January 27, 2022 / 16:39 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets traded volatile and lost over a percent, following weak global cues. After the gap down start, the benchmark inched lower in the first half however healthy buying in the banking space pared the losses significantly. However, continued pressure in the IT majors and a few other index majors capped the upside. Consequently, Nifty closed at 17,110; down by 1%. The broader indices performed in line and lost in the range of 0.7%-1.2%.

Excessive volatility on the global front is keeping our markets also on the edge. With the US FOMC meet behind us, we expect some stability now. However, the prevailing earnings season and upcoming Union budget would keep the participants on their toes.

The recent buoyancy in the banking space is certainly encouraging but the other sectors should also support for any meaningful recovery. We feel it’s prudent to stay light and let the markets stabilise.

January 27, 2022 / 16:16 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty opened gap down on January 27 & went down to test the near term support parameters. It came down to test the junction of the swing low, the 78.6% retracement of the Dec – Jan rally & the hourly lower Bollinger Band. Over there the bulls rushed in to provide support to the benchmark index. As a result, the bulls managed to defend the swing low of 16836.

Thereon the index witnessed decent recovery towards the end of the session. Consequently, the Nifty held on to the psychological mark of 17000 on a closing basis for yet another session.

The overall structure shows that the index is preparing for a short term bounce towards 17500-17600. On the flip side, 17000 will continue to act as a near term support on a closing basis with major support at 16825.

January 27, 2022 / 16:12 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Volatility has been predominant during the day as the benchmark Nifty traded in the range of 300 points. On the lower end Nifty held the recent low of 16836 which it made in early trades of Tuesday. So Nifty has respected the support of 16825.

Going forward the market may remain volatile. On the lower end support is visible at 16825-16800. A decisive fall below 16800 may trigger resumption of the corrective phase. However, if Nifty may remain in the recovery mode as long as 16800 is held.

January 27, 2022 / 16:07 IST

Rahul Sharma, Co-owner, Equity 99:

Markets continued its downward journey, as Fed is likely to hike the interest rates in March. The market was majorly in negative zone due to Fed news. We expect buying in the market, as we are expecting a positive budget. The volatility may continue, but one should hold on their positions and not sell in panic.

For Nifty50 17060 will act as very strong support level. If this level is breached intraday than the next support will be around 16990 levels, post which markets might take support at 16880 levels.

On upper side 17185 will act as strong hurdle rate, if this level is breached than next resistance will be around 17250 levels post which we might see 17300 levels.

January 27, 2022 / 16:04 IST

S Ranganathan, Head of Research at LKP securities:

As the FED left key interest rates near zero, its hawkish commentary quickly washed away gains in Global Markets leading to a gap down opening in indices back home.

As FPI continued to book profits from Indian equities, value stocks made a comeback with the PSU Bank index rallying over 5% in afternoon trade today well supported by auto stocks to stage a smart recovery. As IT & pharma stocks witnessed profit taking, textile stocks were sought after in the broader market on the back of earnings.

January 27, 2022 / 15:34 IST

Market Close:

Benchmark indices ended lower with Nifty below 17,200 in the highly volatile session on January 27 after Federal Reserve in its policy outcome indicated interest rates hike in the near future.

At close, the Sensex was down 581.21 points or 1% at 57,276.94, and the Nifty down 167.80 points or 0.97% at 17,110.20. About 1447 shares have advanced, 1832 shares declined, and 90 shares are unchanged.

HCL Technologies, Tech Mahindra, Dr Reddy’s Laboratories, TCS and Wipro were the top Nifty losers, while gainers included Axis Bank, SBI, Maruti Suzuki, Cipla and Kotak Mahindra Bank.

Among sectors, PSU bank index was up 5 percent, while auto and bank indices rose 0.3-1percent. However, FMCG, realty, pharma, and IT indices shed 1-3 percent. BSE midcap and smallcap indices fell 0.8-1.2percent.

January 27, 2022 / 15:26 IST

Laurus Labs Q3 earnings:

Laurus Labs has reported 43.2 percent fall in its Q3 net profit at Rs 155 crore against Rs 273 crore and revenue was down 20.1% at Rs 1,028.8 crore versus Rs 1,288.4 crore, YoY.

Laurus Labs was quoting at Rs 460.40, down Rs 14.25, or 3 percent on the BSE.

January 27, 2022 / 15:23 IST

Wockhardt Q3 rsults

Wockhardt has posted net loss at Rs 6.8 crore in the quarter ended December 2021 against profit of Rs 15.2 crore in a year ago period.

Revenue of the company was up 11.8% at Rs 854 crore versus Rs 764 crore, YoY.

Wockhardt touched a 52-week low of Rs 379.80 and was quoting at Rs 394.45, down Rs 1.45, or 0.37 percent.

January 27, 2022 / 15:20 IST

Mohit Ralhan, Managing Partner & Chief Investment Officer of TIW Private Equity:

The US Fed has very clearly indicated that the situation of inflation has been deteriorating and the policy decisions will reflect the same. Market participants almost unanimously agree that there would be a rate hike in March, but it remains uncertain whether the rate hike will be 25 bps or more.

Given that the US inflation rate reached 7% in December, which is way above the Fed’s target of 2%, the logical inclination is to expect a hike of at least 50 bps, but the Fed may also want to keep it gradual.

While, in the December meeting Fed has signalled a forecast of three policy rate hikes, but the rising inflation has convinced market participants that there would most likely be four rate hikes. Fed didn’t rule out the same and the decline in the market indicates that a large section of market participants who were still considering three policy hikes in their calculations have now moved beyond it and joined the four rate hikes bandwagon.

The emerging markets will feel the pressure as liquidity gets eroded. FII’s have been net sellers in the Indian market and the US Fed’s increasingly hawkish stance is expected to continue putting selling pressure in Indian markets. This is liquidity-driven an un-correlated to domestic factors of economic recovery and growth. Therefore, the impact is expected to act as a stabilizing event and the long-term bull-run in India is likely to continue based on local macroeconomic factors.

January 27, 2022 / 15:14 IST

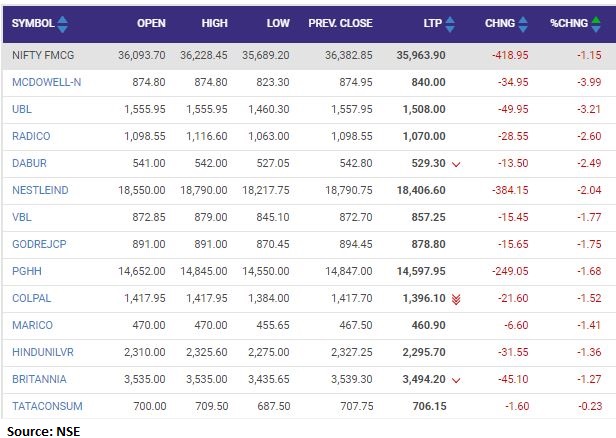

Nifty FMCG index shed 1 percent dragged by the United Spirits, United Breweries, Radico Khaitan

January 27, 2022 / 15:08 IST

Sameer Kaul – MD & CEO, TrustPlutus Wealth:

The fall in the Indian markets is in line with global markets. The markets were eagerly awaiting the outcome of the US Federal Reserve meeting on Monetary Policy which was held on 25th and 26thJanuary, 2022. The Federal Reserve has indicated that they will begin hiking interest rates in the near future and that there will be multiple rate hikes this year.

Along with that the Fed has also stated that they will end the asset purchase program in March and will also look to reduce the size of the Fed Balance Sheet from sometime later this year. The combination of these measures is what has spooked markets globally as it would mean moving from a scenario of easy and excess liquidity to a scenario of liquidity tightening.

As stated earlier, we expect 2022 to be a much more challenging year from a returns perspective as compared to 2021. We suggest investors stick to their asset allocation and invest in high quality companies and also pay close attention to valuations.

January 27, 2022 / 15:01 IST

Market at 3 PM

Benchmark indices erased most of the intraday gains but still trading lower with Nifty around 17100.

The Sensex was down 623.23 points or 1.08% at 57234.92, and the Nifty was down 180.20 points or 1.04% at 17097.80. About 1349 shares have advanced, 1791 shares declined, and 85 shares are unchanged.

January 27, 2022 / 14:51 IST

KRChoksey on Axis Bank

The Q3FY22 earnings for Axis Bank were strong from all financial metrics. Asset quality improved for Q3FY22 led by moderation in slippages and strong recoveries/accounts upgrades, whereas the operating profits remained flat due to higher operating expenses. Provision coverage remained steady at 72%.

In the long run, we expect Axis Bank to benefit on the back of its expansion of branches, strengthening the loan book mix with improving contribution from the retail segment, gaining market share, and lowering credit costs.

We expect the asset quality to improve further with the moderation of the slippages in Q4FY22E as well. The improvement of the financial parameters will lead to improvement in its returns ratio as targeted by the bank.

We have factored in CAGR 14% in advances, 14.7% in NII, 12.9% in PPOP, and 45.1% in PAT driven by healthy financial metrics on all fronts over FY21-24E.

We maintain our target price of Rs 936 per share, applying 2x FY24E P/ABV with an adjusted book value of Rs 475. This implies an upside of 24.4% over the CMP. We maintain our rating on the share of Axis Bank at buy.