November 03, 2022 / 16:23 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

The benchmark indices witnessed a volatile trading session, the Nifty ended 35 points lower while the Sensex was down by 112 points.

Among Sectors, IT index lost the most, shed over 1.14 percent whereas PSU Banks bounced sharply, rallied 2.64 percent.

Technically, on the backdrop of weak global cues our market opened with a negative note but after a gap down opening it bounced back sharply. However, after an early morning intraday rally the entire day the market witnessed range bound activity.

The current market texture is non directional perhaps traders are waiting for either side breakout.

For the bulls now 18150/61100 would be the fresh breakout level and above which the index could rally till 18250-18300/61300-61500. On the flip side, a fresh round of selling is possible only after dismissal of 17950/60500. Below which, the index could slip till 17850-17800/60300-60150.

November 03, 2022 / 16:06 IST

Mohit Nigam Fund Manager & Head - PMS, Hem Securities:

Indian equity markets closed in red for second consecutive session tailing weak global cues. Globally investors were worried after the US central bank Federal Reserve continued raising key interest rates in its fight against the multi-decade high inflation.

Asian markets closed mostly in red after the Federal Reserve espoused a more hawkish outlook than expected, with Chinese equities cutting short a two-day rally amid uncertainty over the country’s plans to scale back COVID lockdowns.

European markets are trading lower after the US Federal Reserve fully reaffirmed its commitment to fight inflation and signaled it was 'very premature' to think about pausing the tightening cycle.

On the technical front, the key resistance level for Nifty50 is 18,200 and on the downside 17,900 can act as strong support. Key resistance and support levels for Bank Nifty are 41,700 and 40,900 respectively.

November 03, 2022 / 15:48 IST

Karan Desai , Founder - Interface Ventures

The MPC today was all about giving the central government comfort and visibility on the RBI’s efforts to reign in inflation and bring it back closer to the target 4% mark; it has consistently breached the upper tolerance threshold of 6% for the last 3 quarters running.

Driven by the war in Ukraine, with surging inflation on account of supply disruptions of various commodities including food and fuel, the RBI has already hiked the repo rate 4 times this financial year to now rest at 5.9% in order to bring down inflation from its current 7% plus levels.

While some feel that monetary tightening could have started a little earlier, the RBI took a fairly balanced approach to ensure that growth did not slow down as India was still emerging from the COVID induced lockdowns and business disruptions.

The US Fed hiked rates by 75 bps just yesterday to a range of 3.75% to 4% which is at its highest level since 2008. However, it also indicated a tapering off of subsequent hikes in order to bring inflation back to around the 2% target.

This could be indicative of a similar position taken by the central bank in India to continue raising the repo rate in lower increments going forward to keep a check on inflation until global macros reach some level of stability.

November 03, 2022 / 15:43 IST

Raymond Q2 Earnings:

Raymond has posted profit of Rs 158.9 crore in the quarter ended September 2022 against Rs 53.3 crore and revenue was up 39.8% at Rs 2,168.2 crore versus Rs 1,551.3 crore, YoY.

Raymond touched a 52-week high of Rs 1,299 and closed at Rs 1,257.85, up Rs 84.00, or 7.16 percent on the BSE.

November 03, 2022 / 15:40 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty had formed a bearish outside bar along with an Engulfing bear candle on November 02. Thereon it stepped into a short term consolidation. Today, the index dipped below the immediate support of 18000 on an intraday basis however managed to hold on to it on a closing basis.

Once the level of 18000 is breached on a closing basis then the Nifty will be set to test 17800 on the downside.

On the higher side, 18200 will be the resistance for the short term. Thus 17800-18200 will be the short term consolidation range, within which, the index is expected to move towards the lower end of the range.

November 03, 2022 / 15:38 IST

Vinod Nair, Head of Research at Geojit Financial Services

Fed’s refusal to tone down the rate hike narrative shattered the global markets as investors were in expectation of a dovish commentary. Powel cautions that the desired fed rate level is higher than expected, even though he indicated a rate hike of less than 75 bps in the upcoming meetings.

On the back of concerns about the US recession, IT stocks led the domestic selloff, while FII support helped limit the losses.

November 03, 2022 / 15:34 IST

Rupee Close:

Indian rupee ended 11 paise lower at 82.89 per dollar on Thursday versus previous close of 82.78.

November 03, 2022 / 15:33 IST

Market Close:

Indian benchmark indices ended marginally lower in the volatile session on November 3.

At Close, the Sensex was down 69.68 points or 0.11% at 60,836.41, and the Nifty was down 30.10 points or 0.17% at 18,052.70. About 1725 shares have advanced, 1630 shares declined, and 120 shares are unchanged.

Tech Mahindra, Hindalco Industries, Power Grid Corporation, NTPC and Infosys were among the top Nifty losers. Gainers included SBI, Titan Company, UPL, HUL and HUL.

Among sectors, except bank, realty and FMCG, all other sectoral indices ended in the red.

The BSE midcap and smallcap indices ended on flat note.

November 03, 2022 / 15:24 IST

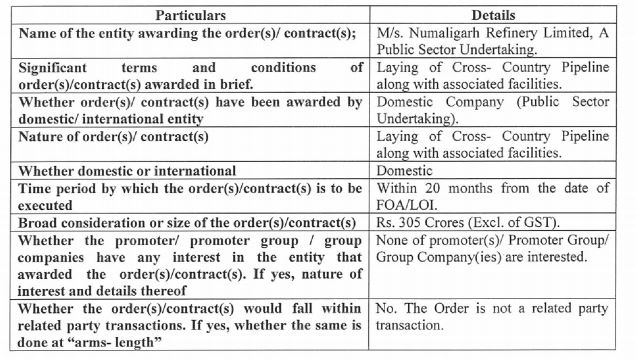

Likhitha Infrastructure bags orders worth Rs 305 crore:

Likhitha Infrastructure was quoting at Rs 390.40, down Rs 2.10, or 0.54 percent.

November 03, 2022 / 15:20 IST

Morgan Stanley View On LIC Housing Finance

-Kept underweight call and cut target to Rs 320 from Rs 375 per share

-Cut EPS forecasts by 14%, 6% & 13% for FY23-25, respectively

-Sharp decline in NIM largely due to yield sacrifice to retain customers

-NIM will improve but should be lower than previous estimate, reported CNBC-TV18.

LIC Housing Finance was quoting at Rs 369.80, up Rs 2.90, or 0.79 percent on the BSE.

November 03, 2022 / 15:13 IST

Coromandel International Q2

Coromandel International has posted 42.6 percent rise in its September 2022 quarter net profit at Rs 740.5 crore versus Rs 519.3 crore and revenue was up 64.5% at Rs 10,113.4 crore versus Rs 6,147.5 crore, YoY.

Coromandel International was quoting at Rs 987.45, up Rs 20.75, or 2.15 percent.

November 03, 2022 / 15:11 IST

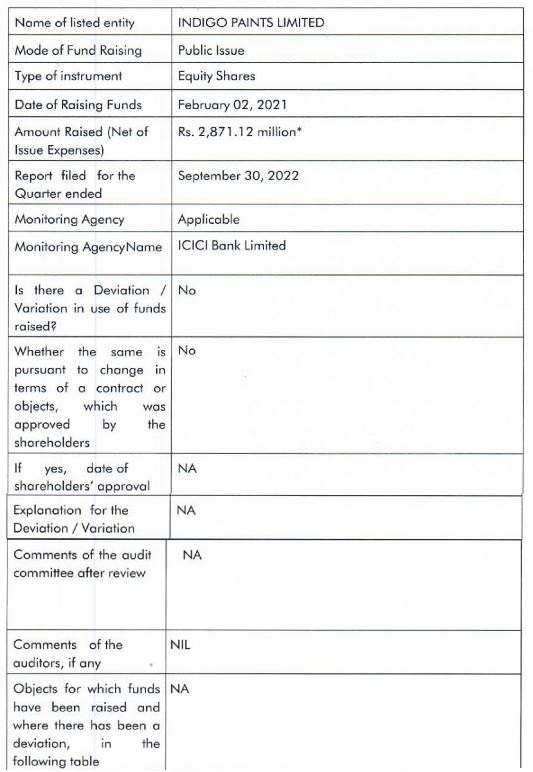

Statement of Deviation or Variation in utilization of funds raised by Indigo Paints

November 03, 2022 / 15:07 IST

SRF Q2 Earnings:

SRF has reported 26 percent jump in its Q2 net profit at Rs 481 crore versus Rs 382 crore and revenue was up 31.3% at Rs 3,728 crore versus Rs 2,839 crore, YoY.

SRF was quoting at Rs 2,556.85, up Rs 7.80, or 0.31 percent on the BSE.