taparia, senior vice president | analyst-derivatives at Motilal Oswal Financial Services said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty and Bank Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,914 followed by 21,978 and 22,059 levels, while on the lower side, it can take support at 21,765 followed by 21,714 and 21,633 levels.

Meanwhile, on January 12, the Bank Nifty also closed higher but the gains were lower than the benchmarks. The banking index climbed 272 points to 47,710 and formed a bullish candlestick pattern with upper & lower shadows on the daily charts.

"The Bank Nifty index displayed strength by overcoming the initial hurdle at 47,500, signaling potential upward movement towards the next resistance level at 48,000," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

He further said a decisive breach of 48,000 is crucial, as it could trigger substantial short covering, propelling the index towards the 50,000 mark. The lower support is evident at 47,000, a level marked by significant Put writing, he added.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at the 47,752 level followed by 47,952 and 48,129 levels, while on the lower side, it may take support at 47,486 followed by 47,376 and 47,199 levels.

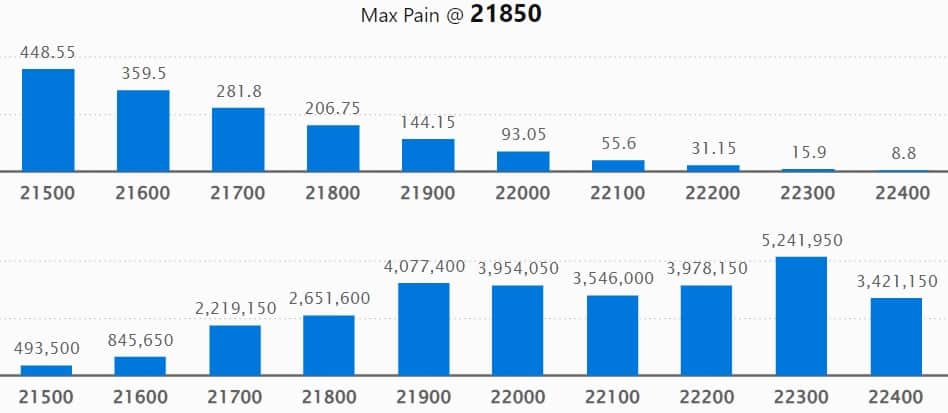

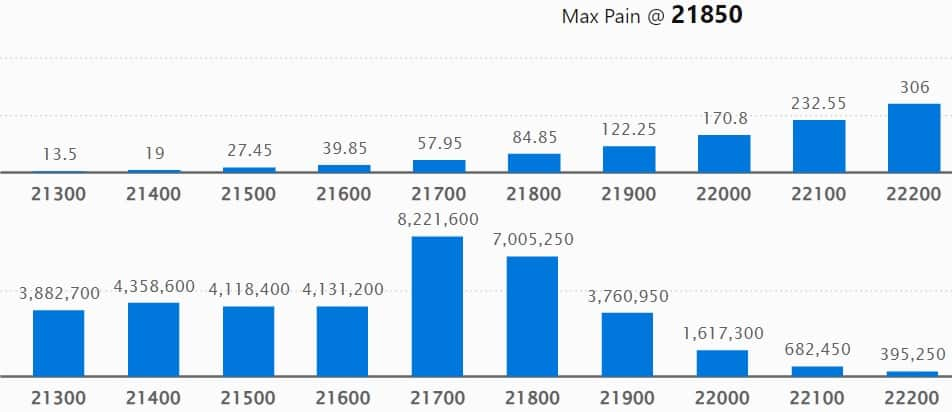

As per the weekly options data, 22,500 strike owned the maximum Call open interest, with 59.15 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,300 strike, which had 52.41 lakh contracts, while the 21,900 strike had 40.77 lakh contracts.

Meaningful Call writing was seen at the 22,600 strike, which added 27.27 lakh contracts followed by 22,500 and 22,700 strikes adding 26.38 lakh and 22.96 lakh contracts, respectively.

The maximum Call unwinding was at the 21,700 strike, that shed 12.32 lakh contracts followed by 21,600 and 21,500 strikes which shed 6.19 lakh and 2.24 lakh contracts.

On the Put front, the maximum open interest was seen at 21,700 strike, which can act as a key support area for Nifty with 82.21 lakh contracts. It was followed by 21,000 strike comprising 70.45 lakh contracts and then 21,800 strike with 70.05 lakh contracts.

Meaningful Put writing was at 21,700 strike, which added 66.79 lakh contracts followed by 21,800 strike and 21,000 strike adding 64.66 lakh contracts and 37.46 lakh contracts, respectively.

There was no Put unwinding in any strike in the range of 20,100-23,000.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Piramal Enterprises, Navin Fluorine International, JK Cement, Cholamandalam Investment & Finance, and Godrej Consumer Products saw the highest delivery among the F&O stocks.

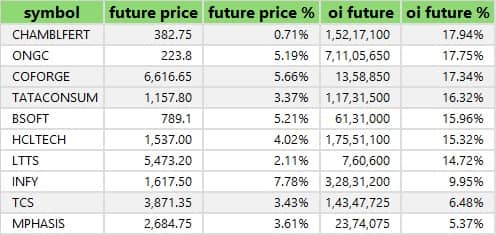

A long build-up was seen in 45 stocks, which included Chambal Fertilisers & Chemicals, ONGC, Coforge, Tata Consumer Products, and Birlasoft. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 34 stocks saw long unwinding, including Gujarat Gas, Dr Lal PathLabs, Exide Industries, BHEL, and Oberoi Realty. A decline in OI and price indicates long unwinding.

57 stocks see a short build-up

A short build-up was seen in 57 stocks including Metropolis Healthcare, HDFC Life Insurance Company, HDFC Asset Management Company, Balrampur Chini Mills, and Container Corporation of India. An increase in OI along with a fall in price points to a build-up of short positions.

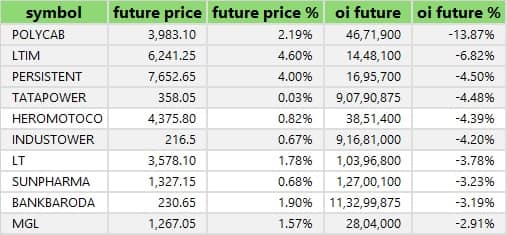

Based on the OI percentage, 50 stocks were on the short-covering list. This included Polycab India, LTIMindtree, Persistent Systems, Tata Power Company, and Hero MotoCorp. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, jumped to 1.43 (the highest level since December 27) on January 12, from 0.86 levels in the previous session. The above 1 PCR indicates that the traders are buying more Puts options than Call, which generally indicates an increase in bearish sentiment.

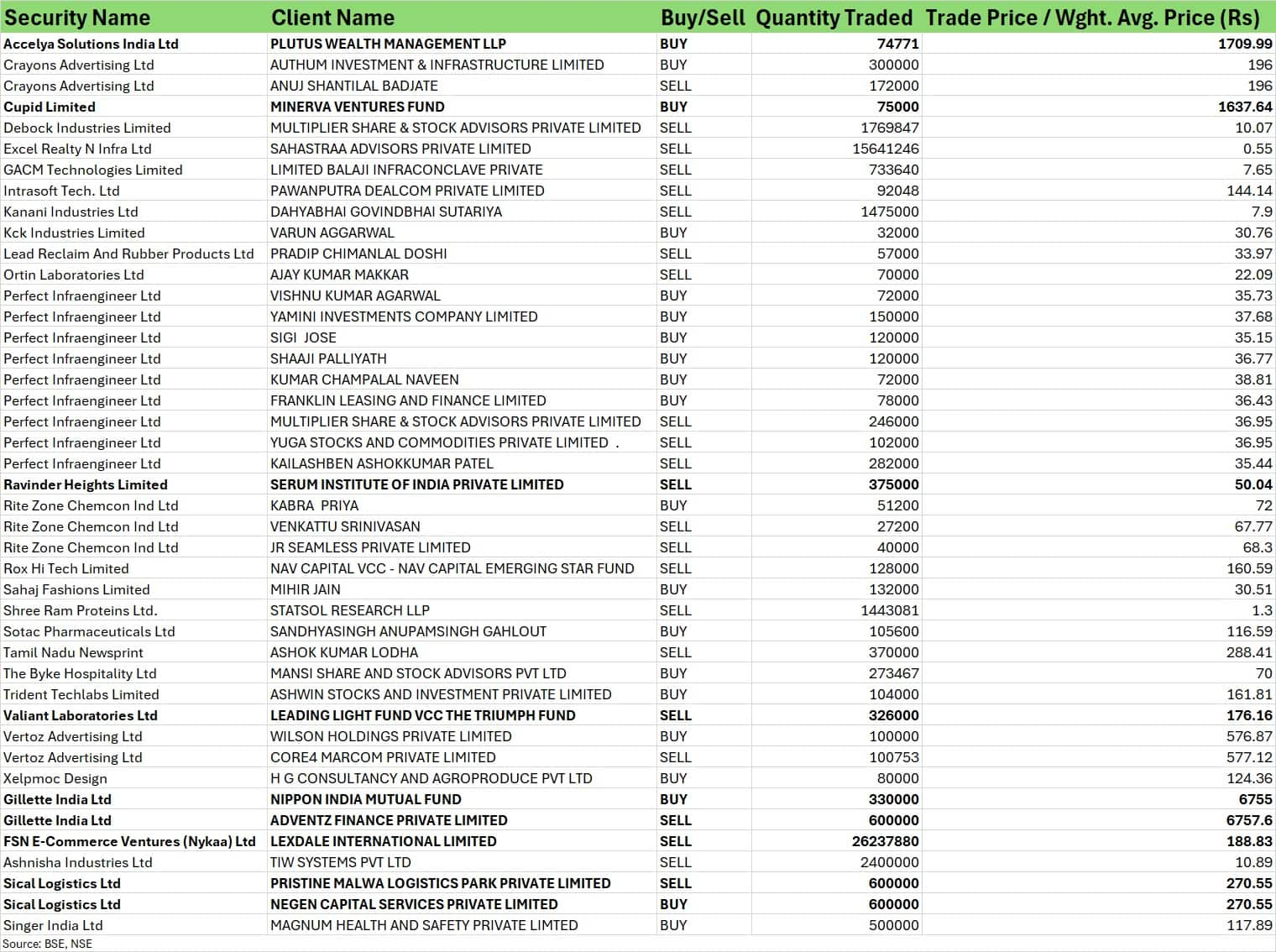

For more bulk deals, click here

Jio Financial Services, Angel One, Fedbank Financial Services, Kesoram Industries, Metalyst Forgings, Nelco, PCBL, Reliance Industrial Infrastructure, Suraj Estate Developers, Brightcom Group, Choice International, Digicontent, Excel Realty N Infra, and Jai Balaji Industries will be in focus ahead of quarterly earnings on January 15.

Stocks in the news

HCL Technologies: The technology company has registered a 13.5 percent QoQ growth in profit at Rs 4,350 crore for the quarter ended December FY24, beating analysts' expectations. Revenue during the quarter grew by 6.7 percent sequentially to Rs 28,446 crore and constant currency revenue growth at 6 percent.

Wipro: The company has reported IT services revenue at Rs 22,150.8 crore for the quarter ended December FY24, falling 1.09 percent over the previous quarter, while revenue in dollar terms dropped 2.1 percent sequentially to $2,656.1 million, and the same in constant currency fell 1.7 percent QoQ for the quarter.

Tata Consumer Products: The FMCG company has signed definitive agreements to acquire a 100 percent stake in Capital Foods for Rs 5,100 crore, and Organic India for Rs 1,900 crore.

Adani Enterprises: Adani New Industries, a wholly-owned subsidiary of the company, has received a Letter of Award (LoA) from Solar Energy Corporation of India (SECI) for setting up electrolysers manufacturing capacity of 198.5 MW per annum in India under Strategic Interventions for Green Hydrogen Transition Scheme (Tranche-I).

Bharat Heavy Electricals: BHEL has received a Letter of Award (LOA) for an EPC package for the 3x800 MW NLC Talabira Thermal Power Project (NTTPP) in Jharsuguda, Odisha from NLC India. The project is worth Rs 15,000 crore.

Just Dial: The local search engine has recorded a 22.3 percent on-year growth in net profit at Rs 92 crore for the quarter ended December FY24, while revenue from operations increased by 19.7 percent YoY to Rs 265 crore during the same period.

Vikas Lifecare: Subsidiary Genesis Gas Solutions has accomplished the incorporation of IGL Genesis Technologies, the joint venture company, with Indraprastha Gas (IGL). IGL holds a 51 percent stake and Genesis Gas 49 percent in the joint venture company.

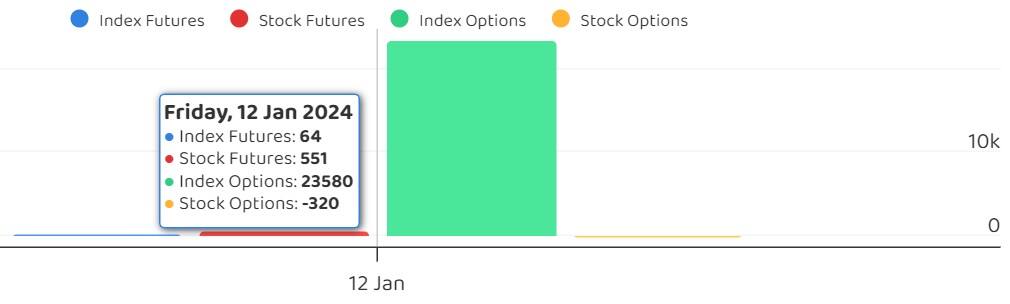

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) offloaded shares worth Rs 340.05 crore, while domestic institutional investors (DIIs) bought Rs 2,911.19 crore worth of stocks on January 12, provisional data from the NSE showed.

Stock under F&O ban on NSE

A total of 15 stocks are in the F&O ban list for January 15. The NSE has added Chambal Fertilisers & Chemicals, and Metropolis Healthcare to the said list while retaining Bandhan Bank, BHEL, Delta Corp, Escorts Kubota, Hindustan Copper, India Cements, Indus Towers, National Aluminium Company, Piramal Enterprises, Polycab India, PVR INOX, SAIL and Zee Entertainment Enterprises to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.