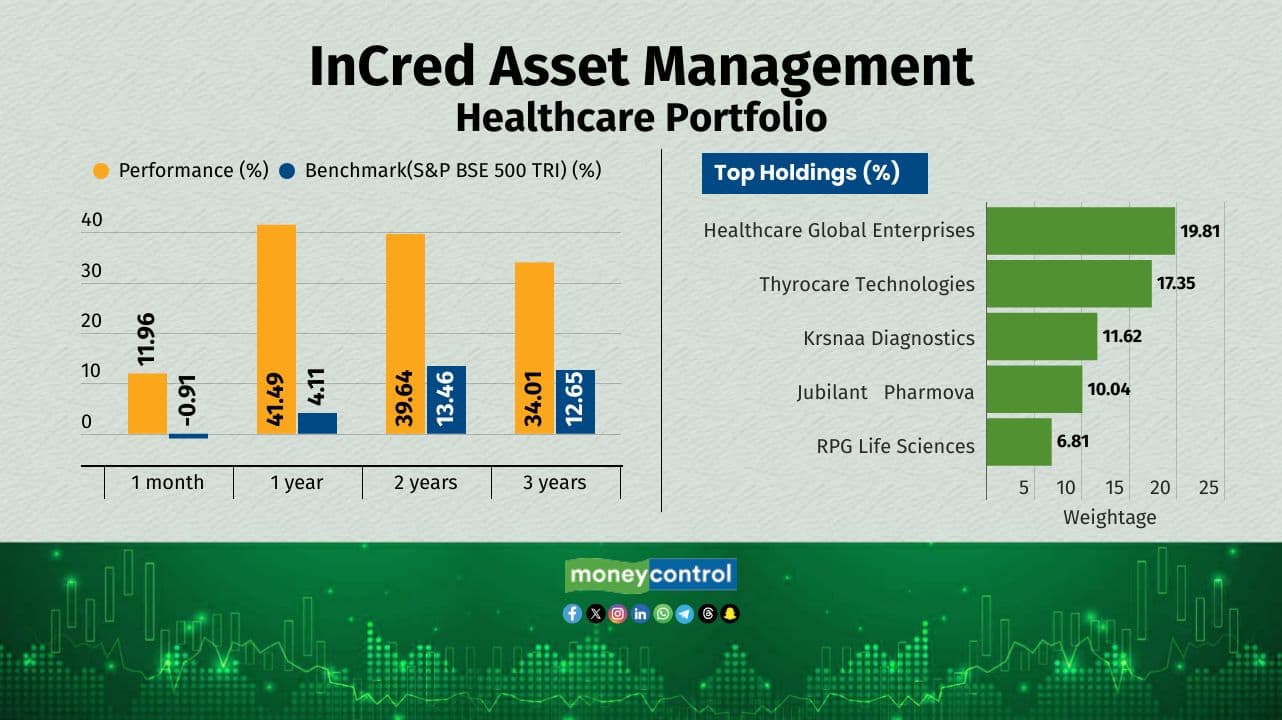

Thematic portfolios dominated the top PMS charts in July, with InCred Asset Management’s Healthcare Portfolio delivering the highest return at 11.96 percent. Close behind was Valcreate’s Lifesciences and Specialty Opportunities strategy, which gained 8.48 percent, followed by Green Portfolio’s MNC Advantage at 6.89 percent.

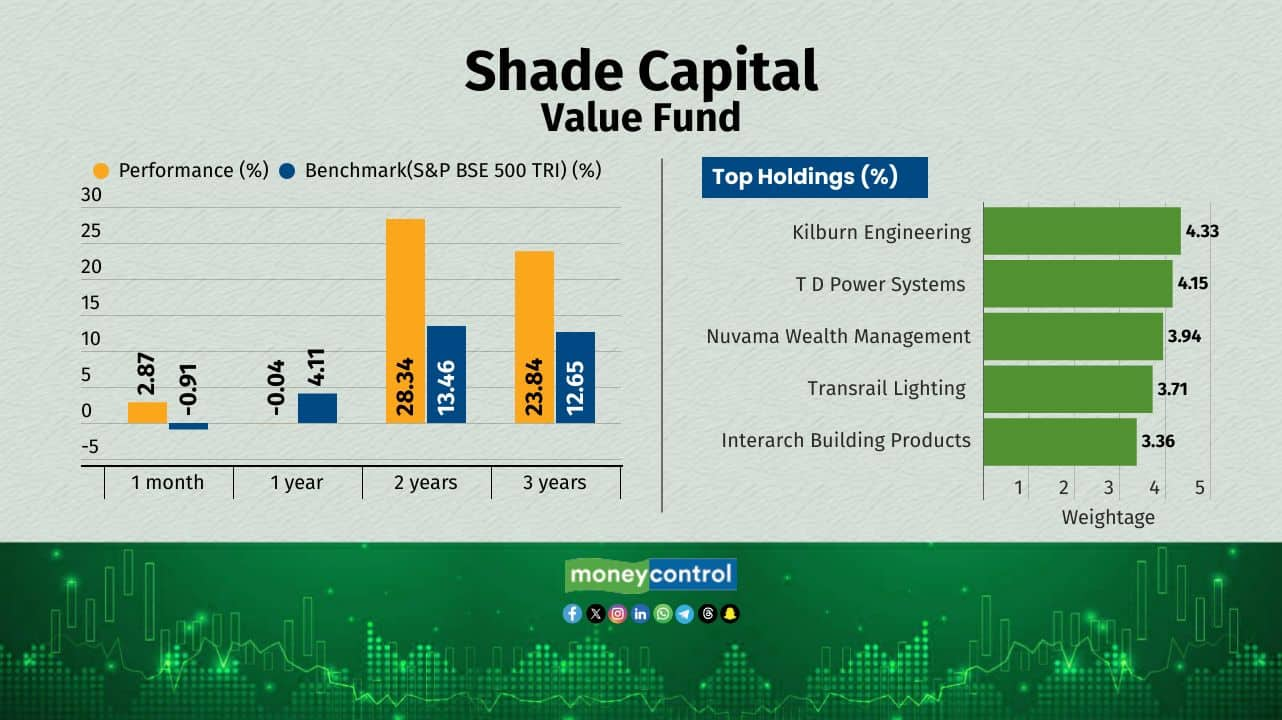

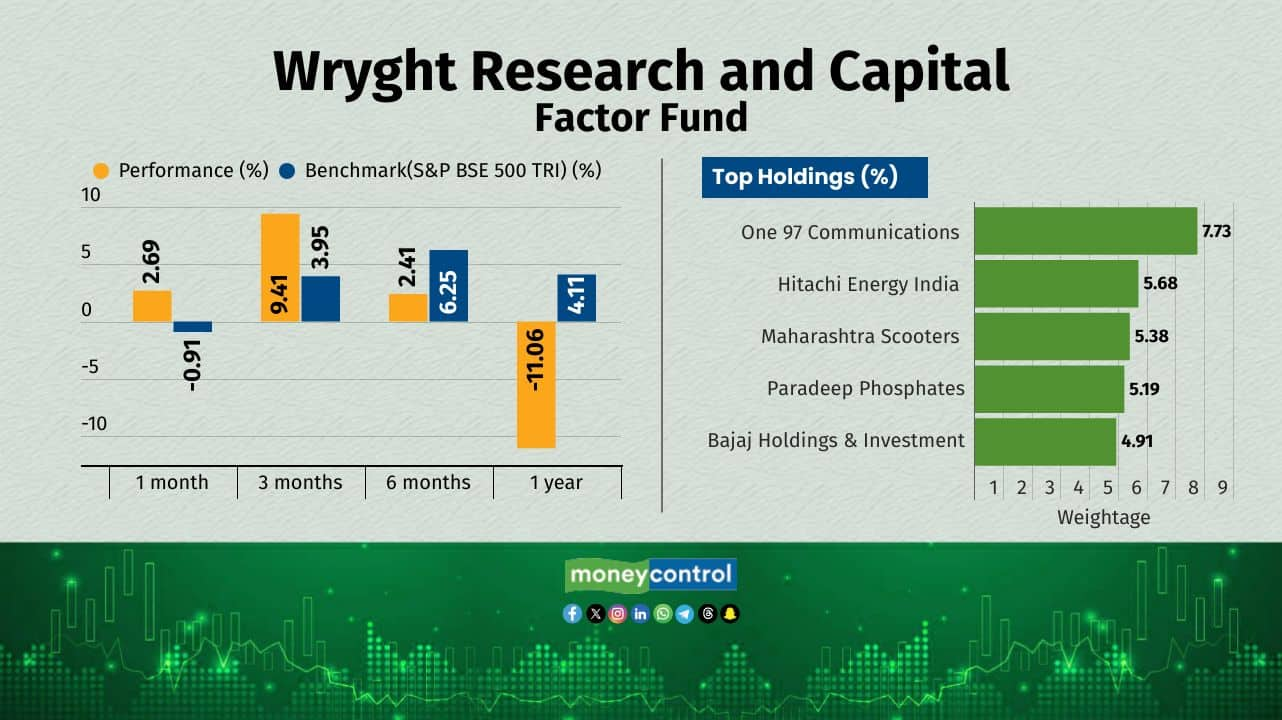

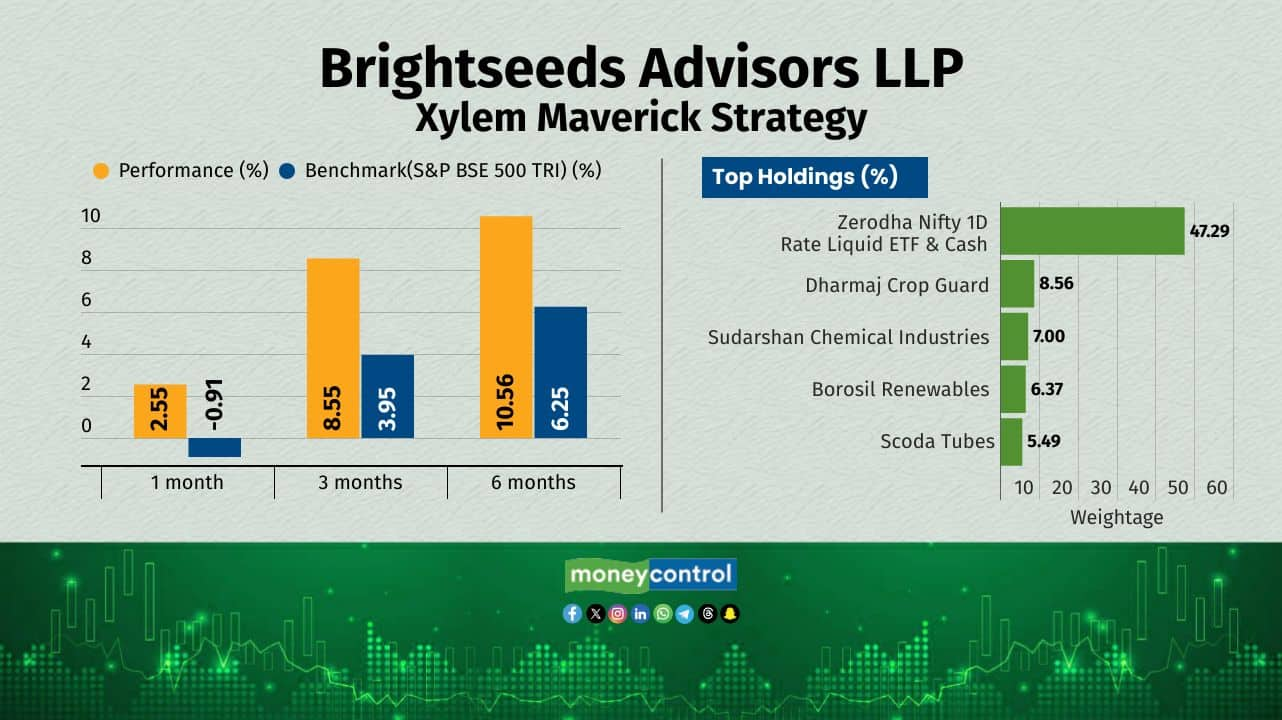

Multi-cap and flexi-cap strategies lagged relatively, with Shade Capital’s Value Fund (2.87 percent), Valcreate’s Growing India (2.84 percent), and Wryght Research and Capital’s Factor Fund (2.69 percent) featuring in the top 10. Brightseeds Advisors’ Xylem Maverick Strategy rounded off the list with 2.55 percent returns.

1.

InCred Asset Management - Healthcare Portfolio

Fund Manager: Aditya Khemka

The Incred Asset Management oversees both the Incred Healthcare Portfolio and the Incred Focused Healthcare Portfolio, managed by Aditya Khemka with 18 years of experience, employing a targeted approach within the Indian healthcare ecosystem. The Healthcare Portfolio blends large, mid, and small-cap companies across pharmaceuticals, hospitals, diagnostics, and insurance, leveraging rising incomes, greater health awareness, increased wellness spending, and export market growth through detailed qualitative and quantitative research.

2.

Valcreate Investment Managers LLP - Lifesciences and Specialty Opportunities

Fund Manager: Rajesh Pherwani

Investment Strategy: Concentrates on innovation-driven sectors like pharmaceuticals, healthcare, animal health, seeds, agrochemicals, and specialty chemicals, seeking companies with unique product or service edges that provide long-term growth advantages, while prioritizing technocrat promoters, extensive product pipelines, and low-competition environments.

3.

Green Portfolio - MNC Advantage

Fund Manager: Divam Sharma

It focuses on multinational corporations with strong parentage, internationally recognized brands, and robust governance, emphasizing those with extensive global operations, ongoing R&D and capital expenditure programs, access to worldwide research, and dominant market shares in their industries.

4.

Valcreate Investment Managers LLP - IME Digital Disruption

Fund Manager: Ashi Anand

It focuses on building a highly concentrated portfolio of digitally native platforms that dominate via network effects, target vast markets for prolonged high growth, and achieve profitability through pricing power and operational leverage, excluding traditional businesses that merely incorporate digital tools.

5.

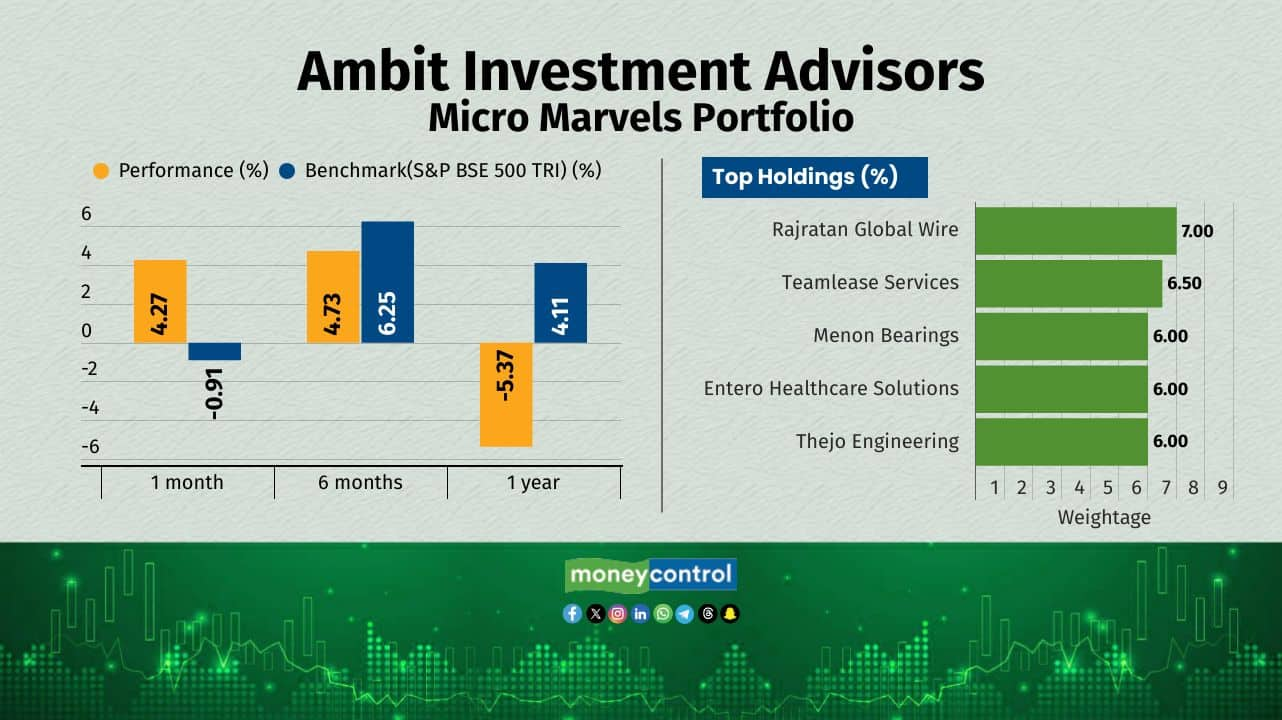

Ambit Investment Advisors - Micro Marvels Portfolio

Fund Manager: Bhargav Buddhadev

The strategy targets micro-cap firms (INR 500-3500 crore market cap) in niche markets that are oligopolistic with deep moats in brand, distribution, technology, or innovation, using on-the-ground scuttlebutt research to select 25-30 stocks focused on high earnings growth and low leverage.

6.

Emkay Investment Managers - Pearls

Fund Manager: Sachin Shah

The strategy employs bargain hunting to spot small and mid-cap companies undervalued due to temporary industry headwinds or corporate issues at business cycle turning points, utilizing the E-Qual model to assess governance risks, with an average holding period exceeding five years.

7.

Shade Capital - Value FundFund Manager: Jagvir Singh Fauzdar

Shade Capital’s Value Fund applies a QGLP framework to target undervalued companies benefiting from structural economic shifts, such as the move to organized sectors or market leadership gains. Its portfolio leans heavily into small-caps (77.19%), maintaining a focused 30-stock spread. With a Rs 50 Lakh minimum investment and exit loads up to 3% in the first year, the fund is geared for patient investors comfortable with small-cap volatility and its research-driven, multi-cap strategy.

8.

Valcreate Investment Managers - Growing India Fund

Fund Manager: Rajesh Pherwani

Valcreate Investment Managers’ Growing India Fund employs a GQV (Growth, Quality, Value) framework to build a concentrated, flexi-cap portfolio targeting India’s economic growth themes. The fund’s sector-agnostic, bottom-up stock selection suits investors seeking long-term capital appreciation but requires tolerance for moderate risk due to its concentrated approach.

9.

Wryght Research and Capital - Factor Fund

Fund Manager: Sonam Srivastava

The fund is suitable suits for data-driven investors comfortable with volatility and a disciplined, tech-heavy approach. It holds 20-30 stocks from the top 700, with per-sector and per-stock allocations capped at 20% and 10%, respectively. It targets factors like value, momentum, growth, and quality, using machine learning for market regime modeling and monthly rebalancing to adapt to conditions.

10.

Brightseeds Advisors LLP - Xylem Maverick Strategy

Fund Manager: Vinit Gala

The portfolio’s sector allocations include financials (15%), consumer services (12%), and capital goods (10%), with a concentrated 20-25 stock selection. Its high small-cap exposure and low 0.06% monthly turnover suit investors seeking disciplined, research-driven growth but comfortable with the volatility of smaller market segments.

Source: PMSBazar

Note: Data has been calculated till July 30, of funds with disclosed top holdings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.