November 24, 2020 / 16:11 IST

Ajit Mishra, VP - Research, Religare Broking:

Nifty touched another milestone today as it crossed 13,000 for the first time and settled around the day’s high as well. The bias was upbeat from the beginning, thanks to the news of the successful trial of another COVID vaccine with high efficacy. It hovered in a range in the middle while movement on the stock-specific front kept the participants busy. The broader markets too ended in positive in a range of 0.6-0.9. Except for Telecom, all the other sectoral indices witnessed healthy buying wherein Banking was the top gainer followed by Auto and Realty.

Markets are celebrating the successful vaccine trials, ignoring the recent spike in the cases. Indications are in the favour of the prevailing up move to extend further but the pace could be gradual. We reiterate our view to focus on the selection of sectors and stocks as we’re seeing rotational buying across the board.

November 24, 2020 / 16:10 IST

Vinod Nair, Head of Research at Geojit Financial services:

Market is inching higher with more confidence that Covid19 vaccine will be available in India soon. It can provide an advantage to India compared to the rest of the world. While, foreign inflows have already broken to a new high on a monthly basis, due to risk on strategy on healthier EMs like India. Recently broad market, including Mid & Small caps, have started to perform better which may continue in the short-term as large caps look expensive post the solid rally from Covid low.

November 24, 2020 / 15:59 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

The Nifty remained solid throughout the day keeping well above the 13000 level. 13100-13200 can prove to be a resistance zone which could see some profit booking. Since the overall trend of the market continues to remain bullish, traders should focus more on the long side of the market than the short side.

November 24, 2020 / 15:37 IST

Jateen Trivedi, Senior Research Analyst (Commodity & Currency) at LKP Securities:

Rupee opened weak but started gaining momentum as the capital market keeps indicating of added funds most importantly in the financial sectors. The range of 74.50-73.90 is witnessed in the market due to volatility in the dollar index mainly, but with higher Crude price in past few days rupee rise is checked near 74.

November 24, 2020 / 15:34 IST

Market Close:

Benchmark indices ended at record closing high on November 24 with Nifty above 13,000 for the first time.

At close, the Sensex was up 445.87 points or 1.01% at 44,523.02, and the Nifty up 128.70 points or 1.00% at 13,055.20. About 1603 shares have advanced, 1167 shares declined, and 175 shares are unchanged.

Adani Ports, Eicher Motors, Axis Bank, Hindalco and M&M were among major gainers on the Nifty, while losers were Titan Company, HDFC, BPCL, Bharti Airtel and Shree Cements.

Among the sectors, Nifty Bank index up 2.4 percent, while auto, metal and pharma indices rose 1 percent each.

November 24, 2020 / 15:25 IST

Abhishek Bansal, Founder Chairman, Abans Group:

WTI Crude oil prices rallied, on the back of optimism of a Covid vaccine, and recent PMI data showing strength in USand European manufacturing activity. Optimism over a Covid vaccine is supportive of economic growth, and will enhance fuel demand in the near future. Geopolitical tensions in the Middle East are likely to support crude oil prices. The Houthi rebels launched a missile attack on a Saudi Aramco petrol distribution facility in Jeddah.

Crude oil is likely to trade firm as OPEC+ may delay a scheduled crude supply increase by 3-6 months. OPEC+ is currently scheduled to restore in January, about 2 million of the 7.7 million bpd kept offline, and will meet between November 30 - December 1 to decide.

WTI crude oil prices are likely to find stiff resistance near $43.77-46.02 per barrel, while key support levels are found near $37.18-34.22 per barrel. The short-term trend is likely to remain firm, on the back of geopolitical tensions in the Middle East, vaccine optimism, and OPEC+ talks of keeping oil production static. However, the rally is likely to be capped, due to increasing production in Libya, reduction in demand in the US, and the rising number of Covid cases globally.

November 24, 2020 / 15:22 IST

B Gopkumar, MD & CEO, Axis Securities:

Indian economy is recovering well. Credit growth also has started picking up. Electricity consumption, PMI, GST collections, and Eway bill data has been quite encouraging. With the road map for vaccination clearing, the economy will be back to full steam in 2021. The prospects ahead look quite encouraging as demand across sectors has started to look promising.

The reset has had challenges, but it has also brought forth good opportunities, and corporates across the country are gearing to cash on them. So, even though markets are at an all-time high, but the risk to rewards still appear promising for the patient long term investors.

November 24, 2020 / 15:11 IST

Manoj Jain, Director (Head-Commodity & Currency Research) at Prithvi Finmart:

Both metals could show further weakness in the coming sessions. Gold could show further weakness towards $1,818-1,800 per troy ounce/Rs 49,220-48,900 and on the upside, major resistance is placed at $1,858/Rs 49,800.

If silver stays below $23.80 per troy ounce /Rs 60,600 levels, then it could show further weakness towards $23.20-22.80 per troy ounce /Rs 60,000-595,00 levels. For silver, $24.00/Rs 61,300 will act as major resistance.

We suggest selling in gold below 49,500 with a strict stop loss of 49,800 for the target of 49,000 and selling in silver below 60,500 with a strict stop loss of 61,200 for the target of 59,500-59,200.

November 24, 2020 / 14:48 IST

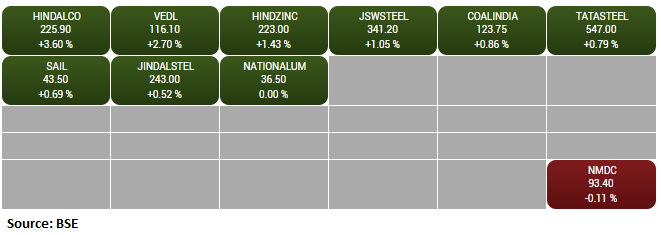

BSE Metal Index added 1 percent supported by the Hindalco, Vedanta, Hindustan Zinc:

November 24, 2020 / 14:29 IST

Gayatri Projects receives Rs 208 crore arbitral award

Gayatri Projects has successfully monetized and received Rs 208 crore net of statutory deductions (Gross Rs 219 crore) under the GOI scheme of monetisation of 'under litigation arbitral award' against bank guarantees. The company along with its JV partner had been awarded an arbitration claim worth Rs 703 crore including interests for its road project in Nagaland and GPL portion in the same was Rs 264 crore.

The company has now received 75% of the claim (including further interest of Rs 27.74 crore for the period from the date of award till the date of payment) after furnishing bank guarantees of similar amount. This inflow is in line with company's guidance of an inflow of Rs 2-3 billion under the GOI award monetisation scheme / conciliation scheme.

November 24, 2020 / 14:20 IST

Rupee Updates

Indian rupee is trading 10paise higher at 73.99per dollar, amid buying seen in the domestic equity market.It opened flat at 74.11 per dollar against previous close of 74.09.