June 13, 2022 / 16:21 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets started the week with a sharp cut, in continuous to the prevailing corrective phase. The fear of aggressive rate hikes dented sentiment and triggered a gap-down start however rebound in the last hour trimmed some losses. Consequently, the Nifty index closed at 15,774; down by 2.6%.

On the sector front, all the indices ended with losses wherein IT, Metal and Banks were the top losers. The broader indices too lost over 2.5% each.

All eyes would be on the CPI data to be released today evening. Moreover, the US Fed meet on Wednesday would induce further volatility. Nifty has almost retested the March 2022 low i.e. around 15,671 levels and its breakdown would pave the way for further decline towards 15,450 levels.

In case of a rebound, the 15,900-16,200 zone would act as a hurdle. We recommend using rebound to create shorts in the index until we see some sign of reversal. Stocks, on the other hand, are offering opportunities on both sides so plan accordingly.

June 13, 2022 / 16:11 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

The market crashed with full force on the first day of the week, as benchmark indices slumped below their crucial levels on across-the-board selling pressure. There have been heightened concerns amongst investors that central banks will be more aggressive in the coming months to hike interest rate hikes in order to combat inflation, which will in turn hurt economic growth and put margins under pressure.

Markets were also down due to continued strength in Brent crude prices, 10-year bond yields rising to 3.20% from recent lows of 2.80%, and the expected CPI numbers.

The fear and uncertainty was clearly visible in India's VIX, which is up over 15% at 22.50. Technically, if the Nifty breaks and closes below 15700, it will be a major downside event for the market. In such a situation, the index would fall to the level of 15500-15400 in the short term. It is advisable to reduce a weak long position below the 15700 level. Also, Bank Nifty could drop to 32000 level if it ends below 33500.

June 13, 2022 / 15:55 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The correction in the global markets is due to a double whammy of upcoming policy rate hikes and cuts to the central bank’s balance sheet.

Higher-than-expected US inflation data added fuel to the already wrecked market which was factoring in a 50bps hike in the Fed rate. The weakened rupee, persistent FII selling along with the anticipation of elevated domestic CPI numbers gripped domestic markets in fear.

We will continue to trade with high volatility, however medium to long-term risk takers, should start chip-in to the market because this could be in the last phases of the consolidation.

June 13, 2022 / 15:52 IST

S Ranganathan, Head of Research at LKP securities:

Weak global cues ahead of the Fed meet painted benchmark indices here in a sea of red as street awaits CPI data today on a day when the rupee hit a new low.

The risk off mode in equities globally after the US inflation print raised fears of an aggressive rate hike and the dollar index at 104 seem to weigh heavily amidst relentless FII selling despite local redemptions in May coming in at a two year low.

June 13, 2022 / 15:40 IST

Rupee Close:

Indian rupee ended 19 paise lower at 78.03 per dollar against Friday's close of 77.84. It touched fresh record low of 78.28 during the day.

June 13, 2022 / 15:35 IST

Market Close:

Benchmark indices ended in the red with Nifty below 15,800 on the back weak global markets.

At Close, the Sensex was down 1,456.74 points or 2.68% at 52,846.70, and the Nifty was down 427.40 points or 2.64% at 15,774.40. About 650 shares have advanced, 2759 shares declined, and 117 shares are unchanged.

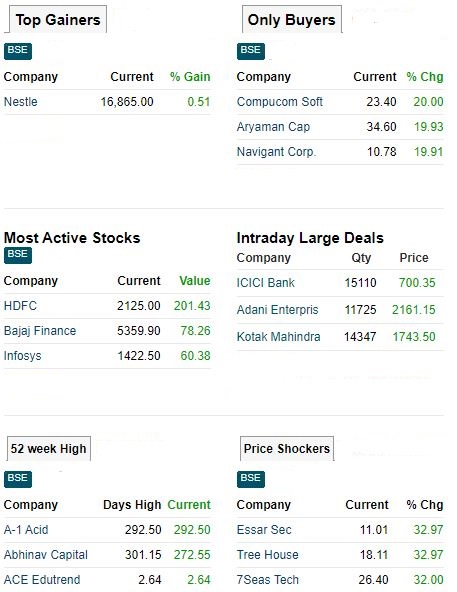

Bajaj Finserv, Bajaj Finance, Tech Mahindra, IndusInd Bank and Hindalco Industries were among the top Nifty losers, while gainers included Nestle India and Bajaj Auto.

BSE Midcap shed 2.7 percent and Smallcap index shed 3 percent.

All the sectoral indices ended in the red with bank, capital goods, auto, metal, IT, realty, PSU Bank, oil & gas indices fell 2-4 percent each.

June 13, 2022 / 15:25 IST

CLSA On RBL Bank

Brokerage firm CLSA India said the new CEO appointment raises several questions about RBL Bank.

It has downgraded the stock to outperform from buy with a target price at Rs 130 per share.

The stock is cheap, however, it lacks material triggers in near term, reported CNBC-TV18.

June 13, 2022 / 15:21 IST

Macquarie View On Asian Paints:

Brokerage house Macquarie has maintained overweight rating on Asian Paints with a target at Rs 3,500 per share.

The dealer checks suggest price hikes of Rs 3-5 per litre and believe the portfolio-level price hike will be marginal (1 percent), reported CNBC-TV18.

Asian Paints was quoting at Rs 2,662.10, down Rs 46.65, or 1.72 percent on the BSE.

June 13, 2022 / 15:16 IST

Today’s Stock Market Action

June 13, 2022 / 15:12 IST

BSE Oil & Gas index slipped over 2 percent dragged by the Gujaart Gas, HPCL, BPCL

June 13, 2022 / 15:08 IST

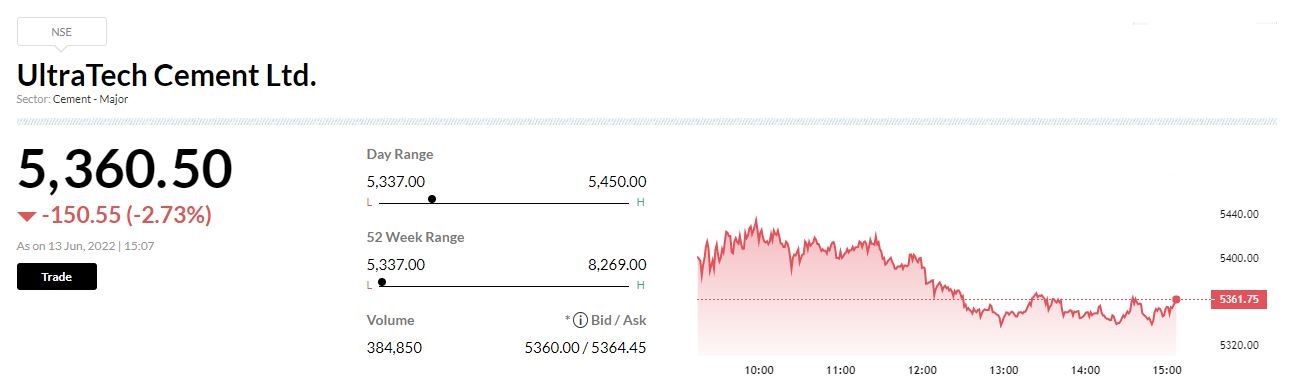

Fitch Revises Outlook on UltraTech's Foreign-Currency IDR to Stable:

Fitch Ratings has revised the Outlook on India-based UltraTech Cement Limited's (UTCL) Long-Term Foreign-Currency Issuer Default Rating (IDR) to Stable from Negative and affirmed the Foreign- and Local-Currency IDRs at 'BBB-'.

The Outlook on the Local-Currency IDR is Stable.

June 13, 2022 / 14:53 IST

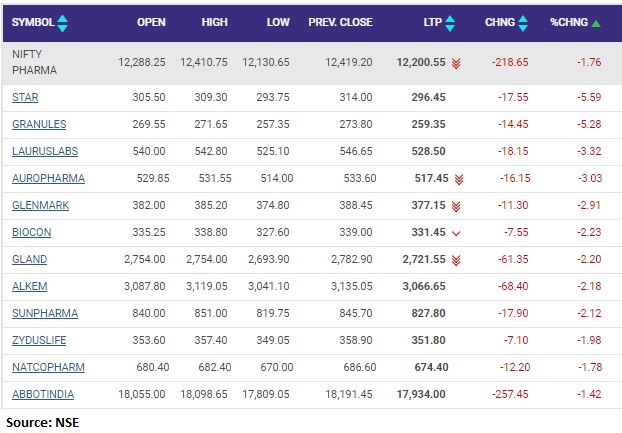

Nifty Pharma index fell nearly 2 percent dragged by the Strides Pharma Science, Granules India, Laurus Lab

June 13, 2022 / 14:49 IST

UBS On Maruti Suzuki India

Research firm UBS has kept buy rating on Maruti Suzuki India with a target price at Rs 10,000 per share.

The company is set to launch next generation Brezza on June 30, while its version of Toyota Hyryder may debut within weeks of Toyota unveil, reported CNBC-TV18.

Maruti Suzuki India was quoting at Rs 7,876.90, down Rs 57.90, or 0.73 percent on the BSE.