Taking Stock: Market Slips From Record High; Realty, Metal, FMCG Take A Hit

Except Nifty IT, all other sectoral indices ended in the red, with Nifty auto, energy, FMCG, metal, pharma and PSU bank down 1-3 percent... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,054.74 | 426.58 | +0.50% |

| Nifty 50 | 26,074.55 | 138.35 | +0.53% |

| Nifty Bank | 58,426.60 | 212.50 | +0.37% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| NTPC | 348.80 | 9.65 | +2.85% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Dr Reddys Labs | 1,258.90 | -30.50 | -2.37% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10813.60 | 217.40 | +2.05% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Auto | 27007.20 | -141.10 | -0.52% |

Indian benchmark indices witnessed selling after hitting fresh high. Strong selling was seen in Metal, Realty and FMCG stocks while buying is witnessed in IT stocks. Today most of the mid cap IT firms showed positive momentum after strong numbers posted by Route Mobile.

On the technical front, benchmark indices witnessed sell off after seven consecutive positive sessions. We believe the profit booking which was witnessed today is healthy for the market and any significant dip is a good opportunity to accumulate quality stocks. Immediate support for Nifty 50 is 18,300.

After hitting the all-time high at 18604.45 in the opening session, the benchmark index slipped more than 200 points from the day high and made a low at 18378.15 levels. Finally, the index has settled at 18418.75 with a loss of 58.30 points while Bank Nifty ended at 39540.50 levels.

On the technical front, the Nifty index has formed a long bearish candle at the top of the trend, which indicates a further reversal in the counter.

However, the index has taken immediate support at upper bollinger band formation on the daily chart. While on an hourly chart, the stochastic has also tested the oversold zone. At present, the index has immediate support at the 18,200 level while resistance comes at 18,600 levels.

The Indian market was showcasing strong resilience however the stretched rally booked some gains by the end of the trading day. The IT sector continued to hold the gains while the rest of the recent performers like Realty, PSUB & Auto went into a sell-off.

Our advice is to transform personal equity portfolios into a balanced basket with high weightage on defensive stocks & sectors. The Indian market is expected to get more stocks & sector specific as market parameters are extremely stretched.

While moving to defensives, though near-term trend can be dull, one can give decent weightage to sectors like manufacturing, power, tourism, chemicals, renewables energy & products on a long-term basis.

Indices met with profit taking today even as the IT Index stood tall through the day which indeed had several bouts of volatility.

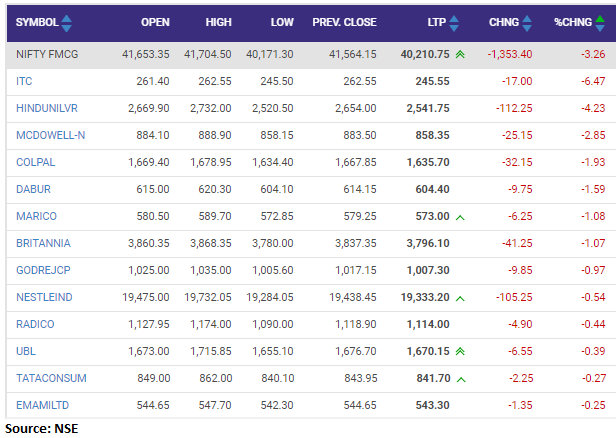

Market breadth too was weak with declines outpacing advances led by the big names of the FMCG sector as the street awaits a slew of primary market offerings in the near term.

The broader markets clearly witnessed profit booking in several top performing midcap names during the day.

The market witnessed some volatile movements after a failed attempt to overcome the Nifty 50 resistance level of 18600. It is going to be crucial for the market to sustain above the 18350-18400 support zone in the near term.

If the market is able to sustain the level of 18350, the market can witness higher levels of 18750. The momentum indicators like RSI and MACD indicating positive momentum is likely to continue.

Market ended seven-day winning momentum and ended lower on October 19.

At close, the Sensex was down 49.54 points or 0.08% at 61716.05, and the Nifty was down 58.20 points or 0.31% at 18418.80. About 959 shares have advanced, 2321 shares declined, and 122 shares are unchanged.

Tech Mahindra, L&T, Bajaj Finserv, Infosys and Kotak Mahindra Bank were among the major Nifty gainers. Losers included ITC, Tata Motors, Eicher Motors, HUL and Titan Company.

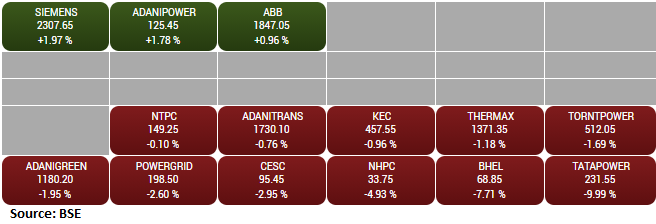

Except IT and Capital Goods, all other sectoral indices ended in the red. The BSE midcap and smallcap lost over 1 percent each.

Sonata Software has posted 5 percent jump in its Q2FY22 consolidated net profit at Rs 91.2 crore versus Rs 86.7 crore and revenue was down 24.1% at Rs 963.2 crore versus Rs 1,268.5 crore, QoQ.

Sonata Software touched a 52-week high of Rs 1,009.15 and was quoting at Rs 953, up Rs 27.00, or 2.92 percent.

The company has reported 33.4 percent jump in its Q2 net profit at Rs 158 crore versus Rs 118.4 crore and revenue was up 6.4% at Rs 2,177.5 crore versus Rs 2,047 crore, YoY

DCM Shriram touched a 52-week high of Rs 1,249.95 and was quoting at Rs 1,180, down Rs 13.40, or 1.12 percent on the BSE.

The Union Ministry for Heath and Family Welfare has set up an expert panel to review the taxation policy for tobacco products.

The panel will develop a proposal for comprehensive tax policy for tobacco products with a public health perspective, the health ministry said.

It will analyse the existing tax structure for all forms of tobacco (smoking and smokeless) and then develop a roadmap for tobacco tax policy and recommend immediate steps to be taken for making India MPOWER compliant.

It will also suggest options/models of tax rates/standards for consideration in the Union Budget for 2022-23. Click to Read More