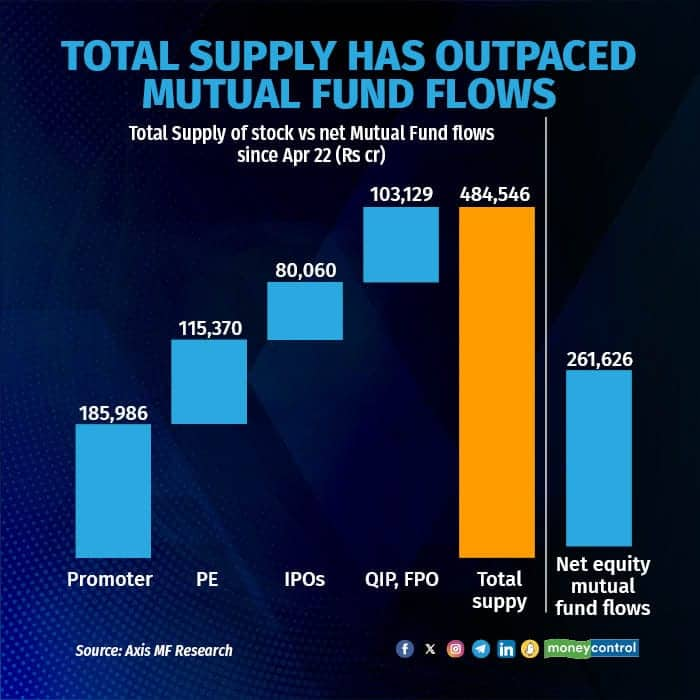

The unprecedented surge in equity supply has outpaced mutual fund inflows, said Axis MF CIO Ashish Gupta. In his latest Acumen note, where Gupta presented a detailed analysis of the supply of papers into the public market, he noted that approximately Rs 4.84 lakh crore of equity supply flowed into the equity market since April 2022. On the other hand, the net flow into equity mutual funds amounted to only Rs 2.21 lakh crore, creating a significant excess supply. This situation is unlikely to change going forward, according to Gupta.

AXIS MF RESEARCH

AXIS MF RESEARCH

Of the Rs 4.84 lakh crore in equity supply, around Rs 1.86 lakh crore came from promoter stake sales, Rs 1.15 lakh crore from private equity divestments, Rs 80,000 crore from Initial Public Offerings (IPOs), and Rs 1.03 lakh crore from Qualified Institutional Placements (QIPs). This supply of paper into public markets is 185 percent of the net flow into equity mutual funds over the same period (Rs 2.61 lakh crore).

Also Read | Rs 5,94,320 crore: That’s the amount of equity supply that is likely to hit the market

Gupta explains, "Supply is often a less frequent market factor. The jump in valuations that the market and companies are now commanding is enticing an increasing number of private companies to list, strategic investors to take profits, and even promoters – both local and multinational – to divest."

According to Gupta, this trend can be attributed to robust corporate actions, including strategic disinvestments and capital-raising exercises facilitated by favorable market conditions. Looking ahead, Gupta expects the pace of equity supply to remain strong. He notes that in the coming months, India's equity markets could witness the IPO pipeline grow by Rs 93,000 crore.

Follow our live blog for all the market action

Private equity divestments are expected to accelerate, with funds currently holding Rs 2.77 lakh crore in listed company stakes, of which over Rs 2.17 lakh crore are aged over three years and set for market entry.

"Additionally, locked-in shares from recent IPOs, averaging a 79 percent increase from their issue price, will enter the market. Furthermore, with investments totaling Rs 4.67 lakh crore in privately held firms, of which Rs 3.70 lakh crore are over three years old, expectations for exits via public markets and IPOs could potentially add another Rs 2.24 lakh crore in supply," Gupta says.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.