Among sectors, the Nifty PSU bank index added 1.5 percent, IT a percent and the energy index closed 0.6 percent higher.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,900.71 | -331.21 | -0.39% |

| Nifty 50 | 25,959.50 | -108.65 | -0.42% |

| Nifty Bank | 58,835.35 | -32.35 | -0.05% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Tech Mahindra | 1,494.70 | 33.20 | +2.27% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Bharat Elec | 403.80 | -12.55 | -3.01% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37006.80 | 121.50 | +0.33% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10017.90 | -124.60 | -1.23% |

Nifty failed to sustain above 18,000 and slipped lower before closing around 17,900. A "dark cloud cover"-like pattern has formed on the daily chart, suggesting a near-term weakness.

Support on the lower end is visible at 17,850/17,750. Below 17,750, Nifty may witness a meaningful correction. On the higher end, resistance is visible at 18,000–18,100.

The sluggish mood continued as markets moved in a narrow range with a negative bias. Investors are taking a cautious stance as the global macroeconomic scenario remains bleak while FIIs continued to be sellers in domestic equities in the current month, thus dampening the market sentiment.

Technically, the market is consolidating within the 17,850 to 18,050 price range. On daily charts, the Nifty has formed a bearish candle near the 100-day SMA which is broadly negative.

We are of the view that 17,800 would act as a sacrosanct support zone for the traders, and a fresh round of selling is possible only after the dismissal of 17,800. Below the same, the index could slip till 17,700-17,650. On the flip side, 18,000 would be the trend reversal level for the bulls and above the same the index could move up till 18,100-18,135.

Markets started the week on a subdued note and lost nearly half a percent amid mixed cues. The initial gains fizzled out in no time and Nifty traded with a negative bias till the end. Meanwhile, a mixed trend on the sectoral front kept the participants busy wherein PSU banking and IT edged higher, while metal and auto settled in the red.

The broader indices too traded in line with the benchmark and closed marginally lower.

Markets have been facing selling pressure on the rise, showing uncertainty among the participants despite favorable cues. We feel it’s prudent to limit positions in the prevailing scenario and wait for a decisive breakout from the 17,800-18,100 zone in Nifty.

In the event of subdued Q3 results, soft budget expectations and cliffing of global rates the market is contemplating with high volatility as these scenarios envelop the future trend.

The Nifty has been witnessing short term consolidation for the last few weeks. In terms of the price patterns, it has formed a triangle on the daily chart. Towards the end of the last week, the Nifty had formed a base near the lower end of the pattern.

Consequently, the index took a leap on the upside & opened gap up on January 16. However, the index stumbled near the upper end of the pattern & stayed back into the pattern.

Till the time the index trades above 17,800 on a closing basis, the pattern is eventually expected to break out on the upside. The Nifty will be set for a larger bounce, once it crosses the near term barrier of 18,050.

Decline in WPI inflation to 4.95% and CPI inflation to 5.72% in December shows a steady downtrend in price level. The significance of this downtrend is that it will enable the MPC to pause after one more, say, 25 bp rate hike in February.

Therefore, higher rates will not impact the growth recovery underway in the economy now.

Indian rupee closed 28 paise lower at 81.61 per dollar on Monday against previous close of 81.33.

Benchmark indices ended lower in the second consecutive session on January 16.

At Close, the Sensex was down 168.21 points or 0.28% at 60,092.97, and the Nifty was down 61.80 points or 0.34% at 17,894.80. About 1658 shares have advanced, 1844 shares declined, and 169 shares are unchanged.

Adani Enterprises, Axis Bank, Hindalco Industries, JSW Steel and TCS were among the top losers on the Nifty, while gainers were Tech Mahindra, Infosys, HCL Technologies, Wipro and Hero MotoCorp.

Among sectors, except IT, power and PSU bank, all other sectoral indices ended in the red.

BSE midcap and smallcap indices ended on flat note.

HG Infra Engineering has received the letter of acceptance from Delhi Metro Rail Corporation (DMRC) for the project worth around Rs 400 crore in Delhi. The construction period is 24 months.

HG Infra Engineering Ltd. was quoting at Rs 656.30, down Rs 10.85, or 1.63 percent.

Roto Pumps has received an order for supply of screw pumps and spare parts amounting to Rs 14 crore from Grasim Industries.

Roto Pumps has touched 52-week high of Rs 538.50 and quoting at Rs 526.15, up Rs 18.00, or 3.54 percent on the BSE.

Swan Energy has bought 8.15 lakh equity shares or 3% stake in Veritas (India) via open market transactions, at an average price of Rs 243.70 per share. However, promoter Niti Nitinkumar Didwania was the seller in this deal.

Veritas touched a 52-week high of Rs 251.05 and quoting at Rs 251.05, up Rs 4.90, or 1.99 percent on the BSE.

Swan Energy was quoting at Rs 323, down Rs 3.95, or 1.21 percent on the BSE.

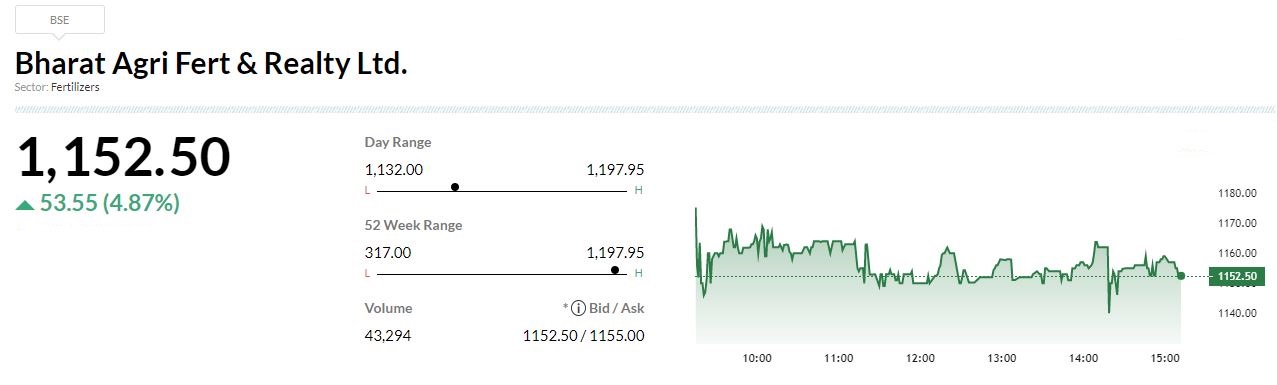

Bharat Agri Fert & Realty will consider sub-division of equity share from the face value of Rs 10 per share to Re 1 per share on February 1.