LiveNow

Closing Bell: Sensex, Nifty end lower; eyes on Union Budget

Closing Bell: Sensex, Nifty end lower; eyes on Union Budget

Indian benchmark indices ended marginally lower in the volatile session on July 22. At close, the Sensex was down 79.43 points or 0.10 percent at 80,525.22, and the Nifty was down 21.60 points or 0.09 percent at 24,509.30.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices for all the global market action.

Rupak De, Senior Technical Analyst, LKP Securities

A small-bodied candle has formed on the daily chart following a bearish engulfing pattern, suggesting a pause before the next movement. The Relative Strength Index (14) has entered a bearish crossover and is exiting the overbought zone.

The 24550 level is likely to act as an immediate hurdle for Nifty. A move above 24550 might induce a meaningful rally in the Nifty, while support is placed at 24480. A decisive fall below 24480 might induce selling pressure in the market.

Ajit Mishra – SVP, Research, Religare Broking

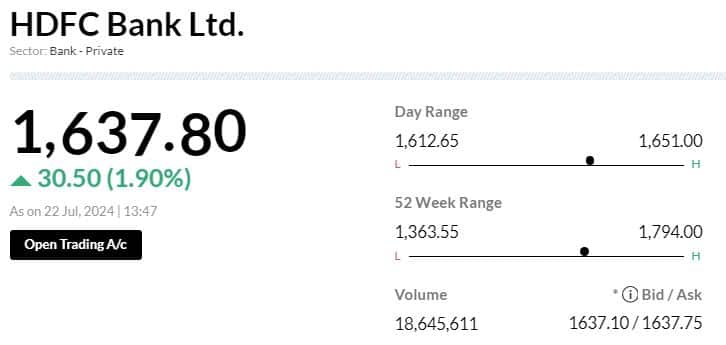

The markets began the week on a subdued note and ended nearly unchanged, reflecting caution ahead of the Union Budget. The Nifty index opened lower and fluctuated within a range before closing at the 24,509.25 level. Initially, weak global cues and pressure on index heavyweights like Reliance and Kotak Bank following their earnings reports weighed on sentiment. However, the strength in banking major HDFC Bank, in reaction to its results, and continued buoyancy in IT heavyweight Infosys Ltd offset the negativity. Sector-wise, auto, metal, and pharma edged higher, while realty and IT were among the top losers.

With all eyes on the Union Budget, volatility is expected to remain high on Tuesday. We thus maintain a cautious stance and recommend a hedged approach. Traders should seek buying opportunities in low-beta counters, especially in the defensive sectors, and remain selective in other areas.

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty closed lower for the second consecutive session on July 22 as traders reduced commitments ahead of the Union Budget on July 23 and investors parsed through corporate results. At close, Nifty was down 0.09% or 21.7 points at 24509.3. Cash market volumes on the NSE fell 9.4%. Broad market indices ended in the positive even as the advance decline ratio recovered to 1.30:1.

Asian markets fell Monday as Joe Biden's decision to drop out of the US presidential race fuelled fresh uncertainty about its impact on Asian economies and currencies. European shares rose on Monday, recovering from steep losses in the previous session, while investors assessed the positive implications of President Joe Biden's exit from the U.S. presidential election race on Europe.

Nifty formed a doji like pattern on July 22 after recovering well from early morning weakness, though ending marginally in the negative. The Union Budget presentation on July 23 will likely create enough intra day volatility on that day. Nifty could face resistance at 24661 and later at 24801 in the near term while 24141 could provide support on falls.

Vinod Nair, Head of Research, Geojit Financial Services

The conservative economic growth forecast for FY25, presented in the economic survey, has introduced some spikes in volatility ahead of the budget. Further, the below-estimated Q1 results from certain index heavyweights like RIL added to apprehensions of a slowdown in earnings growth in FY25.

Although the budget is anticipated to be favourable, investors will closely monitor whether it continues to tickle traction, given high valuations and the risk of a downgrade in earnings.

Aditya Gaggar Director of Progressive Shares

The oversold condition coupled with a bullish divergence in the RSI saved the Index from a steep fall. Mixed market activity was seen where the Mid and Smallcaps soared higher while the Index stayed in a well-maintained range to end the session at 24,509.25 with a marginal loss of 21.65 points.

Auto and Pharma sectors advanced over 1% to become outperformers of the day while Realty was the major laggard followed by IT.

Considering the Union Budget outcome, wild swings can be expected on both sides where 24,200 will be considered as immediate support while the higher side seems to be capped at 24,800.

Currency Check | Rupee closes flat

Indian rupee ended flat at 83.66 per dollar on Monday versus Friday's close of 83.66.

Market Close | Sensex, Nifty end lower; eyes on Union Budget

Indian benchmark indices ended marginally lower in the volatile session on July 22.

At close, the Sensex was down 79.43 points or 0.10 percent at 80,525.22, and the Nifty was down 21.60 points or 0.09 percent at 24,509.30. About 1953 shares advanced, 1575 shares declined, and 116 shares unchanged.

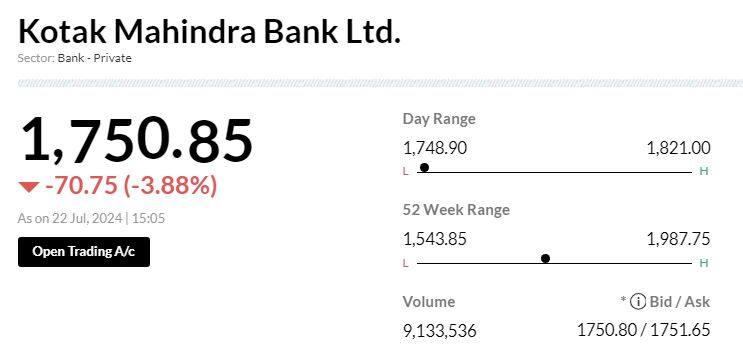

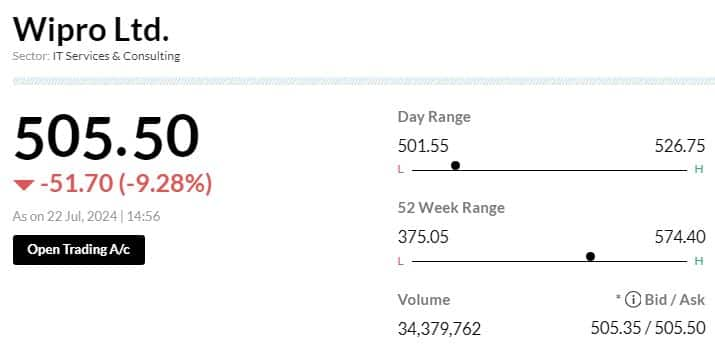

Biggest Nifty losers included Wipro, Kotak Mahindra Bank, Reliance Industries, ITC and SBI Life Insurance, while gainers were Grasim Industries, HDFC Bank, Dr Reddy's Labs, Tata Consumer and Infosys.

On the sectoral front, auto, capital goods, healthcare, metal and power indices went up 1 percent each, while selling was seen in the media, bank, IT, realty and FMCG.

The BSE midcap index added 1.3 percent and the smallcap index rose 0.8 percent.

Brokerage Call | Nomura keeps 'buy' call on Reliance Industries, target at Rs 3,600

#1 Company remains top pick

#2 In-line quarter; strong outlook

#3 O2C delivers well in a challenging environment

#4 Reported net debt moderates to Rs 1.12 trillion; capex increased to Rs 28,800 crore

#5 Jio’s EBITDA of Rs 13,900 crore increased 2 percent QoQ, 2 percent below estimate

#6 Retail adjusted EBITDA of Rs 5,450 crore grew 11 percent YoY

#7 Overall margin rose 20 bps YoY; operational trends remained strong

Brokerage Call | Morgan Stanley keeps 'overweight' rating on BPCL, target Rs 366

#1 Earnings call focussed on start of investment cycle in refining & chemicals after 5-year Hiatus

#2 We were encouraged by strong earnings quality

#3 Q1 integrated margin of USD 9.4/bbl better than estimate and above mid-cycle

#4 Company’s net debt at remains at multi-year low

#5 Current OCF run rate should support USD 2 bn in annual investments

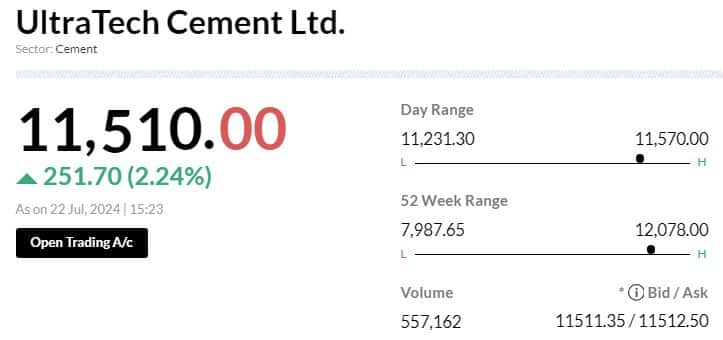

Brokerage Call | Citi keeps 'buy' call on UltraTech Cement, target raises to Rs 13,000

#1 Higher volumes (+7 percent), lower costs (-4 percent) & higher RMC sales offset lower YoY realisations (-6 percent)

#2 EBITDA was 6 percent ahead of estimate on higher volumes/RMC sales

#3 Key call highlights include costs that should come down by >Rs 300/t over 3 years

#4 Earlier guidance for cost was Rs 200-300/t

#5 Q1 was impacted by higher marketing spends – world cup

#6 July prices are lower vs Q1 average by nearly 1.5 percent, any hikes will likely happen only post monsoon

#7 Company expects FY25 industry growth at 7-8 percent, own growth in double digits

#8 Investment in India cements is a financial investment for now

Brokerage Call | Citi keeps 'buy' rating on Polycab India, target Rs 7,600

#1 Overall revenue growth was strong at 21 percent YoY, 2 percent ahead of estimate

#2 Domestic wires and cables growth remained strong

#3 EPC revenue contribution likely to remain elevated

#4 Pick-up In wires growth should aid in recouping margin

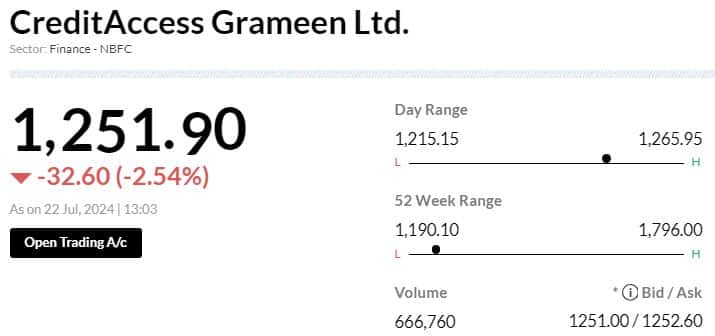

Brokerage Call | Nomura downgrade CreditAccess Grameen to 'neutral', target cut to Rs 1,300

#1 Growth/asset quality trends both disappointed in Q1; outlook uncertain

#2 Asset quality deteriorates for third consecutive quarter

#3 FY25 guidance of nearly 23-24 percent disbursement growth looks difficult to achieve

#4 Given pressure on both growth & asset quality, cut FY25-27 EPS by 2-4 percent

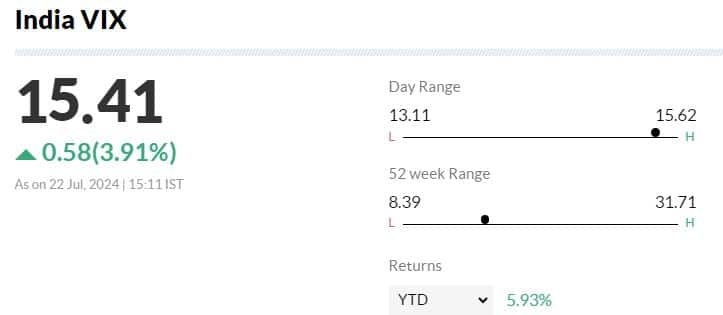

Sensex Today | India VIX up 4 percent

Brokerage Call | Bernstein keeps 'market perform' rating on Kotak Mahindra Bank, target Rs 1,750

#1 Q1 results saw sharp decline in RoA on the back of lower NII & an uptick in credit costs

#2 Loan growth remained strong on the back of a punchy growth in corporate credit

#3 Deposits declined sequentially thanks to the muted growth in CASA deposits

#4 The impact of the RBI restrictions was not visible on loan growth

#5 The bank did see a slowdown in customer acquisition

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| UltraTechCement | 11,520.60 | 2.24 | 8.15k |

| M&M | 2,806.30 | 2.03 | 131.16k |

| NTPC | 371.60 | 1.95 | 844.01k |

| Power Grid Corp | 337.85 | 1.76 | 216.52k |

| HDFC Bank | 1,635.05 | 1.74 | 489.32k |

| Tata Steel | 160.10 | 1.49 | 2.13m |

| Sun Pharma | 1,588.60 | 1.28 | 14.01k |

| Larsen | 3,659.50 | 1.13 | 166.78k |

| Maruti Suzuki | 12,645.25 | 0.99 | 4.04k |

| Infosys | 1,808.55 | 0.88 | 159.62k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

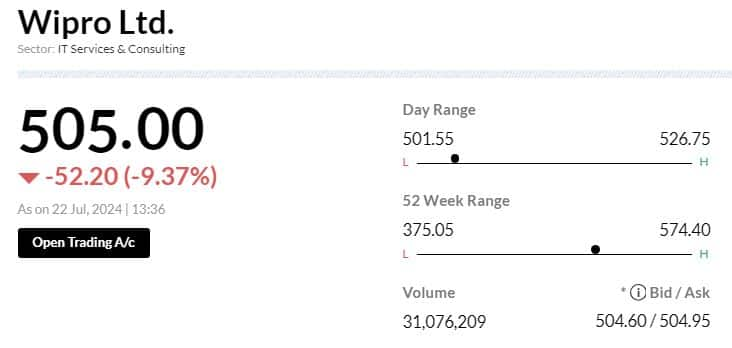

| Wipro | 506.60 | -9.09 | 2.02m |

| Kotak Mahindra | 1,755.45 | -3.64 | 433.67k |

| Reliance | 3,005.50 | -3.34 | 157.87k |

| ITC | 467.00 | -1.54 | 370.34k |

| SBI | 879.80 | -1.06 | 683.16k |

| HCL Tech | 1,577.55 | -1.05 | 226.45k |

| IndusInd Bank | 1,422.00 | -0.71 | 198.68k |

| ICICI Bank | 1,241.05 | -0.58 | 342.04k |

| Bajaj Finance | 6,897.20 | -0.53 | 23.55k |

| Axis Bank | 1,285.50 | -0.51 | 209.42k |

Sensex Today | 1.01 million shares of L&T Finance change hands in bunched trade: Bloomberg

Brokerage Call | Citi maintains 'sell' rating on Wipro, target Rs 495

#1 Company delivered a weak Q1 - 1 percent QoQ decline vs TCS/Infosys delivering +2-3 percent QoQ

#2 Q2 guidance at -1 percent to +1 percent QoQ CC will disappoint in the context of raised expectations

#3 Company’s growth differential vs peers stays, & so will valuation differential

Spot USDINR to trade between 83.20-84.20: Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas

Indian Rupee traded in a narrow range today. Mixed to weak domestic markets put downside on the Rupee. However, weak tone in the US Dollar and a decline in crude oil prices cushioned the downside. US Dollar fell as US President Joe Biden withdrew from US Presidential race. However, Asian currencies fell as China cut 1-year and 5-year PLR by 10 bps.

We expect Rupee to trade with a slight negative bias on weak tone in the global markets and overall strength in the US Dollar. Weak Asian currencies and a weak Yuan may also support the Dollar. However, weakness in crude oil prices and FII inflows may support the Rupee at lower levels.

Any intervention by the RBI may also support the Rupee. Investors may take cues from India’s Union Budget. USDINR spot price is expected to trade in a range of Rs 83.20 to Rs 84.20.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Hindustan Aeron | 4,986.35 | 3.86 | 433.99k |

| BHEL | 304.20 | 3.38 | 1.81m |

| Bharat Forge | 1,627.85 | 3.08 | 16.70k |

| Siemens | 7,007.50 | 2.34 | 7.50k |

| AIA Engineering | 4,370.30 | 2.32 | 4.20k |

| CG Power | 687.25 | 1.91 | 81.14k |

| GMR Airports | 93.46 | 1.72 | 1.51m |

| Rail Vikas | 624.10 | 1.64 | 3.71m |

| Bharat Elec | 311.15 | 1.58 | 3.51m |

| Sona BLW | 701.80 | 1.28 | 22.95k |

Brokerage Call | Morgan Stanley keeps 'overweight' call on Reliance Industries, target Rs 3,540

#1 Q1FY25 earnings & EBIDTA missed, but balance sheet outperformed

#2 Net debt & capex intensity declined

#3 While energy & telecom should see rebound in coming quarters

#4 Company’s pivot in retail to focus on margin amid tepid domestic demand stands out

#5 Q4FY24 EPS was 4.5 percent below estimate, due to higher impact from gasoline margin decline

#6 Reported net debt declined USD 0.6 billion

#7 Capex intensity was below OCF at USD 3.7 bn/quarter versus 2-year average quarterly run rate of USD 4.5 billion

Sensex Today | Great Eastern Shipping jumps most in 20 months

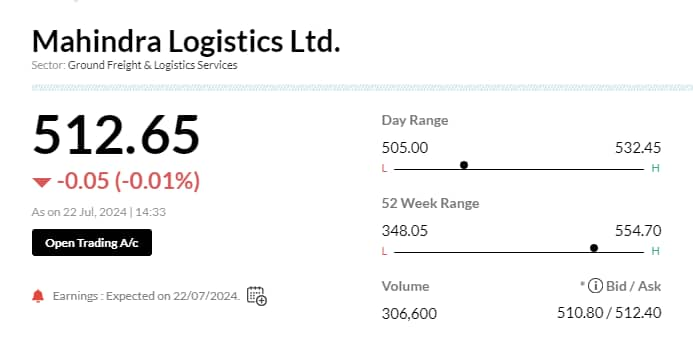

Sensex Today | Mahindra Logistics 1Q net loss at Rs 9.32 crore

#1 Revenue up 9% YoY to Rs 1420 crore

#2 Supply Chain revenue Rs1340 crore, up 11% y/y

#3 Enterprise revenue Rs81.3 crore, up 0.2% y/y

#4 Total costs Rs1430 crore, up 10% y/y

#5 Operating expense Rs1210 crore, up 11% y/y

#6 Staff costs Rs102 crore, up 2.9% y/y

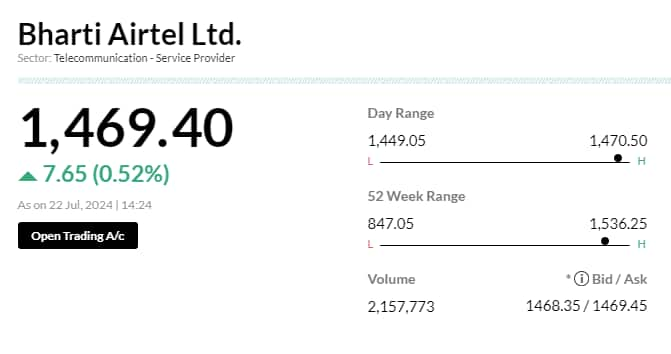

Sensex Today | Bharti Airtel, Nokia complete 5G NSA cloud RAN trial in India

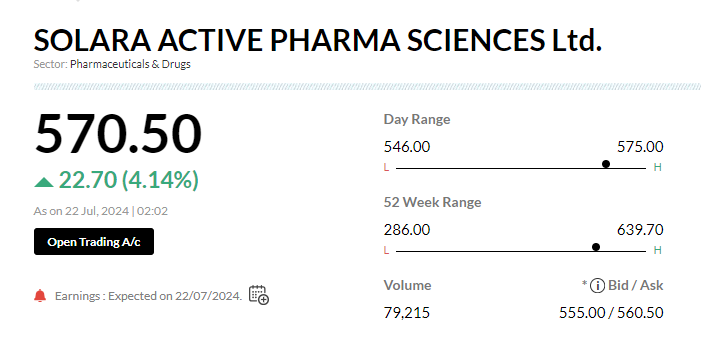

Sensex Today | Solara Active Pharma reports Q1 earnings; net loss at Rs 13.5 cr

#1 Net loss at Rs13.5 cr vs loss of Rs19.5 cr (YoY)

#2 Revenue up 3.3% at Rs364 cr vs Rs352.3 cr (YoY)

#3 EBITDA at Rs42.5 cr vs Rs19.3 cr (YoY)

#4 Margin at 11.7% vs 5.5% (YoY)

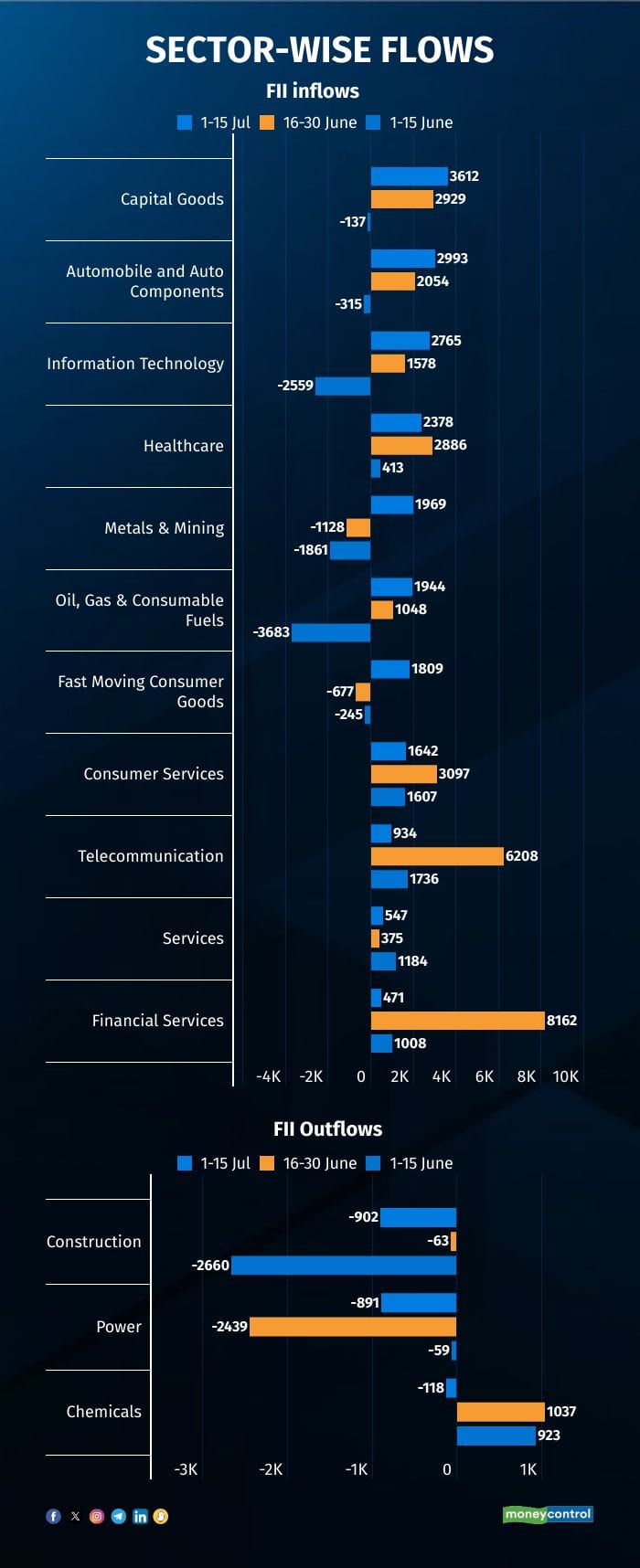

Sensex Today | FII continues selling in power sector; invests in capital goods, auto, IT and healthcare stocks

Foreign investors have invested across all sectors in the first half of July, except for the power sector, where they have been net sellers since the second half of April.

FIIs sold around Rs 891 crore in the power sector during the first half of July, following selling worth Rs 2,500 crore in June, Rs 3,042 crore in May, and Rs 834 crore in the second half of April.

Analysts report that FIIs are reducing their investments in the power sector due to profit booking after a strong rally over the past year. Power stocks have surged, with many penny stocks becoming multibaggers.

Since July 2023, narratives of power shortages, capacity addition, and sector reforms have boosted valuations. The weakest monsoon in 122 years increased demand and power prices from July to October 2023, further driving stock values.

Meanwhile, FIIs resumed buying in metals and mining sectors, investing Rs 1969 crore after selling in May and June.

FIIs also invested heavily in the capital goods sector with Rs 3612 crore, Rs 2993 crore in auto, Rs 2765 crore in IT, and Rs 2378 crore in healthcare in the first half of the month.

Sensex Today | Ahluwalia contracts India down for sixth day

Stock Market LIVE Updates | Indian Hotels shares jump 7% post Q1 earnings

#1 Profit rises 10.2% to Rs 260.2 crore Vs Rs 236 crore, YoY

#2 Revenue increases 5.7% to Rs 1,550.2 crore Vs Rs 1,466.4 crore, YoY

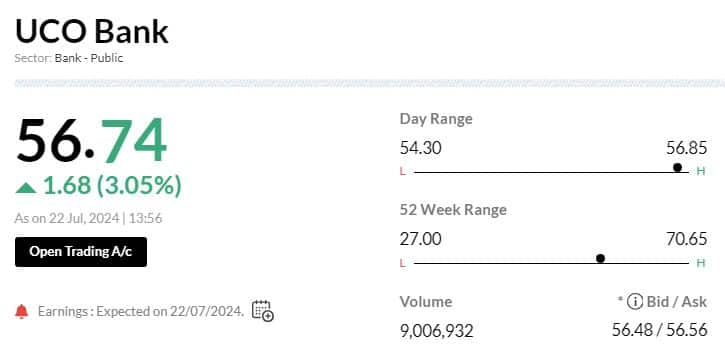

Earnings Watch | UCO Bank Q1 net profit at Rs 551 crore against Rs 223.5 crore, YoY

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ashok Leyland | 232.29 | 3.72 | 12.66m |

| Bharat Forge | 1,624.25 | 2.84 | 796.72k |

| M&M | 2,811.80 | 2.27 | 1.44m |

| MRF | 131,031.10 | 2.27 | 12.30k |

| Tube Investment | 4,066.00 | 1.59 | 50.60k |

| Sona BLW | 702.10 | 1.24 | 911.43k |

| Tata Motors | 998.55 | 0.86 | 4.90m |

| Maruti Suzuki | 12,618.45 | 0.75 | 157.95k |

| Hero Motocorp | 5,468.45 | 0.75 | 309.73k |

| Balkrishna Ind | 3,158.65 | 0.61 | 74.99k |

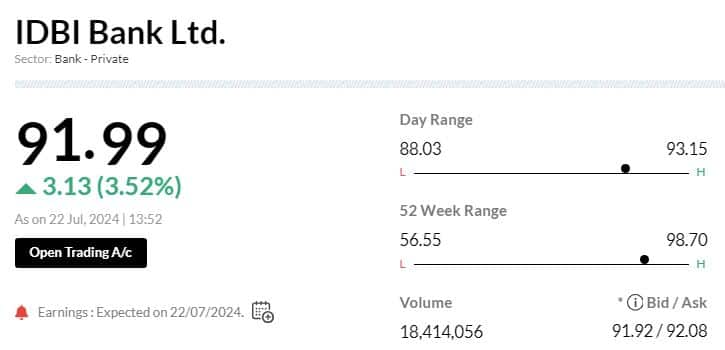

IDBI Bank Q1 net profit up 40.4% at Rs 1,719.3 crore Vs Rs 1,224.2 crore , YoY

Brokerage Call | Nomura mainatains ' neutral' rating on HDFC Bank, target Rs 1,720

#1 Q1FY25 saw slight NIM uptick; muted loan growth outlook stays

#2 Another QoQ NIM uptick; watch out for impact of higher PSL requirements from Q2FY25

#3 Build in 12 percent/17 percent loan/deposit CAGR over FY24-27, which brings down LDR to 92 percent for FY27

#4 From a near-term perspective, watch out for impact on bank’s RoA

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| NMDC | 235.40 | 2.95 | 227.45k |

| Tata Steel | 160.35 | 1.65 | 1.94m |

| Coal India | 493.50 | 1.14 | 307.50k |

| SAIL | 143.15 | 0.95 | 708.59k |

| Jindal Steel | 955.25 | 0.91 | 38.55k |

| Hindalco | 668.75 | 0.87 | 82.75k |

| Vedanta | 442.00 | 0.5 | 829.57k |

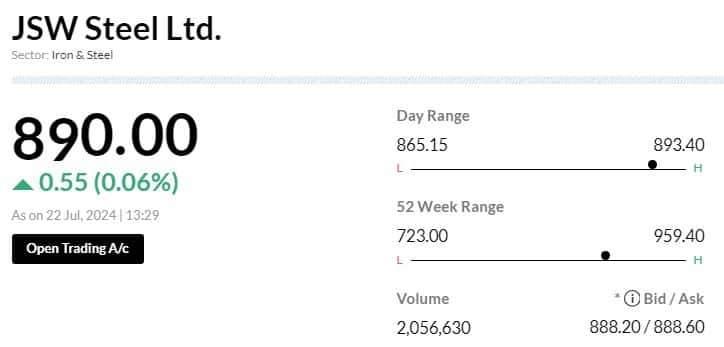

| JSW Steel | 891.85 | 0.26 | 60.54k |

| Jindal Stainles | 746.60 | 0.03 | 53.77k |

Brokerage Call | Jefferies maintain 'buy' rating on BPCL, target Rs 385

#1 Q1 EBITDA came in-line with estimate as weaker refining was offset by better marketing

#2 Refining margin should remain rangebound in near-term on elevated capacity adds

#3 Marketing margin have narrowed on crude strength

#4 Company offers healthy integrated margin versus peers on superior refining margin capture

Sensex Today | 1.05 million shares of Jindal Steel traded in a block: Bloomberg

Brokerage Call | Nomura maintains 'buy' rating on Wipro, target Rs 600

#1 Q1 revenue below, margin in-line with estimates

#2 Discretionary demand showing early signs of a recovery

#3 Q2FY25 guidance weaker than expectations

#4 Robust execution on margin continues despite weak growth

Brokerage Call | Macquarie keep 'neutral' rating on Reliance Industries, target Rs 2,750

#1 Q1 was a material miss against VA consensus

#2 Miss driven by lower-than forecast estimate across Jio, retail, and oil-to-chemicals

#3 Continue to see downside to consensus EPS

#4 Follow through on capex discipline & FCF improvement would be positive

#5 But likely consensus EPS cuts a drag

| Company | Bid Qty | CMP Chg(%) | Today Vol 20D Avg Vol |

|---|---|---|---|

| Akme Fintrade I | 29006.00 | 113.5320 | 20207620.00 |

| Sumeet Ind | 2153774.00 | 3.5519.93 | 82847722310.15 |

| Keynote Finance | 34166.00 | 279.2410 | 2318035335.05 |

| MTNL | 5270783.00 | 76.2510 | 6698234429176548.80 |

| Guj Raffia Ind | 21031.00 | 58.829.99 | 11437724754.40 |

| Cochin Shipyard | 108096.00 | 2670.355 | 26776644940962.35 |

| Garden Reach Sh | 59859.00 | 2578.105 | 23227926232959.65 |

| Asian Hotels | 8694.00 | 179.415 | 52014255.90 |

| Walchandnagar | 194745.00 | 331.525 | 265976805731.20 |

| Suven Life Sci | 85341.00 | 131.735 | 263608786699.05 |

Brokerage Call | Citi maintains 'sell' rating on JSW Steel, target cut to Rs 650 from Rs 750

#1 Q1 standalone EBITDA fell 12 percent YoY on lower blended realisations

#2 Q1 Standalone EBITDA came lower though costs were lower & volumes higher

#3 Performance of the US operations worsened QoQ

#4 Management indicated India spreads should improve despite soft steel prices on lower coking coal

#5 India steel prices have fallen with regional prices (still a premium to import parity)

#6 Investors may also be concerned with transfer of under-construction slurry pipeline to JSW Infra

Stock Market LIVE Updates | Oberoi Realty share price rises 4% post Q1 profit jumps 81%

#1 Profit surges 81.7% to Rs 584.5 crore Vs Rs 321.6 crore, YoY

#2 Revenue jumps 54.4% to Rs 1,405.2 crore Vs Rs 910 crore, YoY

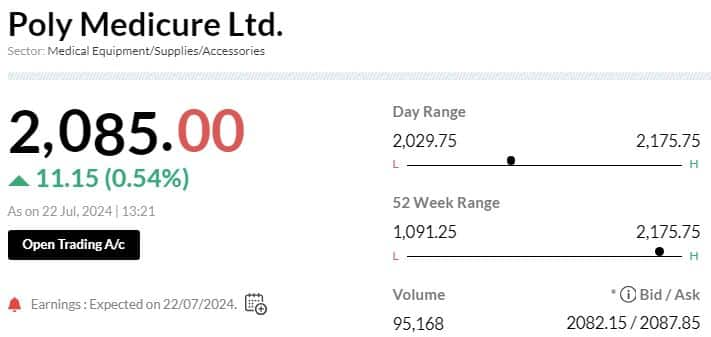

Earnings Watch | Poly Medicure Q1 consolidated profit up at Rs 74 crore versus Rs 62.7 crore, YoY

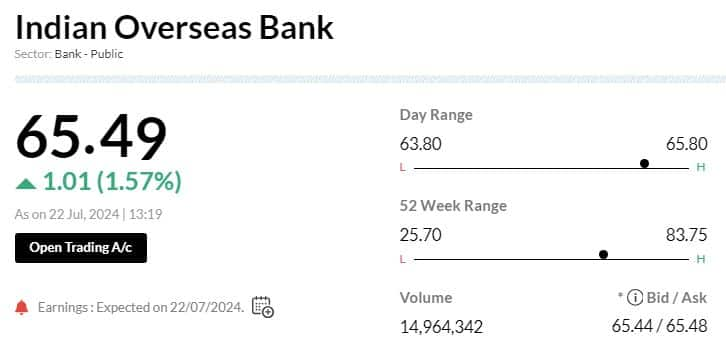

Earnings Watch | Indian Overseas Bank Q1 profit rises to Rs 633 crore from Rs 500 crore

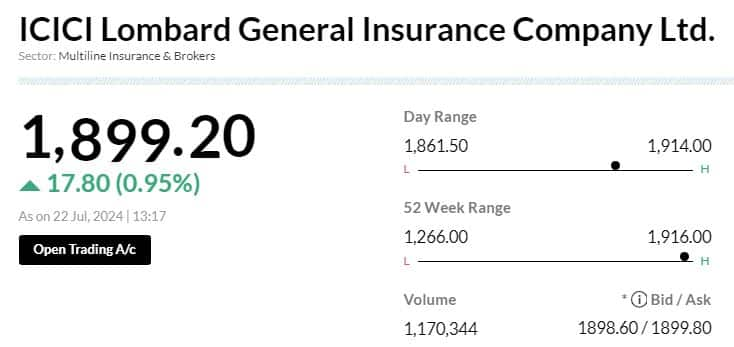

Stock Market LIVE Updates | ICICI Lombard General Insurance shares gain post Q1 earnings

#1 Profit spikes 48.7% to Rs 580.4 crore Vs Rs 390.4 crore, YoY

#2 Gross premium written grows 19.8% to Rs 7,931 crore Vs Rs 6,622.1 crore, YoY

#3 Combined ratio at 102.3% Vs 103.8%, YoY

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Phoenix Mills | 3,625.40 | -8.49 | 329.29k |

| Prestige Estate | 1,751.05 | -2.04 | 389.39k |

| Sobha | 1,810.00 | -2 | 54.14k |

| Brigade Ent | 1,250.40 | -1.54 | 136.82k |

Stock Market LIVE Updates | Bigbloc Construction recommends 1:1 bonus issue

Sensex Tdoay | Veerhealth Care receives Rs 1.21 crore order from existing client

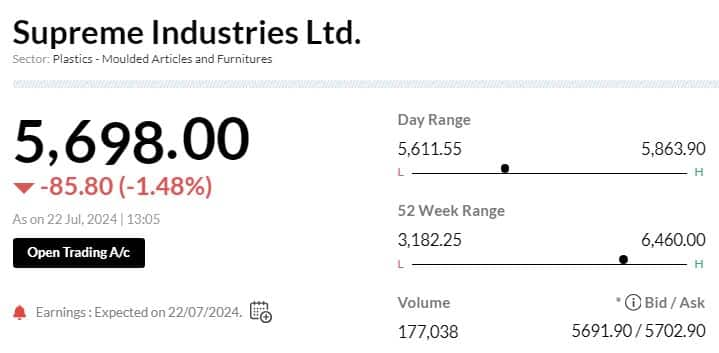

Earnings Watch | Supreme Industries consolidated profit up 26.8% at Rs 273.37 crore

Stock Market LIVE Updates | CreditAccess Grameen shares fall despite Q1 profit jumps 14.8%

#1 Profit increases 14.8% to Rs 397.7 crore Vs Rs 346.3 crore, YoY

#2 Revenue rises 28.7% to Rs 926.8 crore Vs Rs 720.3 crore, YoY