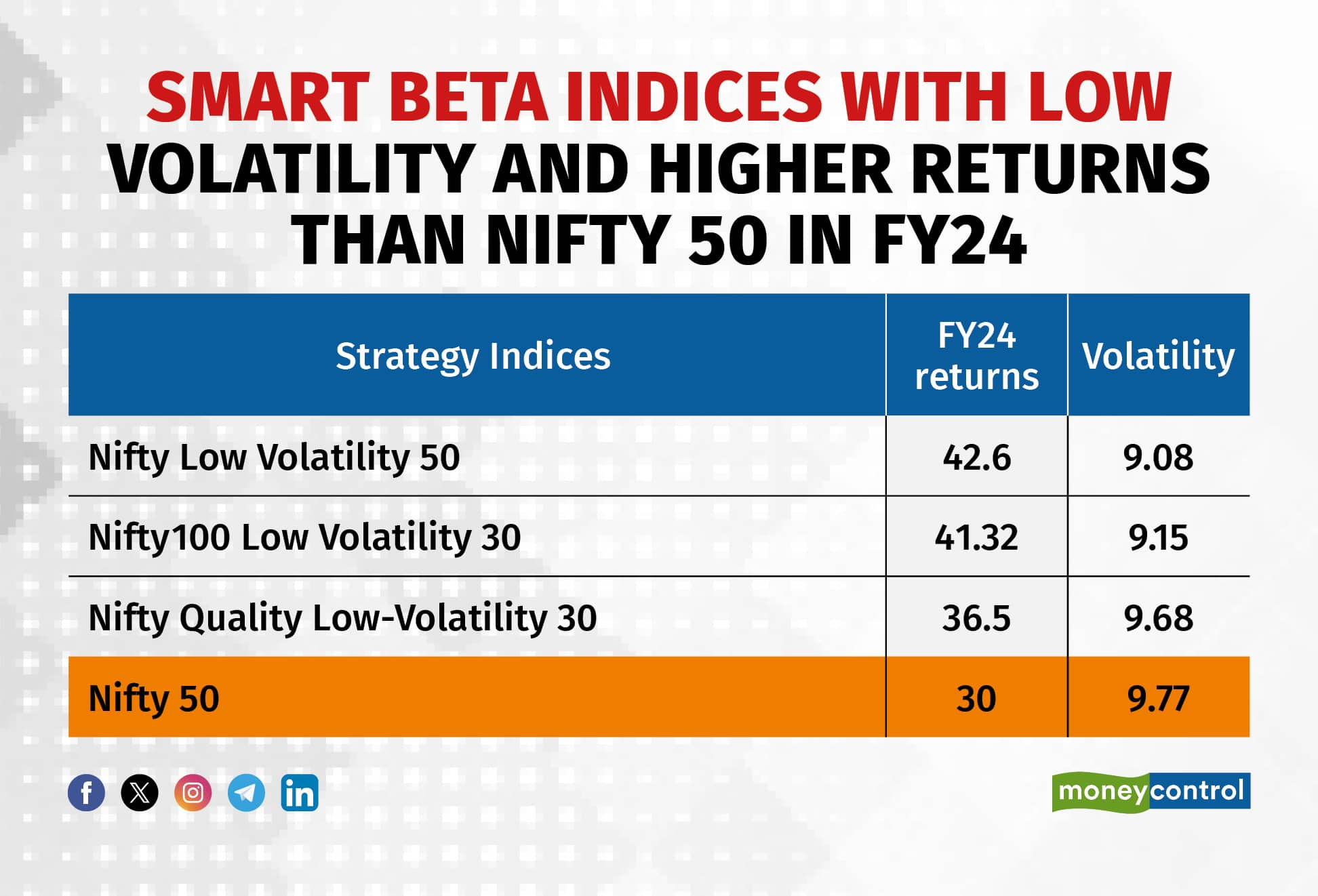

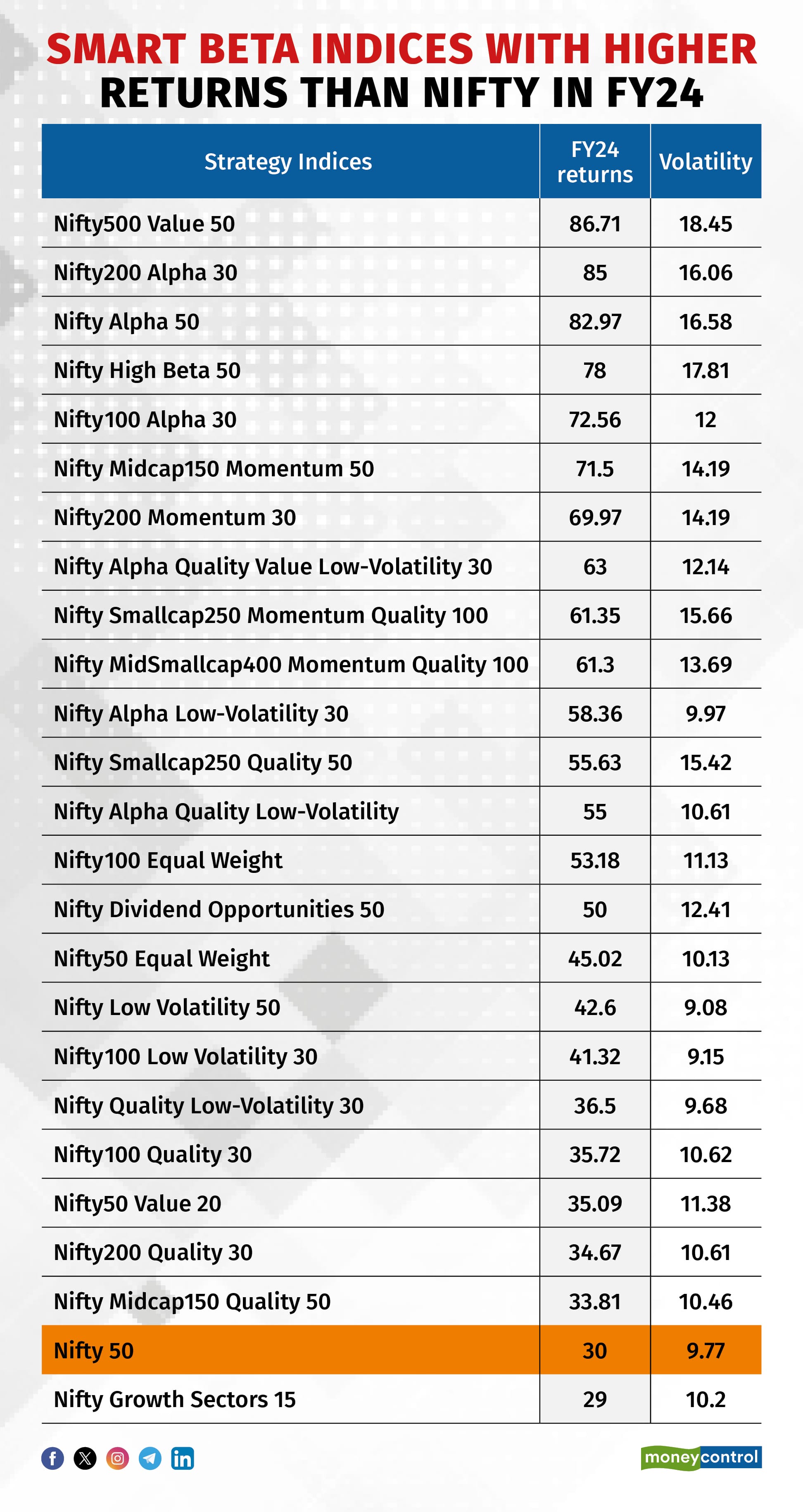

Smart beta Nifty indices handily outperformed the benchmark Nifty 50 index in FY24. According to data provided by the National Stock Exchange (NSE), strategy indices such as the Nifty 50 Value 20, Nifty Alpha 50 and Nifty Quality Low-Volatility 30 gave higher returns than the broader-based index in FY24. Even in terms of volatility, those such as the Nifty Low-Volatility 50 and Nifty Quality Low-Volatility 30 outperformed the Nifty while enjoying lower volatility than the benchmark.

Smart beta indices with low volatility

Smart beta indices with low volatility

Out of the NSE's 24 strategy indices, 23 outperformed the Nifty in terms of returns.

Smart beta indices with higher returns than Nifty

Smart beta indices with higher returns than Nifty

The outperformance of smart beta strategies has attracted investor interest.

“There are 57 smart beta passive funds right now in the market. Their AUM (assets under management) on aggregate is Rs 16,800 crore. Out of this, almost Rs 5400 crore has come in the last six months.” said Siddharth Srivastava, head – ETF Product and fund manager, Mirae Asset Investment Managers (India).

Smart beta funds aim to combine the best of active and passive funds. Active funds in FY24 struggled outpace benchmark indexes, the promise they are sold on Passive funds are expected to mimic the performance of benchmark indices with little scope for outperformance. Smart beta index funds work like a passive fund and aim to pick stocks using specified strategies. These strategies include momentum, alpha, value and volatility.

Investors can choose different strategies based on the market cycle as what works in one may not work in another.

“Post-pandemic, investments in smart beta funds picked up meaningfully. The top 10 holdings of smart beta strategies could be different from the Nifty 50, depending on the strategy chosen. One of the reasons factor-based indices did well is because larger market cap companies in indices like the Nifty 50 has underperformed compared to the rest of the market,” said Chintan Haria, principal investment strategist, ICICI Prudential Mutual Fund.

Haria explained that alpha and momentum funds have performed well over the last two years due to market buoyancy. “The value factor too worked well between 2021 and 2024. Low volatility as a strategy which worked well between 2015 and 2020 is currently going through a consolidation phase when momentum is performing better,” he added.

Sectoral selection was also a factor in the outperformance of some of these indices. Srivastava said “The low-volatility factor is tilted towards sectors like FMCG (fast-moving consumer goods) and healthcare whereas the quality factor is tilted towards FMCG, IT, etc. Both factors are typically underweight on the financial services sector and hence perform better when overweight sectors are doing well, and these strategies typically do well during volatile or bear market cycles.”

Satish Dondapati, fund manager and vice president (passive funds), Kotak Mutual Fund, said sectors like automobiles and auto components constituted 22 percent of the Nifty 200 Momentum 30 index. A lot of these stocks also gave around 100 percent return in the last one year, which added to the index returns.

Regarding a value index, Arun Sundaresan, head ETF, Nippon Life India Asset Management, said the value factor helped find sectors that have run up in the previous year.

“Value strategy gave around 35 percent in the last one year. For this strategy, in December every year, the index rebalances and 'value' stocks at that point in time will be part of the index. Last year, the weight of financials was zero in the index. Underweight position in financials helped value index outperform,” Sundaresan added.

A low volatility index which is less riskier than the benchmark, has also been able to give superior returns. Mahavir Kaswa, head of research - passive funds, Motilal Oswal AMC said "Empirical studies indicate that low-volatility securities, owing to their tendency to experience smaller declines during market downturns, typically yield superior risk-adjusted returns over extended periods. The S&P BSE Low Volatility Index has noted a CAGR of 20.3% against Nifty 50 which grew by 15.6% over 15 years ended as of March 2024 at much lesser risk/volatility."

Experts declined to predict whether this would be the case in FY25. However, they said the strategies in backtesting showed greater resilience in the longer run. “It is difficult to say what its future performance will be. Data suggests that smart beta funds have added value over a long period of time,” said Anand Vardarajan, business head, Tata Mutual Fund.

Analysts said there is increasing investor interest in these investment strategies among HNIs or high net-worth individuals with little enthusiasm among retail investors. However, they believe this will change with greater awareness.

“Since the last few years the inflows in smart beta schemes has increased, mainly investment from family offices, wealth platforms and HNIs. Retail investor participation is still very low in these products.” Dondapati of Kotak Mutual Fund added.

“We are seeing increased interest from retail investors in this space as these strategies have done well and investors are beginning to understand how these funds work and can be used in their portfolio as per their risk profile and investment objective,” said Mirae's Srivastava.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.