Small- and mid-cap indices summarily beat frontline indices in FY24, giving more than double the returns of Nifty 50. However, equity analysts expect the trend to reverse going into the next financial year 2024-25 as large-cap stocks may reclaim momentum, while Sebi's concerns of 'frothy' valuations and mutual funds' stress test results cast a shadow on small-cap stocks.

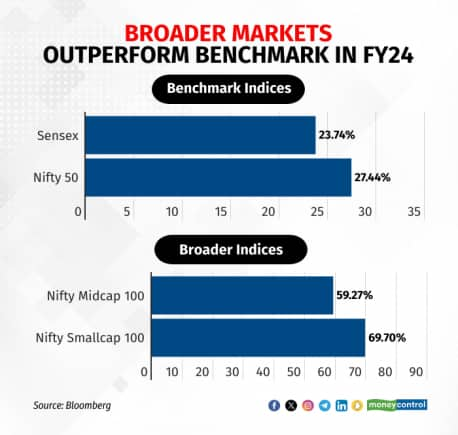

Indian equity markets had exhibited a stellar performance in FY24, backed by accommodative monetary policy, strong domestic retail participation, corporate earnings, and economic recovery post pandemic blues. From 16,900 to 22,500, benchmark Nifty 50 climbed over 27 percent in FY24, while Sensex surged over 23 percent.

Market experts expect the bull trend in large cap stocks to remain intact going ahead even as some uncertainty owing to 2024 general elections may worry investors.

Ajit Mishra, Senior Vice-President of Technical Research at Religare Broking, expects Nifty to surge up to 25,500 in financial year 2024-25 (FY25) supported by heavyweight stocks. However, on the downside, he underlined a strong support of 19,500-20,000 for Nifty.

Broader markets widely outperform Nifty, Sensex

On the broader-end of markets, the Nifty Smallcap 100 and Nifty Midcap 100 indices have outperformed benchmarks by rising 69 percent and 59 percent, respectively in FY24. But experts believe that this trend would change going forward, given market regulator Sebi's concerns on 'frothy' valuations in these segments and mutual funds stress test results.

"Smallcaps, especially, are likely to receive a backlash in FY25 as Sebi may ramp up scrutiny over this segment due to stretched valuations. We expect smallcaps and smaller midcaps to see moderation in gains going ahead," warned VK Vijayakumar, Chief Investment Strategist of Geojit Financial Services.

Where to invest for FY25

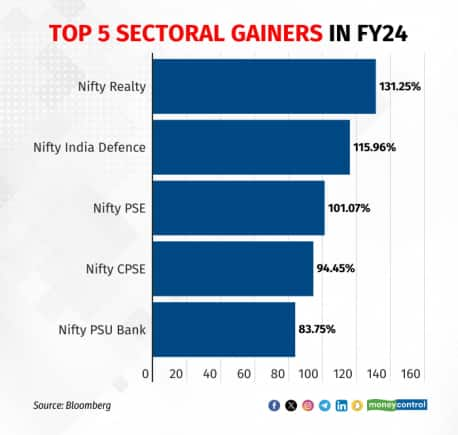

Sectorally, Nifty Realty index was the top winner in FY24 as it gave triple-digit returns (131 percent), followed by Nifty India Defence, Nifty PSE, Nifty CPSE, and Nifty PSU Bank indices.

For FY25, Vijayakumar of Geojit Financial Services expects Nifty PSU Bank index to take the lead, while the realty stocks could see some moderation as most positives are already priced-in.

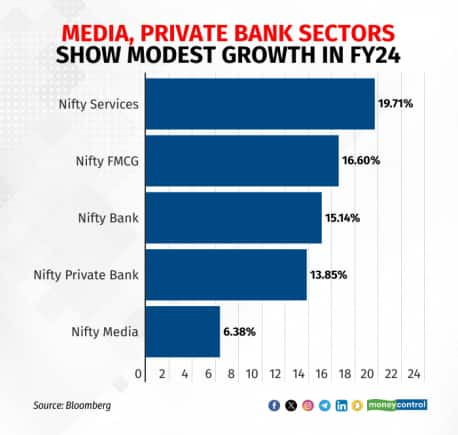

On the flipside, Nifty Media, Nifty Private Bank, and Bank Nifty were among the top sectors that saw modest gains in FY24.

As an investment formula, analysts are advising investors to churn their portfolio towards large-caps and large mid-caps as volatility is likely to rise due to 2024 general elections and uncertainity in banks' monetary policy path. "We expect heavyweight stocks like Reliance Industries, L&T, and top banking names to take the lead going ahead," said Vijayakumar of Geojit Financial Services.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.