December 09, 2022 / 16:22 IST

Kunal Shah, Senior Technical Analyst at LKP Securities

The Bank Nifty index witnessed some selling pressure at higher levels where fresh short positions were built up. The index is still trading in a broad range between 43,000-44,000 where a significant amount of put and call writing has been witnessed respectively.

The index must decisively breach the range for a trending move on either side.

December 09, 2022 / 16:21 IST

Aditi Nayar, Chief Economist, ICRA:

The total net cash outgo under the supplementary demand for grants, which is somewhat smaller than our expectations, is dominated by fertilizer subsidy, food subsidy, payments to the OMCs for domestic LPG operations, and funds towards NRGEGA.

Additionally, capex has been augmented by around Rs. 31000 crore, which should help to ensure that the capex target is achieved. With savings likely under other heads, we do not see the supplementary demands resulting in a meaningful breach of the fiscal deficit target of 6.4% of GDP.

December 09, 2022 / 15:54 IST

Amol Athawale, Deputy Vice President - Technical Research, Kotak Securities

Profit taking was back in action as investors dumped IT, metal and realty stocks, even as benchmark Sensex still managed to end above the psychological level of 62000 mark. The recent trend indicates that markets may continue to exhibit intra-day volatility as investors keenly await the outcome of the US Fed's decision on interest rate next week. More than the rate hike, investors would be more interested in knowing about the forward looking statement on inflation and rate decision going ahead.

Technically, the lower top formation on intraday charts and bearish candle on weekly charts is indicating further weakness from the current levels.

For short-term traders, the 20-day SMA (Simple Moving Average) or 18,450 would act as a sacrosanct support zone, above which, we could expect a one pullback rally till 18,700. On the flip side, below 20 day SMA or 18,450, further sell off is possible till 18,300-18,200.

December 09, 2022 / 15:52 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Equity markets in India posted negative returns this week. Key indices like BSE Sensex, Nifty 50, BSE Midcap and BSE Smallcap ended the week in the red. Amongst sectors, the performance was mixed. BSE IT, BSE Healthcare and BSE Power indices reported sharp declines this week. On the other hand, BSE FMGC, BSE Capital Goods and BSE Bankex saw marginal gains.

FPI’s have been net sellers of Indian equities during the week. Domestic markets reacted to 35 bps repo rate hike by the RBI MPC. The RBI MPC expressed optimism on growth but tackling inflation will likely be a key focus.

Oil prices saw a sharp decline this week and that is positive for India.

Impact of easing of covid restrictions by China needs to be watched out. In the US, the 10 year treasury yields have seen a steady decline over the past few weeks. The 10 year US treasury yield is now below 3.5% compared to a high of 4.22% in November 2022. Globally, markets are now awaiting US FOMC rate hike action and commentary in their scheduled meeting next week.

December 09, 2022 / 15:48 IST

Vinod Nair, Head of Research at Geojit Financial

Today's downfall in the domestic market was sparked by IT stocks extending their losses after warning of a potential slowdown in business on global recession fears.

This was further aggravated by banks losing their grip as PSBs suffered heavy sell-offs. However, global bourses were largely positive, although the Fed is expected to raise interest rates by 50 basis points next week.

December 09, 2022 / 15:44 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty remained volatile before closing lower as Nifty ended more than 100 points lower. On the daily chart, the index slipped below the recent consolidation, suggesting a rise in pessimism. Besides, the bulls failed to protect the 18,500.

Going forward, the trend may remain negative with support placed at 18,350/18,200. On the higher end, 18,670 may act as crucial resistance

December 09, 2022 / 15:35 IST

Rupee Close:

Indian rupee closed 16 paise higher at 82.27 per dollar against previous close of 82.43.

December 09, 2022 / 15:30 IST

Market Close:

Indian benchmark indices ended lower on December 9 with Nifty around 18,500.

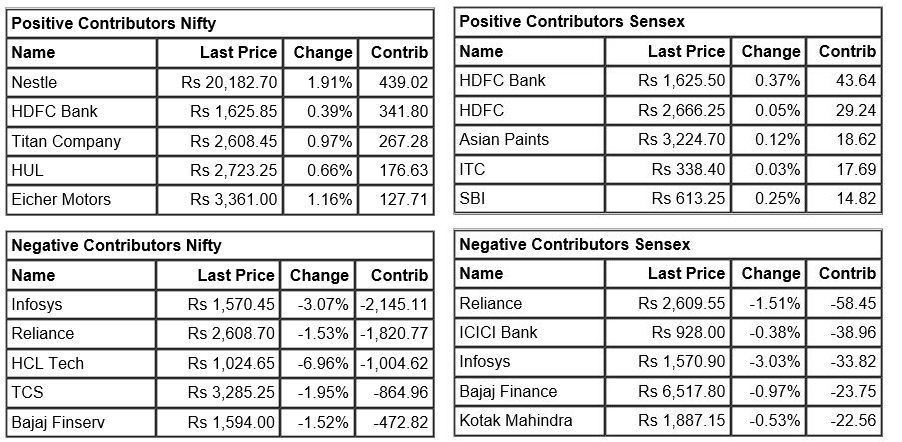

At Close, the Sensex was down 389.01 points or 0.62% at 62,181.67, and the Nifty was down 112.70 points or 0.61% at 18,496.60. About 1199 shares have advanced, 2220 shares declined, and 113 shares are unchanged.

HCL Technologies, Tech Mahindra, Infosys, Wipro and Hindalco Industries were among the top Nifty losers, while gainers were Nestle India, Sun Pharma, Dr Reddy's Laboratories, Titan Company and Eicher Motors.

Among sectors, information technology index shed 3 percent, PSU bank, metal index and realty indices down 1 percent each. However, FMCG index gained nearly 1 percent.

BSE midcap index fell 0.4 percent and smallcap index slipped 1 percent.

December 09, 2022 / 15:24 IST

Akhil Chaturvedi, Chief Business Officer, Motilal Oswal Asset Management Company

These trends reflect sign of maturity in investors' mindset. SIP contribution remaining above Rs 13,000 indicates better awareness among retail investors about long term orientation of equity investments and wealth creation opportunities from India’s growth trajectory.

Investors now have an understanding of seeing short term volatility as a part and parcel of equity investing. Instead of reading too much into month on month dip in net equity inflows, the heartening thing to note is that net equity inflow has remained relatively resilient and investors are willing to look past short term trends and instead focus on long term fundamentals.

December 09, 2022 / 15:21 IST

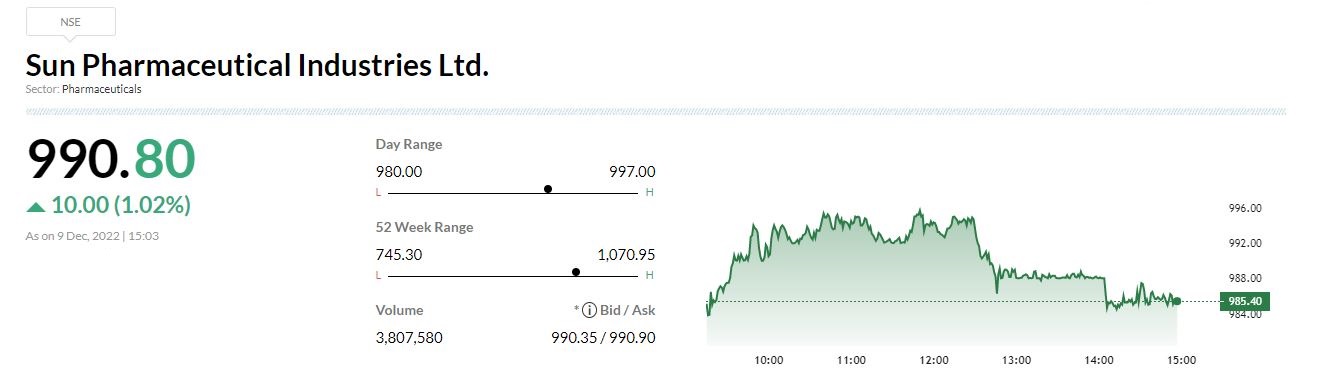

Bernstein On Sun Pharma

-Outperform call, target at Rs 1,099 per share

-Import alert for halol disappointing but rev & margin impact insignificant

-Revenue exposure is 3% of consol sales

-Est US gx EBITDA margin to be 7%, 0.8% -ve impact on FY24 EPS which is immaterial

-US Gx story stopped being material for co since 2019/20

-Largest growth drivers will remain us specialty & India branded generics

-Believe US generics to be a drag on growth & margin

Sun Pharmaceutical Industries was quoting at Rs 994.20, up Rs 13.25, or 1.35 percent.

December 09, 2022 / 15:11 IST

Gujarat Fluorochemicals Large Trade | 3.01 lakh shares (0.27% equity) worth Rs 97.21 crore change hands at Rs 3,232.05 per share

Gujarat Fluorochemicals Limited was quoting at Rs 3,238.75, down Rs 10.95, or 0.34 percent.

December 09, 2022 / 15:06 IST

Nomura maintains 'Buy' on Sun Pharma, target Rs 1,094

-Buy call, target at Rs 1,094 per share

-Import alert will lead to loss of sales, delay in new product approvals

-Overall sales from site to US was USD 150 million in FY22, at 3% of consolidated revenue

-Company has retained sales growth guidance of high-single to low double-digits for FY23

-Assuming annual sales impact of USD 100-150 million, expect 4-7% impact on FY24 EPS

December 09, 2022 / 15:01 IST

Market at 3 PM

Benchmark indices have extended their losses and are trading near day's low.

The Sensex was down 451.87 points or 0.72% at 62118.81, and the Nifty was down 131.60 points or 0.71% at 18477.70. About 950 shares have advanced, 2307 shares declined, and 110 shares are unchanged.