April 20, 2022 / 16:21 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

A Pull-back rally in the global markets lifted sentiments as benchmark indices traded higher. Nifty reclaimed its 17000 level. Among sectors, the Nifty Auto index outperformed rallied by over two percent. Whereas technical sell-off was seen in Metal and Media stocks.

Technically, after today's bounce back, the Nifty is still trading below its 200-day SMA which is broadly negative. On daily charts, Nifty has formed a small inside body bullish candle and on intraday charts. Nifty is consistently taking support near 17050. Direction wise, the medium-term trend is still on the downside. But the continuation of the pullback rally is not ruled out if the Nifty succeeds to trade above 17050.

For traders, 17050 would act as a trend decider level, above which Nifty could rally up to 17250-17350. However, below 17050 uptrend would be vulnerable. Below the same, chances of hitting the level of 16950-16900 would turn bright.

April 20, 2022 / 16:15 IST

Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel One:

Tuesday’s last hour mayhem was followed by a modest gap up opening today on the back of spectacular overnight rally in US bourses. Around the mid-session, Nifty even went on to reclaim the 17200 mark. However, as we once again entered the last couple of hours of the session, market started to become a bit tentative. Fortunately it was no way closer to Tuesday’s weakness as Nifty maintained its position well inside the positive terrain to close with a percent gains.

The benchmark index Nifty showed tremendous resilience today; but banking kept sulking throughout the session. Hence, the Nifty couldn’t stay beyond the sturdy wall of 17200.

Fortunately, we are back above 17000 convincingly and hence, any positivity from the global peers or our banking space, would bring back the strength in our market. As far as levels are concerned, 17200 – 17300 remains to be a stiff hurdle and only a sustainable move beyond this would result in a strong momentum in heavyweights.

On the flipside, 17000 remains to be a sacrosanct support. Considering the overall tentativeness, we advise traders not to trade aggressively and should continue with a stock specific approach.

April 20, 2022 / 16:09 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets witnessed a decent recovery and gained over a percent, tracking firm global cues. The benchmark started with an upside gap and traded in a narrow range thereafter.

Eventually, the Nifty index settled at 17,136.55; up by 1.05%. Meanwhile, a mixed trend on the sectoral front kept the participants busy wherein auto, oil & gas and healthcare posted decent gains.

Markets are largely following their global counterparts, which are currently offering mixed cues. Besides, indications from the domestic front are also not very encouraging.

On the index front, 16,800 would continue to act as crucial support in Nifty while the 17,250-17,350 zone would be tough to cross. Keeping in mind the scenario, participants shouldn’t read much into the single-day rebound and stay light.

April 20, 2022 / 16:04 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty witnessed a bounce back from the daily lower Bollinger Band on April 20. The bulls got some breathing space today post a sharp decline on April 19. On the daily chart, the Nifty has formed an Inside bar pattern. Thus the boundaries of the pattern i.e. 16824 & 17275 become crucial support & resistance respectively.

From short term perspective, 17275-17300 is a key hurdle zone, which encompasses multiple parameters.

As long as the index stays below this barrier, it is expected to trade with a sideways to downward bias. On the other hand, if the bulls manage to take out this hurdle then the index will be poised for a larger bounce back.

April 20, 2022 / 16:01 IST

S. Hariharan, Head- Sales Trading, Emkay Global Financial Services:

A series of sharp negative reactions to minor misses in earnings from large caps (Infy & HDFC Bank) point to a precarious state of positioning among investors. Under-weight positioning in energy and materials sectors and over-weight positioning in IT & consumer-facing sectors across both DII & FII investors has served to accentuate under-performance by active strategies.

Last quarter earnings are not expected to reflect the full extent of impact of input cost inflation, which flared up meaningfully in March – however, management commentary on the margin outlook for FY23 is expected to play a key role in determining reactions to other quarterly results coming up in the next couple of weeks.

As earlier, the macro backdrop remains quite challenging for foreign flows, while valuations do not yet reflect the extent of potential earnings downgrades for FY23, coming up in the next month.

April 20, 2022 / 15:54 IST

Rupak De, Senior Technical Analyst at LKP Securities:

The trend continues to be negative as the benchmark index Nifty remained below 17400. However, the Nifty has formed a bullish harami pattern on the daily chart, which suggests a possibility of a near-term recovery.

On the higher end, Nifty may move towards 17400-17450 where once again it may find resistance. On the lower end support exists at 16800.

April 20, 2022 / 15:50 IST

Vinod Nair, Head of Research at Geojit Financial Services:

With support from recovery in beaten-down HDFC stocks and the IT sector, the market countered yesterday’s selloff. Foreign investors are pumping out funds in large quantities while support from DIIs is helping the market to partially balance the pressure. A similar level of volatility can be expected to continue until global uncertainties settle down leading to a softening of FII selling.

April 20, 2022 / 15:45 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty index is still trading below its 200 DMA, which is placed at the 36800 level. The index needs to cross this level decisively for resuming the up move.

The index lower-end support stands at 36100 and, if breached will witness further downside towards 35800-35100 levels.

April 20, 2022 / 15:39 IST

Market Close:

Benchmark indices bounced back and ended higher on April 20 with Nifty comfortably finishing above 17,100.

At Close, the Sensex was up 574.35 points or 1.02% at 57,037.50, and the Nifty was up 177.80 points or 1.05% at 17,136.50. About 1716 shares have advanced, 1593 shares declined, and 111 shares are unchanged.

BPCL, Tata Motors, Shree Cements, UltraTech Cement and Eicher Motors were among the top Nifty losers. Bajaj Finance, ICICI Bank, Bajaj Finserv, JSW Steel and ONGC were the top losers.

Auto, pharma, IT, oil & gas indices jumped 1-2 percent each, while selling is seen in the metal and banking names. BSE midcap and smallcap indices ended in the green.

April 20, 2022 / 15:23 IST

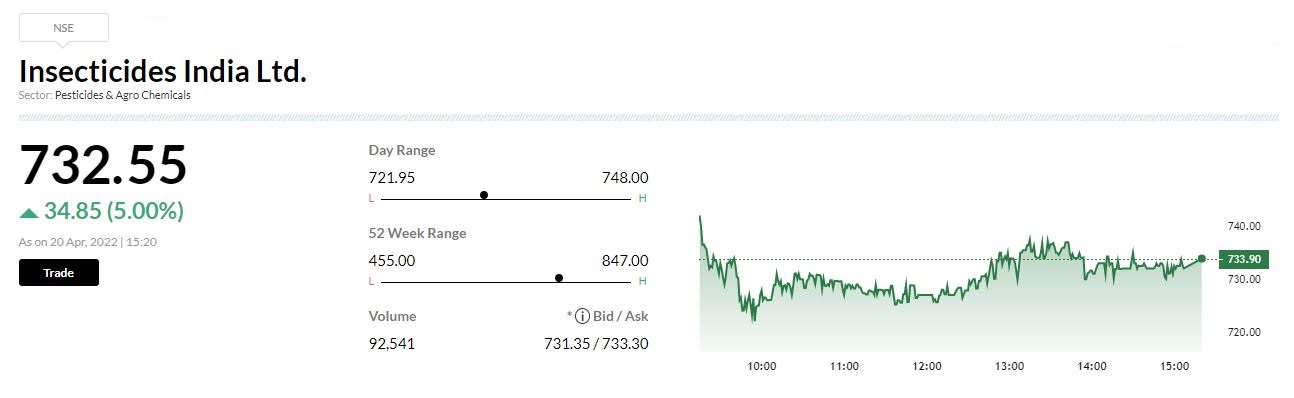

Insecticides (India) receives Patent from Government of India

Insecticides (India) has informed that Government of India, The Patent Office has granted the Patent for an invention entitled 'Novel Granules and its pesticidal compositions' for the terms of 20 years from 11th day of July, 2019 (date of filing).

April 20, 2022 / 15:17 IST

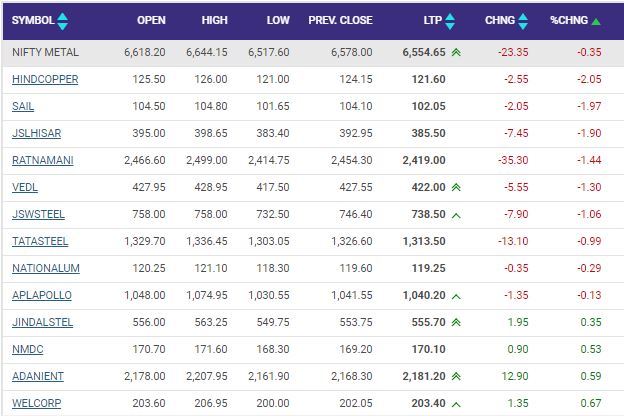

Nifty Metal index shed 0.35 percent dragged by Hindustan Copper, SAIL India, Jindal Stainless Hisar:

April 20, 2022 / 15:15 IST

March Domestic Air Passenger Traffic Up 36.7% YoY: DGCA

The March 2022 domestic air passenger traffic rose 36.7% YoY at 1.07 crore, said Directorate General of Civil Aviation (DGCA).

Interglobe Aviation market share was at 54.8% versus 51.3%, SpiceJet market share stood at 9.5% against 10.7% and Air India market share was at 8.8% versus 11.1%, MoM.

Interglobe Aviation Passenger load factor stood at 81.0% versus 85.2%, SpiceJet Passenger load factor stood at 86.9% versus 89.1% and Air India Passenger load factor was at 85.0% versus 84.1%, MoM.

April 20, 2022 / 15:12 IST

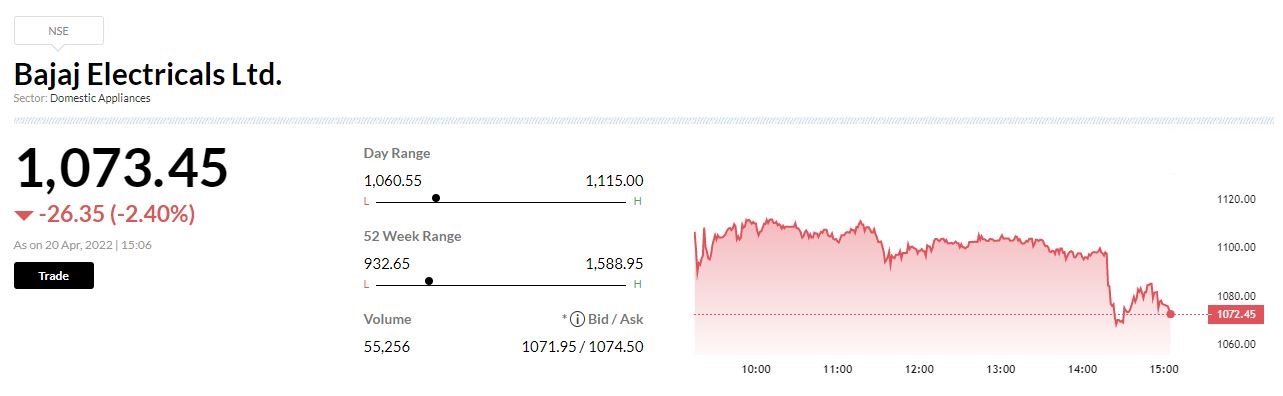

Bajaj Electricals signs partnership with wtec

Bajaj Electricals announced its partnership with wtec which is a global developer of technology dedicated to innovation, reducing environmental impact, and enabling smart building use cases throughout the built space.

The company has selected the smartengine platform as its infrastructure technology for energy-efficient smart lighting and fine-mesh sensor network. Through this strategic alliance, BEL aims to bring disruptive technology to significantly impact infrastructure operations in terms of smarter solutions, efficiencies in operations, and cost savings, Bajaj Electricals said in its release.