The domestic equities witnessed a strong rally on the monthly F&O expiry day as the benchmark indices clocked more than a percent gain on November 24, tracking positive global cues and falling oil prices. A continued decline in volatility after FOMC minutes, too, aided the investor sentiment.

All sectors participated in the bull run, but the broader markets underperformed frontliners as the Nifty Midcap 100, Smallcap 100, and Midcap 50 indices gained around half a percent each.

The benchmark indices ended at a record closing high on Thursday. The BSE Sensex jumped 762 points to 62,273, while the Nifty50 rose 217 points to 18,484 and formed a long bullish candle on the daily charts making a higher high higher low for the second consecutive session.

"A long bull candle was formed on the daily chart, which indicates an attempt at a sharp upside breakout of the crucial resistance around 18,400 levels. This also signals an upside breakout of the range movement of the last two weeks," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Positive chart patterns such as higher tops and bottoms continued on the daily chart and the recent swing low of 18,133 could now be considered as a new higher bottom of the sequence. Further upmove from here is likely to pull Nifty towards the new higher top, the market expert said.

The volatility index India VIX fell by 4 percent to 13.48 levels, giving more comfort to bulls.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,346, followed by 18,290 & 18,200. If the index moves up, the key resistance levels to watch out for are 18,526 followed by 18,581 and 18,671.

The Nifty Bank rallied 346 points to 43,075 and formed a bullish candle on the daily charts, making a higher high and higher low for the third straight session. The important pivot level, which will act as crucial support for the index, is placed at 42,852, followed by 42,759 and 42,609 levels. On the upside, key resistance levels are placed at 43,153 followed by 43,246 & 43,397 levels.

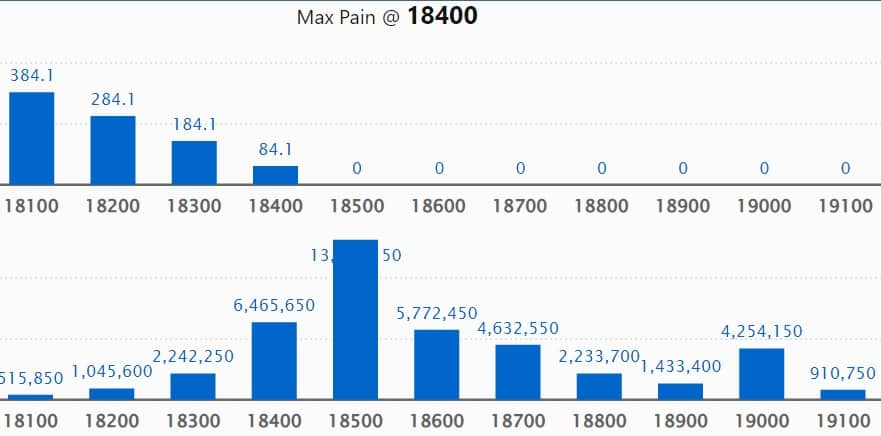

The maximum Call open interest of 1.31 crore contracts was seen at 18,500 strike, which can act as a crucial resistance level in the December series.

This is followed by 18,400 strike, which holds 64.65 lakh contracts, and 18,600 strike, which have more than 57.72 lakh contracts.

Call writing was seen at 18,500 strike, which added 39.18 lakh contracts.

Call unwinding was seen at 18,300 strike, which shed 1.21 crore contracts, followed by 18,400 strike which shed 51.73 lakh contracts and 18,700 strike which shed 32.44 lakh contracts.

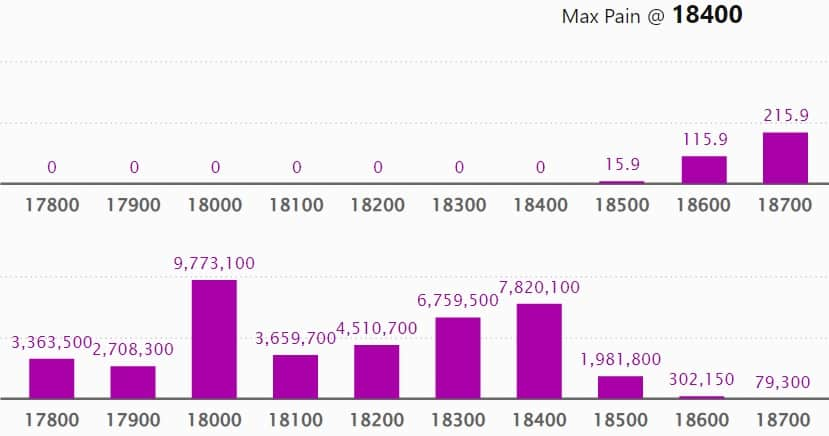

We have seen a maximum Put open interest of 97.73 lakh contracts at 18,000 strike, which can act as a crucial support level in the December series.

This is followed by an 18,400 strike, which holds 78.20 lakh contracts, and an 18,300 strike, which has accumulated 67.59 lakh contracts.

Put writing was seen at 18,400 strike, which added 55.08 lakh contracts, followed by 18,500 strike, which added 12.31 lakh contracts, and 17,300 strike which added 8.98 lakh contracts.

Put unwinding was seen at 18,200 strike, which shed 33.57 lakh contracts, followed by 18,100 strike which shed 20.32 lakh contracts and 17,900 strike which shed 15.79 lakh contracts.

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Voltas, ICICI Lombard General Insurance, ICICI Bank, ICICI Prudential Life Insurance, and SBI Life Insurance Company, among others.

Here are the top 10 stocks which saw the highest rollovers on monthly expiry day including Atul, Max Financial Services, IndusInd Bank, UltraTech Cement, and Oberoi Realty with more than 98 percent rollovers.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 9 stocks including Honeywell Automation, REC, Nestle India, Persistent Systems, and ABB India, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Alkem Laboratories, Escorts, NMDC, Gujarat Gas, and Vodafone Idea, in which long unwinding was seen.

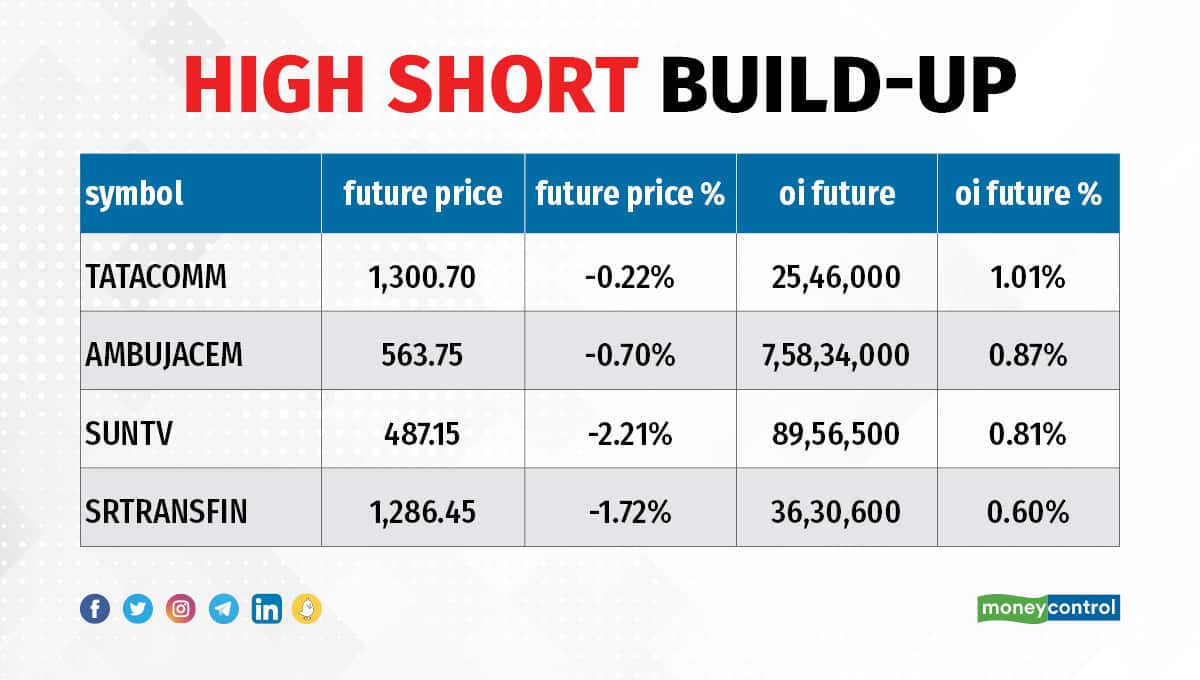

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 4 stocks in which a short build-up was seen - Tata Communications, Ambuja Cements, Sun TV Network, and Shriram Transport Finance.

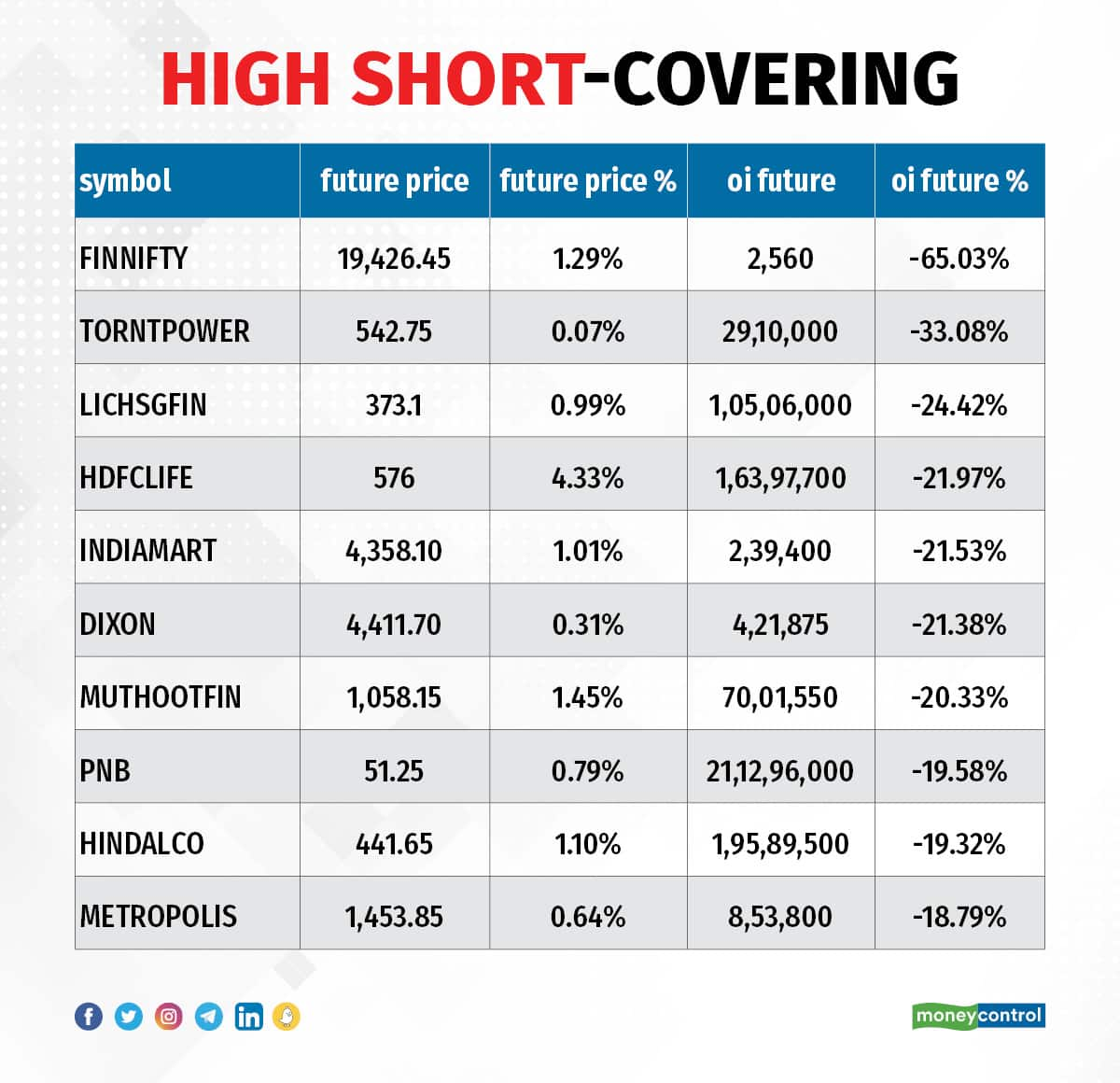

113 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen including Nifty Financial, Torrent Power, LIC Housing Finance, HDFC Life Insurance, and IndiaMART InterMESH.

Fino Payments Bank: Capri Global Holdings bought additional 6.06 lakh equity shares in the company via open market transactions. These shares were bought at an average price of Rs 258.47 per share.

Keystone Realtors: Plutus Wealth Management LLP bought 17.1 lakh shares or 1.5% stake in the Rustomjee Group company at an average price of Rs 555.03 per share.

PB Fintech: Hedge fund WF Asian Smaller Companies Fund bought 67.75 lakh shares in Policybazaar operator via open market transactions, which is 1.5 percent of total paid-up equity. The fund has purchased 34.21 lakh shares on the NSE and 33.53 lakh shares on the BSE, at an average price of Rs 400 per share. The stake buy was worth Rs 271 crore.

(For more bulk deals, click here)

Investors Meetings on November 25

MCX India: Officials of the company will interact with C Worldwide Asset Management.

PI Industries: Officials of company will interact with NBIE Investor Group.

Metro Brands: Officials of company will interact with Pine Bridge Investments.

Aptus Value Housing Finance India: Officials of the company will be meeting investors and analysts in London.

Tracxn Technologies: Officials of company will interact with ICICI Prudential AMC, and Param Capital Research.

BLS International Services: Officials of company will interact with Helios Capital Management Profusion Capital.

Godawari Power and Ispat: Officials of company will interact with Lucky Investments, Kotak Securities, IIFL AMC, Kotak AMC, ICICI Pru, and Monarch Networth.

Tega Industries: Officials of company will interact with Securities Investment Management, and Kotak PCG.

Stocks in News

Lupin: The USFDA has issued Form-483 with 8 observations for the drug product facility and API facility at Mandideep. The US drug regulator has inspected company's Mandideep unit-1 facility during November 14-23, 2022. "We do not believe this will have an impact on disruption of supplies or the existing revenues from operations of this facility," the company said.

Hariom Pipe Industries: The company has completed the setting up of its 15 ton electric melting furnace and the commercial production from the same will commence from November 25, 2022. This will increase the company's production of MS billets from the current 95,832 MTPA to 1.04 lakh MTPA.

Punjab National Bank: The public sector lender has received approval of DIPAM, Ministry of Finance, for divestment of stake in UTI Asset Management Company in single or multiple tranches. As of now, PNB holds 15.22 percent stake in UTI AMC. The objective is to realise gain on investment.

Tube Investments of India: The auto ancillary company will pick 50 percent stake in X2Fuels and Energy, a start-up company engaged in developing processes to convert waste to liquid/solid fuels, for Rs 6.15 crore. Tube Investments has signed shares' subscription agreement with X2Fuels and Energy, and its founders.

Laurus Labs: The company has entered into Share Subscription Agreement and Shareholders' Agreement with Ethan Energy India for buying 26 percent stake in Ethan Energy India. This will enable the company to consume 100 percent of the solar energy to be supplied by Ethan Energy India from their 10 MW solar energy plant.

Kintech Renewables: Promoters Gaurank Singhal & Aditya Singhal will sell 1.96 lakh shares or 19.69 percent stake via offer for sale on November 25 and November 28. The floor price for the sale would be Rs 480 per share.

Biocon: Biocon Biologics has allotted equity shares worth Rs 2,205.63 crore to parent company Biocon. Its stake in Biocon Biologics will be 88.85% post allotment of shares.

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 1,231.98 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 235.66 crore on November 24, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.