Taking Stock: Market Ends Flat On F&O Expiry Day; Mid, Smallcap Outperform, Metals Drag

The broader market outperformed the benchmarks, with BSE midcap and smallcap indices adding 0.3 percent each... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,535.35 | 319.07 | +0.38% |

| Nifty 50 | 25,574.35 | 82.05 | +0.32% |

| Nifty Bank | 57,937.55 | 60.75 | +0.10% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Infosys | 1,513.50 | 36.70 | +2.49% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Trent | 4,283.70 | -343.60 | -7.43% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 35688.30 | 570.70 | +1.63% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty FMCG | 55334.40 | -102.80 | -0.19% |

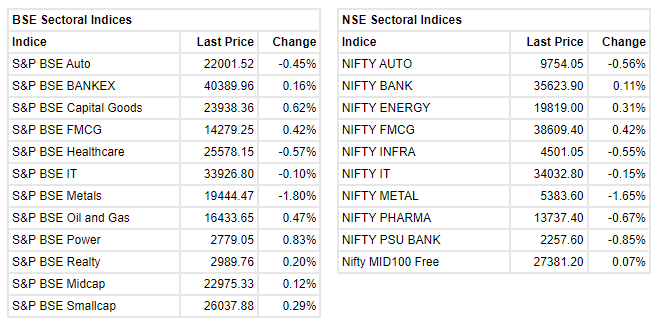

Markets remained range bound for yet another session and ended almost unchanged. After the flat start, the benchmark hovered in a narrow band till the end however movement due to the scheduled monthly derivatives expiry kept the participants busy. Among the key indices, the Nifty index ended on a flat note at 16,637 levels. The broader markets outperformed wherein both Midcap and Smallcap ended marginally higher. On the sectoral front, a mixed trend was witnessed wherein metal and auto ended with losses whereas capital goods, consumer goods and realty ended with gains.

The rotational buying in select index majors across sectors is helping the index to maintain the positive bias and inch higher. However, the momentum is still missing due to the continuous underperformance of the banking index. Considering the scenario, we reiterate our view to restrict naked leveraged positions and prefer index majors over others.

Index closed flat for the second consecutive day at 16,637 and formed a Doji sort of candle pattern for the second consecutive session.

The index has formed a strong hurdle zone around 16,700 and until index wont cross above said level we may see capping to northward move and we may also see a profit booking towards the 16,500 zone, which is strong base on the downside where traders can initiate fresh long keeping stop out level below 16,400 zone on a closing basis. If manage to break above 16700, we may see a quick move towards 17k mark.

Amid weak global cues, the domestic market traded cautiously with a positive bias. Renewed tension between China and US along with the fear of rise in the Delta variant capped the gains in the Asian market. Investors globally are awaiting the Fed Reserve’s Jackson Hole Economic Symposium on Friday to gain insights on asset tapering plans and economic outlook.

Benchmark indices erased early gains and ended on flat note amid expiry day volatility.

At close, the Sensex was up 4.89 points or 0.01% at 55,949.10, and the Nifty was up 2.20 points or 0.01% at 16,636.90. About 1578 shares have advanced, 1372 shares declined, and 105 shares are unchanged.

Britannia Industries, Tata Consumer Products, HDFC Life, BPCL and Reliance Industries were the top Nifty gainers. Bharti Airtel, JSW Steel, Maruti Suzuki, Hindalco Industries and Power Grid were among the top losers.

Among sectors, metal index shed over 1 percent, while selling was also seen in the auto, pharma and PSU banking stocks. However, FMCG, oil & gas, realty and power indices ended in the green. BSE midcap and smallcap indices added 0.3 percent each.

Today Bharti Airtel stock is down ~ 4% which provides buying opportunity to long term investors. In 1QFY22, company has shown healthy revenue growth of ~ 12% and adjusted profit growth of ~ 102%.

Going forward, we expect company to report healthy top-line & bottom-line growth on the back of a strong brand, growth in customer additions, and improvement in ARPU due to increase in tariffs rate. Hence, we are positive on stock.

The market witnessed another day of consolidated movement and an attempt to hold the level around the Nifty 50 Index level of 16600. The market is going to be crucial for the short-term market scenario to sustain above the 16500 level. If the market is unable to sustain the level of 16500, it witness lower levels of 16350. The technical indicator suggests, a volatile movement in the market in a small range between 16350-16700.

Nippon Life India Trustee sold 58,06,120 shares (1.6484 percent) of Sadbhav Infrastructure Project on behalf of Nippon India Mutual Fund in the Open Market on August 24, 2021.

Sadbhav Infrastructure Projects was quoting at Rs 16.35, down Rs 0.50, or 2.97 percent on the BSE.

We think there is a case of sector rotation to play out, which may invite some profit booking in the sectors that have been big outperformers recently, while we could see interest coming back in some of the recent underperformers such as Financials, Auto and Healthcare.

In the very near term, the commentary by the US Fed and news flow related to the third wave of the pandemic will remain a source of volatility and opportunity for the markets. The primary market frenzy also seems to have waned a bit, with tepid listings of some recent IPOs, which should result in better liquidity support for the secondary markets. Also, over the period, India could emerge as a possible beneficiary in case of some re-allocations by FIIs on account of the recent uncertainty around the Chinese markets.

With a positive recent experience and lack of alternate attractive asset class, the intermittent corrections could continue to keep investors interested in equities, as the overall economic and earnings recovery set-up remains in a good place.

Benchmark indices continued to trade flat ahead of August F&O expiry.

The Sensex was down 0.08 points or 0.00% at 55944.13, and the Nifty was down 6.40 points or 0.04% at 16628.30. About 1517 shares have advanced, 1411 shares declined, and 111 shares are unchanged.

Brahmaputra Infrastructure declared a lowest bidder for a quoted Price of Rs 102.22 crore for the work Protection of cutting and embankment by Construction of RCC retaining wall, catch water drain, sub surface drain, shot creting/ Providing Concrete canvas, geo jute textile turfing on slopes, finishing of blanketing materials etc, in between station kawnpuri & sairang in connection with the construction of New BG Railway line from Bairabi to Sairang (Mizoram Project).

Brahmaputra Infrastructure was quoting at Rs 16.90, up Rs 1.15, or 7.30 percent on the BSE.

: Crude oil prices traded lower with benchmark NYMEX WTI crude oil prices were trading 1.21% down near $67.53 per barrel for the day. MCX Crude oil September futures were trading 0.69% down at Rs 5022 per barrel by noon.

Crude oil prices are expected to trade sideways to up for the day with resistance at $69 and support at $65 per barrel. MCX Crude oil September has support at Rs 4950 and resistance at Rs 5090.