Dhruv Girdhar

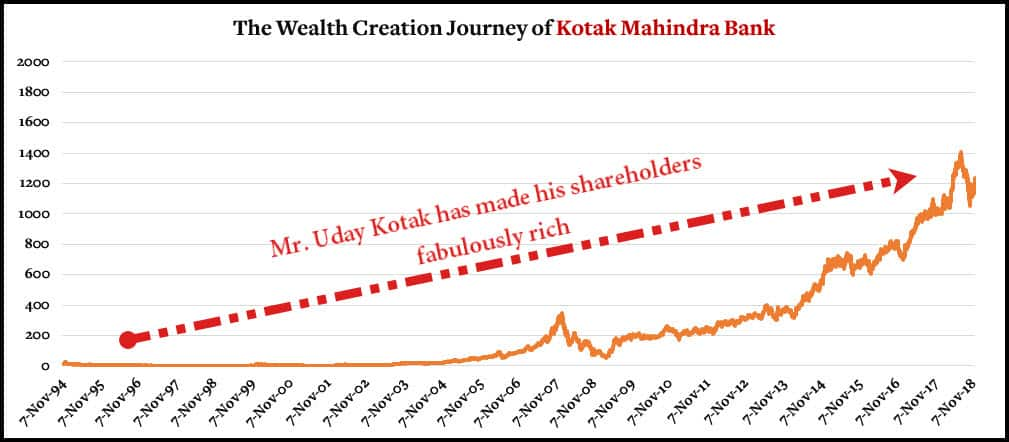

A few days ago, I was reading an analysis report on Kotak Mahindra Bank by Jana Vembu. It explains how KMB emerged as a survivor by providing its banking services to consumers, corporates and commercial businesses. As per the report, Re.1 invested with Uday Kotak (Managing Director, KMB) in 1985 would be worth Rs 2 Lakh today.

Image: Journey of KMB | Data Source: Moneycontrol

Let me make it sound a little more fanciful. With lots of ups and downs in 33 years, Rs 1 Lakh invested in Kotak Mahindra Bank (KMB) would be worth 2,000 Crore. That’s an astonishing rise of 1,99,99,900 percent. Really amazing. Isn’t it? Besides, who doesn’t love to own such companies? Almost all of us. And yet, a majority of us fail to grasp such exemplary returns.

Why?

Because owning such companies can turn out to be real nightmares during the holding period. The fear that erupts inside us after seeing a decline in stock price outpowers the conviction with which we had bought the stock in the very first place. Thus, the fear makes us sell it even if its primary business is fundamentally strong. In fact, under panic, we fail to analyze the capability of the management that works day and night to make it really successful.

The pain of holding a stock.

***

In a span of 33 long years, KMB compounded at a CAGR of 45 percent. But this didn’t happen every year. The high returns did come at a cost. The below chart portrays totally a different picture altogether. The kind of torture that its investors had to go through, can easily be noticed.

Image: Drawdowns in KMB | Data Source: Moneycontrol

During the 2008-Recession, it lost its value by 84.9%. Post-recession, it took more than 5 years to reclaim its 2008 peak. Not only this. At least on 6 occasions, the stock fell down by more than 50 percent. Around 73 percent of the time, during its journey, it stayed below its previous all-time high open price. Besides, it tasted the aftermaths of Kargil War, Asian Currency Criss, the Dot-Com Bubble Crash, 2008-Recession and other global key events that made investors pee in their pants.

Despite all these sufferings, I wish I had owned the shares of KMB. I wish I could be one of those investors who was made filthy rich by KMB. But why? Because it’s headed by one of those intelligent fanatics, Uday Kotak, who has built the Kotak business worth billions of dollars from scratch. And this is not an easy task.

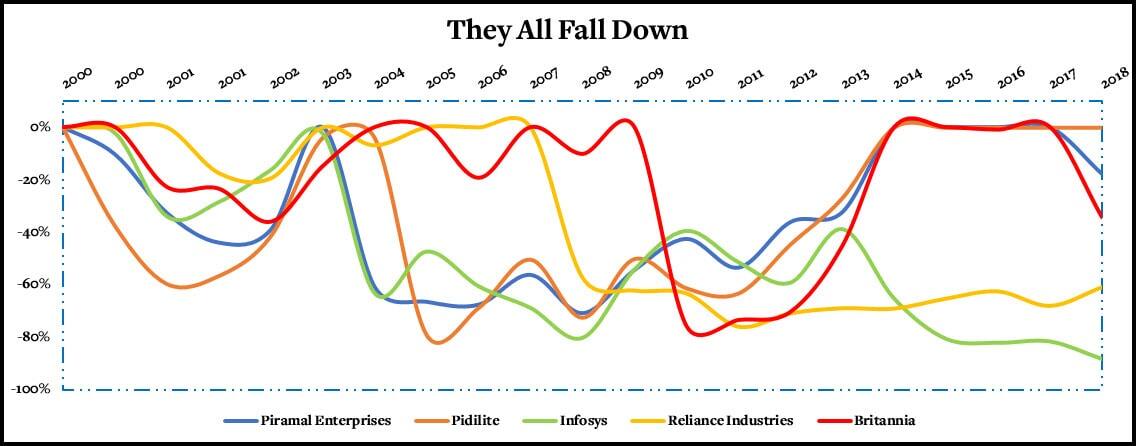

The truth is that all great companies go through such adverse stages. The pain of holding a stock lies in the fact that it can face a drawdown in extreme double digits. That too for a long period of time. Sometimes, it may never even recover within a stipulated timeframe. The other times, it may test your patience by staying stagnant. Be it the adhesive big player Pidilite or biscuit maker Britannia. They all have fallen down in the past.

Image: They All Fall Down | Datasource: Moneycontrol

On the other hand, the ones who have the stomach to ride such roller-coaster rides throughout the awful phases make the real money. All they need to do is ignore the short-term fluctuations in the stock prices and focus on the long-term business prospects instead. With a growing business and its earnings, the stock price eventually starts resonating.

Having said that, it reminds me of one of the quotes by Prof Sanjay Bakshi of MDI, Gurgaon:

“If you end up owning a fantastic business, then plan to hold it for a long time. And prepare yourself for a roller coaster ride. If you have chosen the right business to own, the ride will be worth it in the end.”

***

While writing this post, I happened to remember an old BBC interview on Charlie Munger (Vice-Chairman, Berkshire Hathaway). On 26th October 2009, he was asked, “So how much does Charlie worry when Berkshire’s common stock declines?“

He replied: “Zero. This is the third time that Warren and I have seen our holdings in Berkshire Hathaway go down, top tick to bottom tick, by 50 percent.”

Further, he added: “I think it’s in the nature of long-term shareholding of the normal vicissitudes, in worldly outcomes, and in markets that the long-term holder has his quoted value of his stocks go down by say 50 percent.”

Then, later in the interview, he said: “In fact, you can argue that if you’re not willing to react with equanimity to a market price decline of 50 percent two or three times a century you’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations.”

That’s the pain of holding a stock. It can wipe off the gains that may go beyond our imagination!!!

(The article has been reproduced with permission from richifymeclub.com. You can read the original article here.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.