If you've been tuned into financial news recently, "recession" seems to be the buzzword playing on repeat. A recession can be the devil in disguise for a bull market. But before we hit the panic button, let's take a closer look at one key indicator that could shed some light: the 10-2 year yield spread.

So, what’s the deal with this spread? Essentially, the 10-2 year yield spread measures the difference between the yields on 10-year and 2-year Treasury bonds. For example, if the 10-year yield is 4% and the 2-year yield is 3.75%, the spread is 0.25%, or 25 basis points.

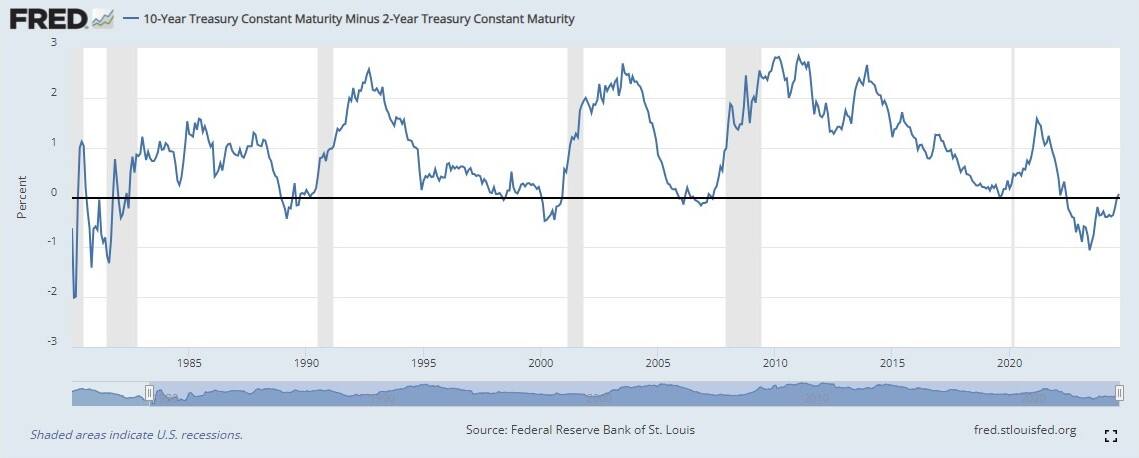

But, here's where it gets intriguing. The yield curve, which had been inverted (in negative) for over two years, began to uninvert (turned positive) in the last week of August 2024. Historically, such uninversion has often been a precursor to economic downturns, including the 2007 financial crisis, the 2001 recession, and even the Great Depression of 1929.

Here's a graph:

As the chart illustrates, recessions typically begin 6-24 months after the 10-2 spread turns positive from having been in negative territory. As of September 17, 2024, the 10-2 year yield spread was 0.06%. Before the uninversion, the yield spread was in the red for 112 weeks, starting in July 2022.

Even as we keep an eye on the yield spread and the Fed's upcoming rate decisions, remember that while the yield curve (10-2 spread) can be a powerful indicator, it's not infallible. It offers clues but is just one piece of the puzzle.

Either way, it's hard to tell if higher rates under a resilient economy are better than a rate cut and recession.

Follow our live blog for all the market action

Star Cement (Rs 216.10, +4.1%)

Stock surged after company shared expansion, growth plan in annual report

Bull Case: Star Cement's dominant 23% market share in the North Eastern region, proximity to limestone mines, and robust financials position it for continued growth. Capacity expansion, cost optimization, and growing demand in key regions further solidify its leadership and profitability.

Bear Case: Star Cement's heavy reliance on the North Eastern market poses growth risks if regional demand slows. Intense competition and rising transportation costs could pressure margins, while regulatory hurdles may disrupt raw material access, hampering operations and profitability.

Shilpa Medicare (Rs 894 | -0.04%)

Antique initiates 'buy' coverage.

Bull case: Shilpa Medicare is set for strong growth, driven by new product launches in the API and GLP-1 segments, market expansion for Non-Oncology APIs, and an exclusive CDMO agreement with Unicycive. With a robust pipeline targeting the US and EU, and investments in biosimilars, the company's revenue is expected to grow at ~34 percent CAGR from FY25-27, enhancing margins and profitability.

Bear case: Shilpa Medicare could face setbacks if Unicycive fails to secure FDA approval or struggles to gain market share, leading to lower CDMO revenues. Additionally, heightened competition in APIs, price declines, and potential Phase 3 failures in key programs could significantly impact growth projections and delay commercialization efforts.

Also Read | India becomes largest MSCI EM market, overtaking China; Morgan Stanley remains bullish

Ola Electric Mobility (Rs 118, +9.7)

Shares rose after BofA and Goldman Sachs initiated coverage with a 'buy' call.

Bull Case: Ola Electric is well positioned for significant growth in the electric two-wheeler market, benefiting from long-term structural trends in India. Ola’s technology and cost leadership as key drivers for its success in transforming the two-wheeler market to electric.

Bear Case: Stiff competition from peers such as TVS Motor could pose risk to the company.

(With inputs from Harshita, Lovisha, and Veer)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!