Taking Stock | Market erases gains to end flat amid volatility; auto shines, metal worst hit

At close, the Sensex was down 37.78 points or 0.07% at 54,288.61, while the Nifty settled 51.50 points or 0.32% lower at 16,214.70.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,720.38 | 110.87 | +0.13% |

| Nifty 50 | 26,215.55 | 10.25 | +0.04% |

| Nifty Bank | 59,737.30 | 209.25 | +0.35% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Bajaj Finance | 1,033.80 | 23.10 | +2.29% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Eicher Motors | 6,999.00 | -199.50 | -2.77% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Bank | 59737.30 | 209.20 | +0.35% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Energy | 35756.20 | -208.60 | -0.58% |

After a firm start, markets failed to hold on to their early upsurge and simply lost track to end marginally lower. Metal stocks bore the brunt while automobile, realty, and oil & gas stocks also came under selling pressure, thus dragging key indices lower.

Technically, on intraday charts, the Nifty has formed a double top formation and on daily charts it has formed Hammer candlestick formation which is broadly negative.

For day traders 16200 would act as a crucial support level, and below the same we could see a quick intraday correction till 16100-16050.

On the flip side, fresh uptrend is possible only after 16300 intraday breakout. On breaching the level, the index could move up to 16400-16475.

The Nifty opened on a positive note & attempted to scale higher on May 23. It went on to test the crucial level of 16400 where the index had faced resistance in the last two weeks. 16400 proved to be a strong barrier yet another time.

The hourly chart shows that upper end of an upward sloping channel also created pressure near 16400. Thus the index nose dived towards the end of the session & closed in the red for the day.

The overall structure shows that the Nifty is likely to witness sideways action in the short term. 16000 – 16400 is expected to be the range for the next few sessions.

The government and RBI are making persistent efforts to moderate future inflation. Government fiscal measures like a hike in custom duty on steel and similar steps on other products in the future will help to control inflation.

However, the hawkish monetary and fiscal measures adopted by RBI & Government will have a cascading effect on market & economy in the short to medium-term.

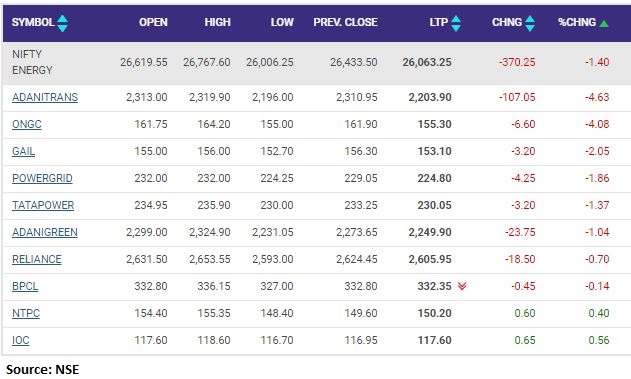

The Nifty metal index on the back of government policy news witnessed a massive sell-off. The Index is trading at a very crucial support of 5,100 and if fails to sustain above it will lead to a further sell-off.

The upside resistance stands at 5,800 and the index remains in a sell-on-rise mode.

Indian rupee ended flat at 77.52 per dollar against Friday's close of 77.54.

Markets gave up all its gains in afternoon trade today as it simply could not recover after the export tax imposed on steel products with the metal index falling almost 9% to 5200 levels in morning trade.

The prolonged Russia-Ukraine conflict coupled with its consequences and inflationary pressures weighed heavily in the minds of investors and traders.

Prospects of additional market borrowings by the GOI in the wake of the tax cuts on fuel to tame inflation also came to the forefront.

Benchmark indices erased all the intraday gains and ended marginally lower in the volatile session on May 23.

At close, the Sensex was down 37.78 points or 0.07% at 54,288.61, and the Nifty was down 51.50 points or 0.32% at 16,214.70. About 1390 shares have advanced, 1932 shares declined, and 158 shares are unchanged.

M&M, Maruti Suzuki, HUL, Asian Paints and Larsen and Toubro were among the top Nifty gainers, while losers included JSW Steel, Tata Steel, Divis Labs, ONGC and Hindalco Industries.

Among sectors, auto, capital goods and IT indices added 0.5-1 percent, while metal index shed 8 percent and realty, pharma and oil & gas index fell 1 percent.

BSE midcap and smallcap indices ended in the red.

Brokerage firm CLSA has maintained buy rating on with a target at Rs 490 per share.

The in-line revenue, cost optimisation offsets inflationary pressures, while multiple R&D initiatives make its medium-term story promising, reported CNBC-TV18.

Zydus Lifesciences was quoting at Rs 362.60, up Rs 5.45, or 1.53 percent on the BSE.

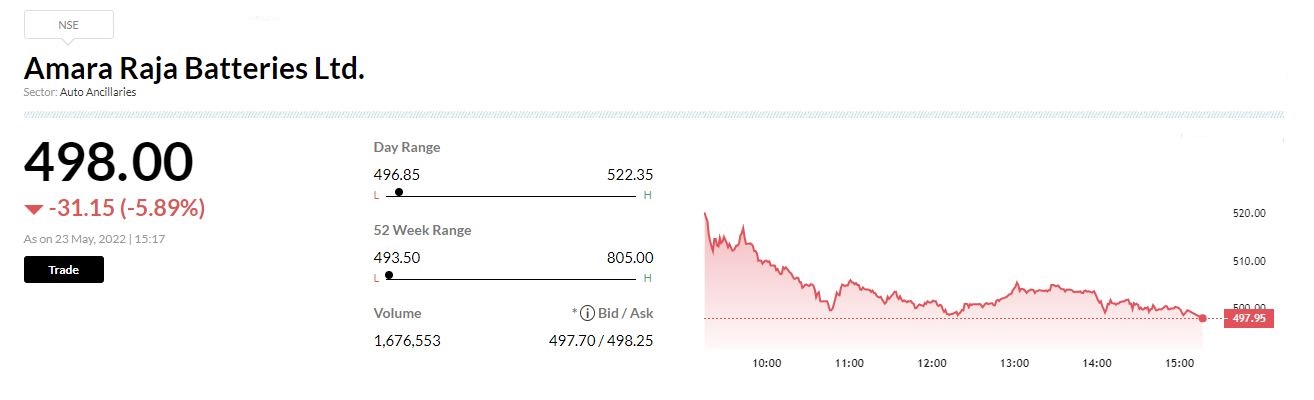

Amara Raja Batteries share price fell 6 percent after company reported a decline of 47.80 percent in consolidated net profit at Rs 98.85 crore in the fourth quarter ended March 2022.

Revenue from the operations was up 3.72 percent at Rs 2,180.96 crore during the quarter as compared to Rs 2,102.61 crore in the year-ago period.

Total expenses were at Rs 2,064.13 crore, up 10% from a year ago.

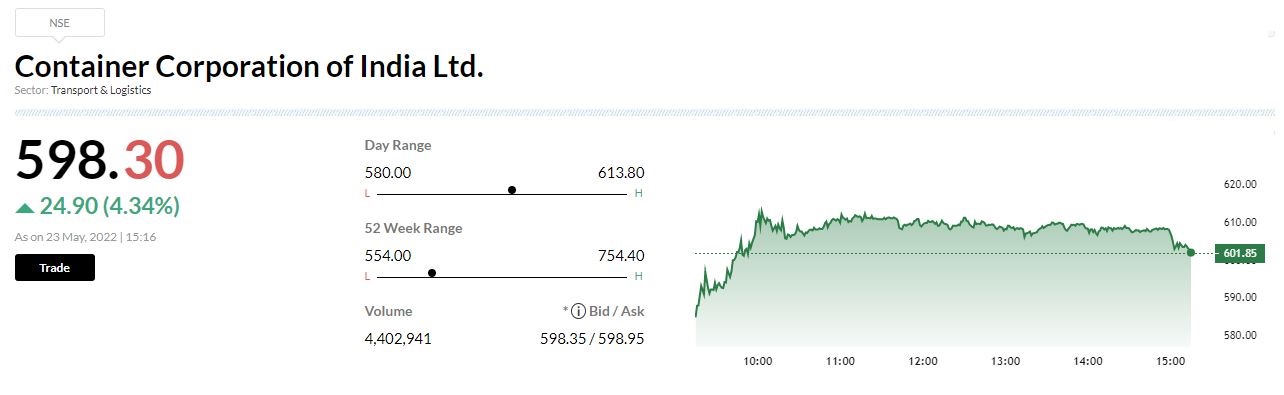

Nomura has maintained buy rating on Container Corporation of India but cut the target price to Rs 785 per share.

The results were in-line post adjustments with strong volume guidance. However, capex concerns were unjustified.

Nomura retained FY24/25 EPS estimates on strong volume outlook, reported CNBC-TV18.

India's largest licensed certified authority (CA) in the digital signature certificates space, eMudhra Limited, saw its public issue being booked 81 percent on the second day of subscription.

Investors have bid for 92.45 lakh shares against an IPO size of 1.13 crore units. Retail investors booked 1.55 times or 89.21 lakh shares of the portion set aside for them. Non-institutional investors booked 13 percent or 3.23 lakh shares allotted to them, while qualified institutional buyers were yet to subscribe to the issue.