July 14, 2022 / 16:31 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Market is simply following herd mentality as most of the global indices exhibited weakness, prompting domestic investors to further prune their holdings in equities. Led by a steep fall in IT stocks, metals & select banking counters, key benchmarks ended weak in yet another fragile trading session. Investors offloaded their holdings in frontline technology stocks on worries that slowdown in western & the US could squeeze margins of domestic IT companies.

Technically, the Nifty has been consistently trading below 16000 and the 50-day SMA (Simple Moving Average) mark which is broadly negative. On intraday charts, the index is holding on to a lower top formation which indicates short term weakness.

For bulls, 16000 would be the key resistance level and above the same, the index could move up to 16100-16150. On the flip side, 15850 would be the key support level and if it slips further, the index could fall up to 15800-15725 levels.

July 14, 2022 / 16:23 IST

Ajit Mishra, VP - Research, Religare Broking

Markets remained volatile on the weekly expiry day and settled with a marginal cut. After the initial uptick, the benchmark drifted lower and traded with a negative bias for most of the session. However, a rebound in select index majors in the final hour trimmed some losses.

Consequently, the Nifty index settled at 15,938; down by 0.18%, Meanwhile, sectoral indices traded mixed wherein IT, banking and realty ended with losses whereas oil & gas, power and consumer durables ended with gains.

Besides global headwinds, the domestic cues are also portraying a mixed picture. On the benchmark front, it’s critical for Nifty to hold 15,900 else the bias would shift sideways to negative. While most sectors are trading in tandem with the benchmark and drifting lower, defensive like FMCG and pharma are still holding strong. Participants should maintain a cautious stance and align their positions accordingly.

July 14, 2022 / 16:13 IST

Rupak De, Senior Technical Analyst at LKP Securities:

The Nifty corrected towards the lower band of the rising channel before closing a bit off the day's low. On the daily chart, the index has remained below the important moving average.

The daily RSI is in a bearish crossover. On the lower end, the index may find support at 15850-15875. On the higher end resistance is visible at 16100.

July 14, 2022 / 16:00 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Tracking weak cues in global markets, Indian indices gave away their initial gains amid concerns over higher-than-expected US inflation data. Investors are increasingly expecting the Fed to carry out a minimum 75bps rate hike this month in order to combat high inflation.

On the domestic front, India’s WPI inflation moderated in June although it remains at the elevated levels, but is expected to ease further during the year.

July 14, 2022 / 15:45 IST

Kunal Shah, Senior Technical Analyst at LKP Securities

The Bank Nifty index continued to face selling pressure from higher levels and faced stiff resistance at the 35,200-35,300 zone. The lower-end support stands at 34,400 and if breached will lead to further selling pressure towards 34000.

The index is broadly stuck in a range between 34,400-35,300 zones and a break on either side will lead to trending moves.

July 14, 2022 / 15:36 IST

Rupee Close:

Indian rupee ended at fresh record closing low at 79.87 per dollar against previous close of 79.63 per dollar

July 14, 2022 / 15:34 IST

Market Close

Benchmark indices ended on flat note in the highly volatile session on July 14.

At close, the Sensex was down 98 points or 0.18% at 53,416.15, and the Nifty was down 28 points or 0.18% at 15,938.70. About 1360 shares have advanced, 1880 shares declined, and 137 shares are unchanged.

ONGC, Sun Pharma, Kotak Mahindra Bank, Dr Reddy’s Labs and Maruti Suzuki were among the top Nifty gainers, while losers included Hero MotoCorp, Axis Bank, HCL Technologies, Tech Mahindra and SBI.

On the sectoral front, Information Technology and PSU Bank indices fell 1-2 percent, while Oil & Gas and Power indices gained 1-1.6 percent.

The BSE midcap and smallcap indices ended in the red.

July 14, 2022 / 15:25 IST

Rajani Sinha, Chief Economist at Care Edge

Wholesale inflation remained elevated above 15% for the third straight month in June driven by higher food and fuel prices.

Sequentially, the wholesale price index was unchanged as moderation in manufactured products inflation on the back of the government’s supply-side measures and easing of global metal prices countered the higher food and fuel inflation.

While the easing of many of the global commodity prices is a comforting factor, volatile crude oil prices and the weakening of rupee against dollar continue to pose an upside risk to the wholesale inflation number.

Food inflation will continue to inch higher due to accelerating vegetable prices. Consequently, we expect WPI to remain in double-digits till the second quarter of this fiscal.

July 14, 2022 / 15:19 IST

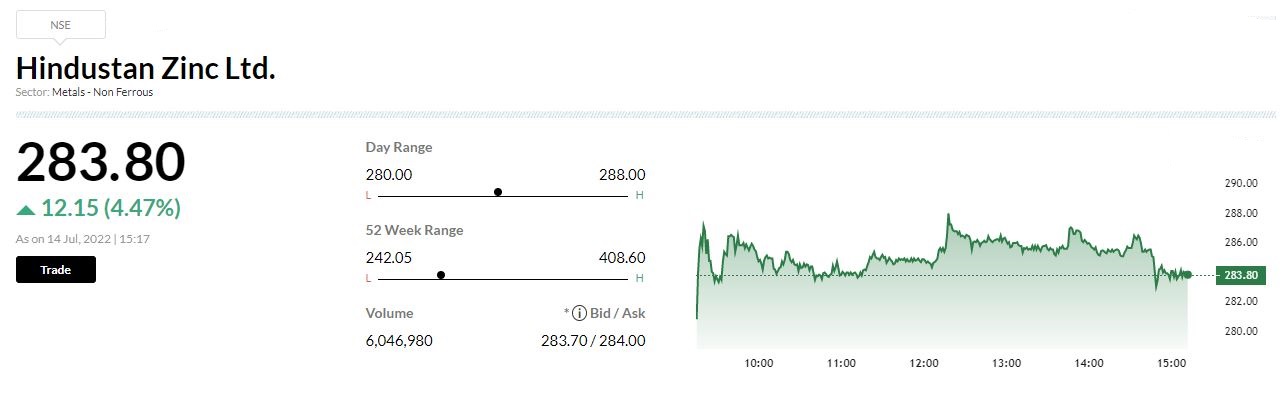

Citi On Hindustan Zinc

Research house Citi has maintained neutral rating on Hindustan Zinc and cut the target price to Rs 255 from Rs 330 per share.

The valuations appear inexpensive at current levels, while interim dividend announcement of Rs 21 per share is augur well.

The stock may be range-bound and have limited cost support for zinc LME.

Likely offer for sale by government looks imminent, reported CNBC-TV18.

July 14, 2022 / 15:16 IST

Dollar climbs further

The dollar resumed its relentless rise on Thursday, charting new 24-year highs against the yen and pinning the euro close to parity, as investors bet on the Federal Reserve ratcheting up interest rates to combat soaring inflation.

Global economic turmoil has put a rocket under the safe haven dollar, pushing the dollar index that tracks the greenback against six counterparts up more than 13% this year. It was last up a fifth of a percent on the day at 108.500.

The dollar strengthened more than 1% against the yen, pushing it above 139 yen per dollar for the first time since 1998. It was last up 1.3% at 139.18 yen per dollar.

The euro was hovering just above parity with the dollar - a day after breaking below the key level for the first time in almost two decades. The single currency fell as much as 0.5% on the day and was last down 0.3% at $1.00310.

July 14, 2022 / 15:13 IST

BSE Metal index shed 0.7 percent dragged by the NMDC, NALCO, Vedanta

July 14, 2022 / 15:11 IST

Chandan Taparia, Vice President, Equity Derivatives and Technical, Broking & Distribution, Motilal Oswal Financial Services:

Nifty opened gap up above 16000 level and made a high of 16070. The index could not sustain at higher zones and drifted lower. Any rise towards 16061 can be utilised as a selling opportunity in the index. India VIX has cooled off a bit and near 18 zones but it needs to cool down further below 18 zone for some comfort. Now as long as it below 16161, we can expect lower levels of 15888 and 15735 whereas resistance can be faced at higher levels of 16061 and 16161 zones. Market breadth has turned negative which indicates that the market is facing pressure at higher zones.

Today, we are witnessing positive momentum in sectors including Pharma, Auto and Financial services while some weakness was witnessed in PSU Banks, IT, Metals, FMCG and Realty.

Nifty and Bank Nifty have been facing resistance at higher zone. Going forwards, any rise can be utilised as a selling opportunity. At current juncture, we are advising to be with selective stocks and one can look for buying opportunity in Bharat Forge and Pidilite while selling opportunity is seen in RBL Bank, Coforge and Tech Mahindra.

July 14, 2022 / 15:07 IST

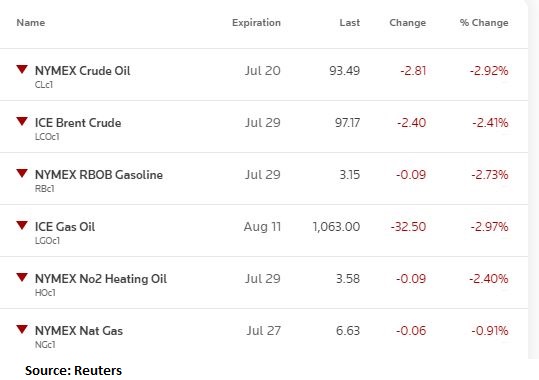

Energy Prices Update: