Also Read: Mutual funds update: All equity, debt schemes deliver positive returns in June

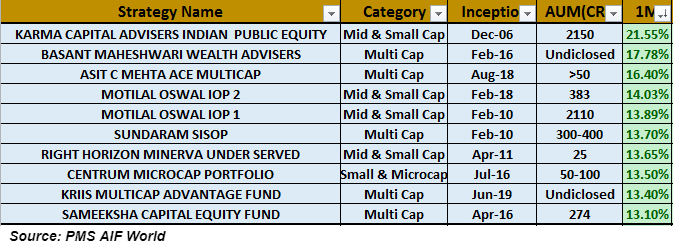

"Midcaps and smallcaps are seeing a valuation catch up as smart allocation of money by funds and high net worth clients are investing in regular phases of corrective markets," Vikas Jain, Senior Research Analyst at Reliance Securities told Moneycontrol in June.The growing confidence in the broader markets also reflected in the returns of portfolio management schemes (PMS) as all the 10 best-performing schemes of June were from the mid & smallcap and multicap space.

The leader of the pack was Karma Capital Adviser Indian Public Equity, which rose a whopping 21.55 percent during June, data collated by PMS AIF World, a research-backed financial services firm, shows.

The fund has an AUM of Rs 2,150 crore focused heavily on the midcap space, which constitutes 58.6 percent of its 20-stock portfolio.As on June 30, media companies had the highest sectoral allocation in its portfolio at 19.6 percent followed by pharma (17.2 percent) and telecom (13.3 percent). It also has exposure to financial, consumer staples and retail.Basant Maheshwari Wealth Advisers Equity Fund was the second-biggest gainer among the 136 schemes assessed by PMS AIF World. The highly concentrated multitap focused fund backed by the veteran investor returned 17.78 percent in June.Asit C Mehta Ace Mulitcap took the third spot, with a month-on-month return of 16.4 percent.The fund primarily focuses on sectors such as energy, technology and industrials. Basic material and consumer cyclical form the remainder of its portfolio.As on June 30, Bharti Dynamics, Larsen & Toubro Infotech and Tata Elxsi were some of the top holdings in its 28-stock portfolio.Speaking on the current investment scenario that is dictated by the COVID-19-led economic disruption, Kamal Manocha, CEO and Chief Strategist at PMS AIF World, said despite these unprecedented times, 2020 was a good opportunity for long-term investors with a 10-year horizon."For long-term equity investors, any fall in the market because of geopolitical reasons, or macro factors like COVID-19 should be a reason to invest and not a reason to worry. The only thing investors should be worried about is the quality in a portfolio, as earnings, premium, returns and compounding follow," he said.Portfolio Management Services cater to wealthy investors and the professional fee charged by them is slightly higher than regular mutual funds (MFs). The minimum investment in a PMS scheme is Rs 50 lakh in India.Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.