Taking Stock | Market In Bear Grip As Profit-booking In 2nd Straight Session Pulls Nifty Below 14,300

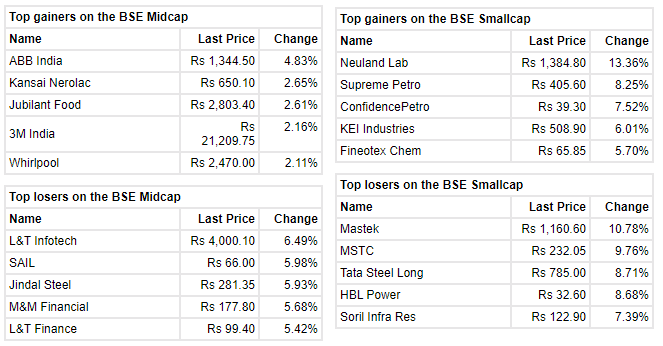

Broader markets underperformed the main indices with BSE Midcap and Smallcap indices falling 2 percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,673.02 | -277.93 | -0.33% |

| Nifty 50 | 25,910.05 | -103.40 | -0.40% |

| Nifty Bank | 58,899.25 | -63.45 | -0.11% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Bharti Airtel | 2,149.20 | 37.00 | +1.75% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Interglobe Avi | 5,739.50 | -133.50 | -2.27% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Bank | 58899.30 | -63.40 | -0.11% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 35975.20 | -400.00 | -1.10% |

Unusual strength in the dollar index and sustained run up in the commodities have battered the sentiment of the equity market. Nifty/Sensex fell more than one percent during the day and made a low of 14222/48460. It has triggered selling in commodities and the Nifty Metal index closed 4.57% lower.

Reliance Industries and HDFC Bank have supported the market otherwise it could have closed below the levels of 14200/48400. On a daily chart, Nifty/Sensex has formed bearish continuation formation following to a Doji star of formation on a weekly chart. As the market closed below the crucial support 14350/48800, Nifty could fall to 14100/48100 or 14000/47900 in next couple of days.

On the higher side, 14350/48800 and 14460/49150 would be major hurdles. The strategy should be to trade on bounces and keep a final stop loss at 14470/49200 levels. Select buying is advisable between 14100 and 14000 (48100/47900) levels, strictly with a medium term view.

Markets plunged sharply lower and lost nearly one and a half percent amid weak global cues. Initially, the benchmark opened marginally in the red tracking unsupportive global markets which further deteriorated as the session progressed. However, recovery in select index majors recouped losses in the middle but not for long. Consequently, the Nifty ended around the day’s low at 14,281 levels. On the sector front, except consumer durable, all the other indices ended in the red wherein metals, healthcare and auto were the top losers. In line with the benchmark, the broader market indices too ended lower in the range of 2-2.3%.

The news of fresh COVID cases in China has spooked the markets across the globe including India as participants are worried about global economic recovery. At the same time, we’re seeing a noticeable rise in volatility on the domestic front too, thanks to the prevailing earnings season. Amid all, we reiterate our positive yet cautious view and suggest focusing more on stock selection and risk management. On the index front, Nifty has critical support at 14,100.

We have broken the crucial support of 14350 and should ideally be headed further south to levels closer to 14150 and then 14000. Markets have become volatile and strict stops must be placed on all trades. 14500 has become a resistance zone and any rally up can be utilized to short the Nifty for lower targets.

The market has got choppy ahead of the upcoming Union Budget and due to weakness in an expensive global market. A good part of the economic gains is well factored in by the upside of the last 11 weeks. A short-term correction was being anticipated for some time, it will be welcome for the market on a long-term basis.

Crude oil prices are holding near $52.20, after selling, from the previous weeks high of $53.93. Strength in the Dollar Index has pushed oil prices lower. Dollar Index prices are currently holding near 90.77, up 1.80%, from the recent low of 89.16. Also, demand concerns, due to fresh lockdowns in many countries, are likely to keep oil prices under pressure.

Indian rupee ended near the day's low at 73.28per dollar, amid selling saw in the domestic equity market.It opened lower by 10 paise at 73.22 per dollar versus Friday's close of 73.12 and trade in the range of 73.19-73.30.

Rupee traded weak near 73.25 on back of support from dollar index which has stabilized before new US President Biden takes over from current President Trump. With dollar taking support near $90.00 USDINR has taken support near 73.00. 73.55 can be on cards in coming sessions.

Benchmark indices witnessed profit booking in the second consecutive day on January 18 on the back of selling seen across the sectors.

At close, the Sensex was down 470.40 points or 0.96% at 48,564.27, and the Nifty was down 152.40 points or 1.06% at 14,281.30. About 900 shares have advanced, 2074 shares declined, and 144 shares are unchanged.

UPL, Reliance Industries, Titan Company, HDFC Bank and ITC were among major gainers on the Nifty, while losers were Tata Steel, Tata Motors, ONGC, Hindalco and Sun Pharma.

All the sectoral indices ended lower led by metal (down 4 percent), while auto, PSU bank and pharma indices shed 2 percent each. BSE Midcap and Smallcap indices shed 2 percent each.

The market manages to hold above the Nifty 50 Index support zone of 14,170-14,230. The technical factors are aligned to support a range-bound market movement in the coming week. Therefore, the short-term traders to use the rally to exit while buying any dip towards the support level around 14,170-14,230 (considered best practice in a volatile market). The market breadth to deteriorate, indicating a likelihood of higher volatility.

Rakesh Jhunjhunwala raised his stake in Indian Hotels to 2.10% from 1.05% in Q3, reported CNBC-TV18.

RK Damani's Derive Investments has cut its stake in Trent to 1.52% from 2.56% in Q3, reported CNBC-TV18.