July 26, 2022 / 16:23 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty had stepped into a short term consolidation mode on July 25. It witnessed follow through selling on July 26. The hourly chart shows that the index is parting from an upper channel line on the downside & on the way down, it has breached the key hourly moving averages.

The hourly Bollinger Bands have started expansion thus making way for the index on the downside. Also, the Nifty has entered into a recent gap area on the daily chart & can move down further towards 15360 in order to fill up the gap area. On the higher side, immediate resistance zone shifts downwards to 16570-16600

July 26, 2022 / 16:14 IST

Jateen Trivedi, VP Research Analyst at LKP Securities:

Rupee witnessed range bound sessions with flat trades around 79.80 as the dollar index held rates above USD 106 and showed some recovery to 106.80. Further cues remain to be watched as FOMC two days meet starts today and rupee shall carry momentum based on commentary of FED Chair Person Jerome Powell. The Rupee range can be seen at 79.70-79.95.

July 26, 2022 / 16:10 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Traders were nervous ahead of the US Federal Reserve meet on rate decision on Wednesday and hence trimmed their position by dumping IT, banking and realty stocks. As the market has already risen continuously last week, investors are booking profit given the overall negative sentiment.

Technically, on intraday charts, the Nifty has maintained a lower top formation and also formed a bearish candle on daily charts, which suggests further correction from the current levels.

For traders, 16600 would act as an immediate resistance level and below the same, the correction wave is likely to continue till 16400-16350. A fresh uptrend rally is possible only after the 16600 breakout. Above which, the index could retest the level of 16700-16735.

July 26, 2022 / 15:58 IST

Rupak De, Senior Technical Analyst at LKP Securities:

The benchmark Nifty slipped lower before closing for the day as the proximity to the upper band of the rising channel on the daily timeframe attracted selling pressure.

A "lower top lower bottom" formation is visible on the hourly chart, which indicates a near-term bearishness.

On the lower end, immediate support is placed at 16400-16350, below which the index may fall towards 16000. On the higher end, resistance is visible at 16600, above which the uptrend resumes.

July 26, 2022 / 15:41 IST

Vinod Nair, Head of Research at Geojit Financial Services

Concerns over the global economic slowdown accelerated further as global corporate majors continued their trend of downgrading future estimates.

The Fed’s meeting commencing today, which is expected to maintain its aggressive rate hike of 75 bps, weighed on recession fears, especially in western markets. Even though the domestic market is showcasing strength, the spillover effect from the western market is inevitable.

July 26, 2022 / 15:35 IST

Rupee Close:

Indian rupee ended marginally lower at 79.76 per dollar against Monday's close of 79.73.

July 26, 2022 / 15:34 IST

Market Close

Indian benchmark indices ended lower for the second consecutive session on July 26 with Nifty closing below 16,500.

At Close, the Sensex was down 497.73 points or 0.89% at 55,268.49, and the Nifty was down 147.20 points or 0.89% at 16,483.80. About 1119 shares have advanced, 2128 shares declined, and 138 shares are unchanged.

Infosys, HUL, Axis Bank, Dr Reddy’s Laboratories and Bajaj Auto were among the top Nifty losers, while gainers included Bajaj Finserv, JSW Steel, Grasim Industries, Bharti Airtel and Coal India.

All the sectoral indices ended in the red with metal, IT, pharma, auto, bank, capital goods, realty and FMCG indices down 1-2 percent.

BSE midcap and smallcap indices fell 1 percent each.

July 26, 2022 / 15:26 IST

Aishvarya Dadheech, Fund Manager, Ambit Asset Management

The investors are betting on another Fed rate hike of at least 75 bps, this week. Some market participants are expecting even a 100 bps hike. Current inflation of almost 9% in the USA is far from their target inflation of 2%, and hence at least 150 bps of a rate hike in this cycle (July-August) can't be ruled out, effectively ending pandemic era support for the US economy.

Indeed, this initiative to control inflation will inflict more pain on the US economy and its growth. The market has discounted a 75 bps rate hike by the Fed this week. An aggressive rate hike or a very hawkish commentary for the remaining leg of the rate hike cycle will make the market jittery.

The Indian market will also closely watch the RBI policy meet due next month. We expect the Indian market to remain volatile due to this chain of events, despite a better-expected earnings season so far. The Fed in its next policy meeting will prioritise inflation over growth.

The differential between the effective Fed Fund rate (1.55%) and Ten Year yield in the US (2.8%) will be covered with at least a 140- 150 bps rate hike in this calendar year. The Fed will possibly go slow post that, once they have better visibility about any adverse impact on growth. Back home, the RBI should go for a smaller rate hike now. We expect a 20 or 25 bps rate hike in August as inflation has already started to moderate with a correction in commodities prices lately.

July 26, 2022 / 15:22 IST

JPMorgan View on Tata Steel

Foreign research firm JPMorgan has kept overweight rating on the Tata Steel with a target at Rs 1,400 per share.

It was a substantial all around beat driven by Europe, while Q2 is seasonally weak, H2 should see rebound.

The large Q1 beat with Europe EBITDA/T at $365/t. The steel prices bottomed in India given limited imports & steady underlying demand, reported CNBC-TV18.

July 26, 2022 / 15:19 IST

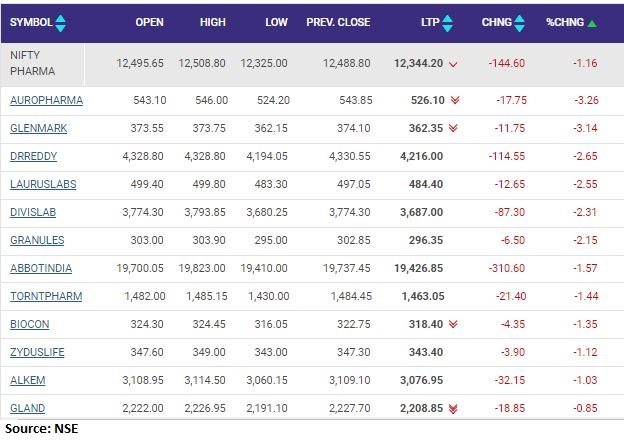

Nifty Pharma index shed 1 percent dragged by the Aurobindo Pharma, Glenmark Pharma, Dr Reddy's Laboratories

July 26, 2022 / 15:15 IST

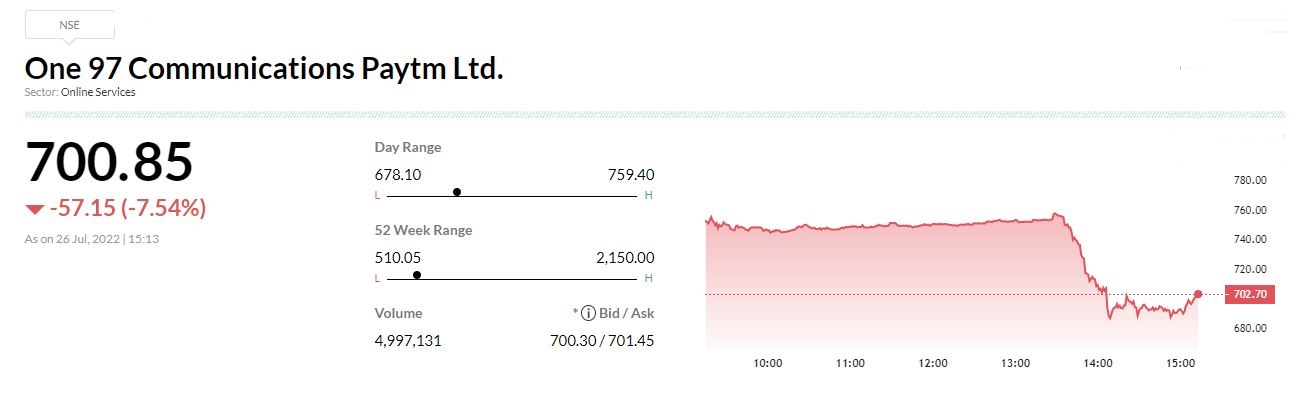

One 97 Communications (Paytm) share price under pressure

July 26, 2022 / 15:11 IST

JPMorgan View on Axis Bank

JPMorgan kept a neutral rating on Axis Bank and cut the target price to Rs 780 from Rs 880.

Loan growth disappoints with one percent sequential fall while retail does better with corporate being slower.

Net interest margin improvement guidance has been maintained. The RoA was 1.4 percent, remaining 60 basis points lower than larger peers, reported CNBC-TV18.

July 26, 2022 / 15:06 IST

Healthy Life Agritecbecomes 385th Company to get listed on BSE SME Platform:

Healthy Life Agritec Limited became the 385th company to get listed on the BSE SME Platform on July 26, 2022. Healthy Life Agritec Limited came out with an initial public offering of 1,00,00,000 Equity Shares of Rs.10 each for cash at a price of Rs. 10 per equity share, aggregating to Rs10.00 crore. The company has successfully completed its public issue on July 18, 2022.

Healthy Life Agritec engaged in the business of Trading Raw Milk, Chicken and Agro Products in the state of Maharashtra and Karnataka.