March 07, 2022 / 16:32 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

On account of global cues, Nifty had a significant gap down opening on March 7. With this gap down opening the index breached certain short term supports, which were present in the range of 16200-16000. The larger structure shows that the Nifty has tested 61.8% retracement of the previous April – October rally, which is near 15850. Though the index breached this key Fibonacci level on an intraday basis, it managed to hold on to that level on a closing basis. Also, the channel study shows that Nifty has broken couple of lower channel lines today, however it has taken support near lower end of a steeper channel. Consequently, Nifty has halted near another support zone, which is near 15850-15700, which holds the key for further course of action. On the flip side, 16000 & 16200 will now pose as hurdles for the near term.

March 07, 2022 / 16:23 IST

Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel One

:

The situation with respect to Russia and Ukraine is getting worse day by day and due to further aberrations over the weekend, the market started the week with a huge downside gap well below the psychological level of 16000. The weakness extended in the initial trade which was followed by a modest recovery towards the midst of the session. However this attempt got sold into as we stepped into the latter half to make a fresh seven-month low of 15711.45. Things did not look good at that point but fortunately, we witnessed yet another round of recovery in the last hour of the session which pulled the Nifty towards 15900 to trim some potion of losses.

As far as levels are concerned, 16000 followed by 16200 are to be seen as immediate hurdles; whereas on the lower side, 15700 is to be seen as immediate support. In case of any further escalation globally, we would see Nifty entering our mentioned sacrosanct support zone of 15500 – 15200.

March 07, 2022 / 16:19 IST

Rupee closes at all-time low against US dollar

The rupee tanked 84 paise to close at its lifetime low of 77.01 (provisional) against the US dollar on Monday as intensifying geopolitical risks due to the Russia-Ukraine conflict pushed investors to safe haven assets. Forex traders said escalating tensions between Russia and Ukraine kept crude oil prices at an elevated level and heightened worries about domestic inflation and wider trade deficits. Sustained foreign fund outflows and a lacklustre trend in domestic equities also weighed on investor sentiment.

March 07, 2022 / 16:11 IST

Ajit Mishra, VP - Research, Religare Broking

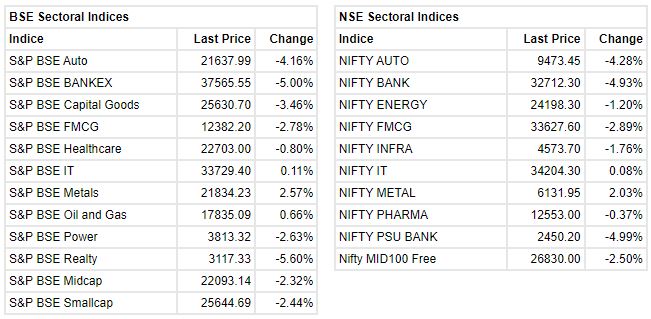

Markets plunged sharply lower and lost over 2%, tracking a continuous surge in the crude and feeble global cues. The benchmark opened gap-down and oscillated in a broader range till the end. Meanwhile, sectoral indices traded mixed front wherein Telecom, IT, Metal and Oil & Gas ended with gains whereas Auto, Banks and Capital Goods were among the top losers. Consequently, the Nifty index breached the psychological mark of 16,000 to close at 15,863 levels. The broader markets too ended with similar losses.

Markets are rattled with a sharp surge in crude amid the fear of further sanctions on Russia. Besides, there’s no sign of de-escalation of tension between the two nations. In short, we expect volatility to remain high and suggest keeping a close watch on global markets for cues. On the domestic front, state elections exit polls and actual results on March 10 would be actively tracked.

March 07, 2022 / 16:08 IST

Mohit Nigam, Head - PMS, Hem Securities

:

Local equities markets have succumbed to selling pressure and are down over 2%, dragging the Sensex and Nifty below critical levels of 53,000 and 15,900, respectively. Concerns about the Russia-Ukraine conflict, as well as rising crude oil prices, drove the markets lower. Oil prices increased by more than 6%, reaching their highest level since 2008, as the US and its European allies consider imposing a Russian oil import ban, while delays in the prospective return of Iranian petroleum to global markets exacerbated supply concerns. Foreign portfolio investors (FPIs) withdrew a total of Rs 17,537 crore from Indian markets in just three trading days in March. All Asian markets were trading down on the global front, reflecting a drop in global equity markets amid increasing commodity prices and a worsening Russia-Ukraine crisis. During the continuous market turmoil, inflation fears prompted a rush for safe-haven assets, pushing the global gold price to $2,000 per ounce today. On the technical front, immediate support and resistance in Nifty 50 are 15700 and 16200 respectively. Bank Nifty's immediate support and resistance are 32400 and 35000 respectively.

March 07, 2022 / 15:57 IST

Sachin Gupta, AVP, Research at Choice Broking

Domestic market extended the losses in Monday's session as prospects of the US and its allies imposing sanctions on Russian oil exports. The Nifty index plunged more than 2% to close at 15863.15 levels while Bank Nifty fell by 4% to settle at 32871.25 levels. Technically, Nifty has formed a Doji candlestick on the daily time frame that suggests indecisiveness among the trades. However, the index has closed below the Lower Bollinger Band formation and psychological levels of 16000. RSI & Stochastic is trading near the oversold territory. At present, Nifty has immediate support around 15700 levels while on upside the resistance comes around 16000 levels. On the other hand, Bank Nifty has support at 32100 levels while resistance is at 34000 levels.

March 07, 2022 / 15:50 IST

Vinod Nair, Head of Research at Geojit Financial Services

Oil prices surged above $130 a barrel for the first time since July 2008, following the risk of a US and European ban on Russia’s oil export which accounts for about 10% of global supply. As a result, the domestic market along with its global peers witnessed a huge sell-off from opening hours. Inflationary pressure is also witnessed in other commodities like gold, aluminium, copper, etc which will eventually eat away corporate profits in the coming quarters.

March 07, 2022 / 15:44 IST

Sun TV Network to pay Rs 5 per share interim dividend

Sun TV Network in a BSE filing said that the Board of Directors at their meeting held on March 7, 2022 have declared an interim dividend of Rs. 5/- per equity share of Rs 5 each (i.e. 100%) for the financial year 2021-22. The stock ended at Rs 438.50, up Re 1, or 0.23 percent. It as touched a 52-week low of Rs 425.

March 07, 2022 / 15:34 IST

Market at close

Benchmark indices closed deep in the red on March 7 but trimmed some of the loses. Sensex ended 1,402.74 points or 2.58% lower at 52931.07, and the Nifty shed 366.10 points or 2.25% at 15879.30. About 837 shares have advanced, 2543 shares declined, and 129 shares are unchanged.

March 07, 2022 / 15:14 IST

India Exposition Mart files draft papers, to raise Rs 600 crore via IPO

India Exposition Mart, the fourth largest integrated exhibitions and conventions venue, has filed its preliminary papers with the capital markets regulator Sebi for fund raising via IPO. The initial share sale comprises a fresh issue of Rs 450 crore and an offer for sale of 1.12 crore equity shares by selling shareholders. The company does not have any promoter as all shareholders are under the 'public category'.

Selling shareholders include Vectra Investments, Rakesh Sharma, Vivek Vikas, MIL Vehicles & Technologies, Dinesh Kumar Aggarwal, Pankaj Garg, Overseas Carpets, Navratan Samdaria, RS Computech, Lekhraj Maheshwari, and Babu Lal Dosi.

March 07, 2022 / 15:01 IST

Market Update at 3 PM

Sensex is down 1,548.98 points or 2.85% at 52784.83, and the Nifty down 404.40 points or 2.49% at 15841.

March 07, 2022 / 14:53 IST

Pankaj Pandey, Head – Research, ICICIdirect on today's market

The global as well as Indian equities continue to witness correction amid the ongoing Russia Ukraine conflict and concerns over economic costs of war and subsequent sanctions on global economies with key concern right now being sharp rise in crude prices.

Brent crude oil prices have surged above USD 125/barrel amid media reports that nuclear deal discussions with Iran were delayed and possibility of further sanctions on Russia by western countries. If crude prices sustain at higher levels, it is likely to impact India's current account deficit as well as fiscal deficit as India imports more than 80% of its total requirement.

On the equity market outlook, while we believe volatility will remain in the near term till there is clarity over cessation of this attack, the recent correction gives an opportunity to the long term investors to load up on quality companies with sustainable growth visibility. In the near term, Metals, IT, Pharma would be the key resilient sectors. On the medium term, we continue to remain constructive on domestic capex linked capital goods and allied space and PLI oriented domestic manufacturing plays.