February 23, 2022 / 16:17 IST

Ajit Mishra, VP - Research, Religare Broking

:

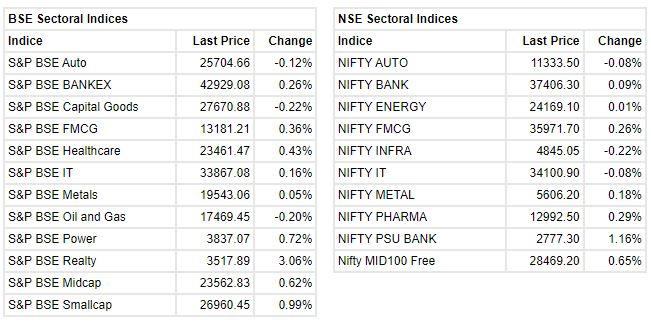

Markets traded lackluster in a narrow range and finally ended marginally lower. Initially, the benchmark opened marginally higher however lack of follow-up buying capped upside. It hovered in a narrow band for most of the session which finally ended with a breakdown. Consequently, the Nifty index closed at 17,063.25 levels; down by 0.2%. Meanwhile, noticeable action on the broader front kept the participants busy. Mostly sectoral indices, barring realty, ended flat to marginally lower in line with the benchmark.

Markets are gradually drifting lower amid excessive intraday volatility, mirroring the global markets. Meanwhile, a mixed trend on the sectoral front is further adding to the participants’ worries. In such a scenario, it’s prudent to restrict positions and wait for clarity over the next directional move.

February 23, 2022 / 16:12 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Investors traded with caution on the eve of the monthly F&O expiry, which also got reflected in the overall sentiment. After trading in positive territory for the better part of the session, indices eased marginally due to selective profit-taking in late trades. Also, there are multiple challenges ahead, and hence investors are staying on the sidelines amid worries over Russia-Ukraine crises and the subsequent rise in crude prices. Technically, Nifty has formed a small bearish candle and is also holding lower top formation, which is broadly negative.

We are of the view that the narrow range activity is likely to continue in the near future. For the short term traders, 17000 is immediate support and 17225 would be the key resistance level. One can expect a quick pullback rally up to 17150 -17175 levels, if Nifty trades above 17000. However, if the index slips below 17000, further correction is possible up to 16950-16850.

February 23, 2022 / 16:06 IST

Mohit Nigam, Head - PMS, Hem Securities

:

Indian equity benchmarks snapped their 5-day losing streak with optimistic start on Wednesday. Markets traded with gains of over half a percent each in early deals as buying resumed after recent market slide. Markets trimmed some of their gains in late afternoon session and closed below the neutral line with the loss of 0.17%. Traders were cautious after Finance Minister Nirmala Sitharaman’s statement that the Russia-Ukraine crisis and the ensuing jump in global crude prices are a challenge to financial stability in India.

On technical fornt, Nifty50 may take immediate support and resistance at 16,850 level and 17,300 level respectively. In case of Bank Nifty 36,900 and 37,600 level will act as immediate support and resistance.

February 23, 2022 / 15:57 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

Nifty had tested the crucial support of 16800 yesterday from where it started recovering. The index opened gap up on February 23 and attempted to continue with the recovery process. However it couldn’t sustain above the key hourly moving averages & dipped into the negative territory at the end of the day. In terms of the price pattern, Nifty has formed a triangular pattern on the daily chart & is witnessing consolidation within the pattern. The lower end of the pattern is at 16800 whereas the upper end is near 17300. Nifty is expected to witness further consolidation in this range post which it can resume the larger uptrend.

February 23, 2022 / 15:56 IST

Vinod Nair, Head of Research at Geojit Financial Services

:

As global markets turned positive, domestic indices opened the day on a positive note, however, witnessed high volatility and succumbed to selling pressure to close the day in favour of bears. The impact of geopolitical uncertainties and soaring fuel costs will continue to keep markets across the globe highly volatile. Broader markets outperformed benchmark indices while on the sectoral front, realty stocks attracted buyers.

February 23, 2022 / 15:35 IST

India Ratings pegs India's FY22 GDP growth at 8.6% on data revision

India Ratings has revised downwards its GDP growth forecast for 2021-22 to 8.6 percent from the consensus 9.2 percent projected earlier. The National Statistical Organisation (NSO), which has forecast 9.2 percent real GDP growth for the year, will release the second advance estimate of national income on Monday.

According to an India Ratings analysis, NSO is likely to peg the FY22 real gross domestic product growth at Rs 147.2 lakh crore. This translates into a GDP growth rate of 8.6 percent, down from 9.2 percent forecast in the first advance estimate released on January 7, 2022.

February 23, 2022 / 15:33 IST

Market at close: Sensex is down 68.62 points or 0.12% at 57232.06, and the Nifty shed 28.90 points or 0.17% at 17063.30.

February 23, 2022 / 15:21 IST

Mahesh Kumar, EVP & Head Capital & Commodities Market at Abans Group

:

Gold is currently trading at $1898 per troy ounce, a slight decrease from Monday's high of $1918.30 per troy ounce. However, prices have risen significantly from last year's low of $1680 per troy ounce in August 2021 to a multi-month high. Due to ongoing conflicts between Russia and Ukraine, geopolitical tensions are at an all-time high, which is beneficial to gold. In the short term, safe haven demand is likely to support gold prices.

Gold prices are likely to face stiff resistance as pandemic in the US has improved after the 7-day average of new US Covid infections fell to a 2-3/4 month low Monday of 86,852. Gold prices are in a bullish trend in the short term and are likely to trade higher while above key support levels of $1877-1869; however, it may face stiff resistance around the recent high of $1918.30.

February 23, 2022 / 15:10 IST

Market Update at 3 PM: Sensex is down 52.04 points or 0.09% at 57248.64, and the Nifty shed 20.80 points or 0.12% at 17071.40.

February 23, 2022 / 14:49 IST

Lupin Announces Executive Leadership Change

Lupin Announces Executive Leadership Change, Dr. Fabrice Egros to assume Corporate Development responsibilities as President, Corporate Development &

Growth Markets. He will lead the development and execution of the Company’s inorganic growth strategy, including mergers and acquisitions, business development, in-licensing arrangements, and related matters. He will continue to lead business in LATAM and Asia regions in this new role. Alan Butcher who was managing this role till now will be departing from the Company on February 28, 2022.

February 23, 2022 / 14:32 IST

TVS Motor clocks 1 million exports in two wheeler segment in FY21-22

Two and three wheeler major TVS Motor Company on Wednesday said its exports in two wheeler segment clocked sales of one million (10 lakh) units, marking a significant milestone in the current financial year for the first time, the company said on Wednesday. The exports include the sales from TVS Motor and also from Indonesian unit PT TVS.

"The key exports include TVS Apache series, TVS HLX Series, TVS Raider and TVS Neo Series. An increase in sales in global motorcycles significantly contributed to this achievement", the company said in a statement.

The stock was trading at Rs 651.80, down Rs 10.45, or 1.58 percent. It has touched an intraday high of Rs 671.65 and an intraday low of Rs 648.90.

February 23, 2022 / 14:25 IST

Nykaa shares rally nearly 5% on settlement of litigation with L'Oreal

FSN E-Commerce Ventures, which is widely known as Nykaa, gained as much as 4.6 percent on February 23, as the company finally settled its pending litigation with L'Oreal. The company informed exchanges on February 22 that the litigation with L'Oreal S.A. has been settled. "The certified true copy of the Delhi High Court order dated January 21, 2022 was received by the company on February 21."

In November 2019, L'Oreal S.A. had filed a case against FSN E-Commerce Ventures and Nykaa E-Retail, alleging copyright infringement and passing-off against Nykaa with respect to its trademark "Maybelline" and the trade dress and colour combination of its product "Maybelline New Lasting Drama Gel Liner".

The District Court in Delhi passed an ex-parte order, against which Nykaa preferred an appeal before the Delhi High Court. Both the companies have decided to go for settlement that was approved by the District Court as well as Delhi High Court.

February 23, 2022 / 14:18 IST

European stocks open higher with all eyes on Ukraine

European stock markets climbed at the open on Wednesday, as investors tracked the latest developments in the Russia-Ukraine crisis. London's benchmark FTSE 100 advanced 0.5 percent to 7,531.42 points compared with Tuesday's closing level. In the eurozone, Frankfurt's DAX added 0.8 percent to 14,814.86 points and the Paris CAC 40 won almost one percent to 6,854.16.