On Wednesday, US President Donald Trump imposed a 25 percent tariff on India even as concerns related to the tariff war were in play since December last year. The period also saw Indian equity markets emerging as the worst performers globally among all leading equity benchmarks.

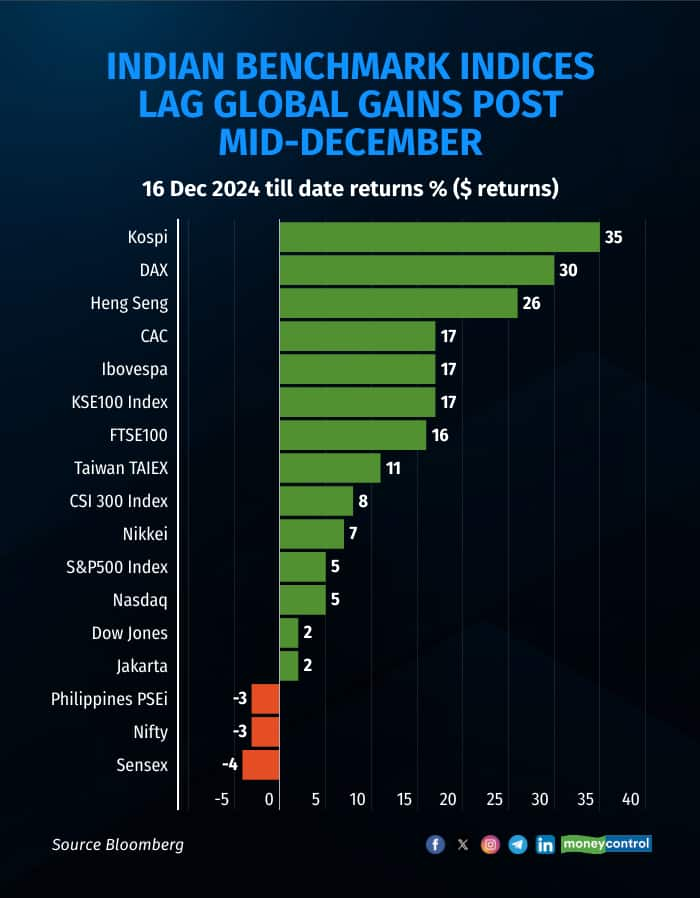

Between December 17 last year and now, India’s benchmark indices, Sensex and Nifty, have each declined by nearly 4 percent, making them the worst-performers among major global indices. Only the Philippines Stock Exchange comes close, declining 3 percent.

In sharp contrast, South Korea’s Kospi surged 35 percent, emerging as the top gainer. Germany’s DAX and Hong Kong’s Hang Seng followed with impressive gains of 30 percent and 26 percent, respectively. Other notable performers included France’s CAC, Brazil’s Ibovespa, and the UK’s FTSE 100, each posting an increase of approximately 17 percent.

Elsewhere, other global indices also posted healthy gains during this period. Taiwan rose by 11 percent, China’s CSI 300 advanced 8 percent, Japan’s Nikkei gained 7 percent, while the Nasdaq and S&P 500 each rose 5 percent. The Dow Jones Industrial Average and Jakarta Composite Index recorded gains of 2 percent each.

Elsewhere, other global indices also posted healthy gains during this period. Taiwan rose by 11 percent, China’s CSI 300 advanced 8 percent, Japan’s Nikkei gained 7 percent, while the Nasdaq and S&P 500 each rose 5 percent. The Dow Jones Industrial Average and Jakarta Composite Index recorded gains of 2 percent each.

For the Indian markets, though, tariffs were not the only concern as factors like elevated valuations, persistent foreign institutional investor (FII) outflows, and signs of an earnings slowdown also dampened overall market sentiment.

The downturn was notably triggered after the US Federal Reserve revised its 2025 interest rate cut projections to just two, influenced in part by the growing electoral prospects of the Trump administration and the anticipated imposition of higher tariffs under the then President-elect Trump.

Apart from global trade concerns, the recent escalation of conflict between India and Pakistan had also briefly added a layer of volatility and uncertainty, further unsettling investor sentiment in the Indian markets. Incidentally, foreign institutional investors have withdrawn nearly $11 billion from Indian equities this calendar year.

Additionally, a slew of large initial public offerings (IPOs) on the main board, along with a number of SME issues, as well as qualified institutional placements (QIPs), have diverted liquidity that might otherwise have supported the secondary market.

According to Deepak Jasani, an independent research analyst, Indian markets have long appeared overvalued, and recent corporate earnings have largely failed to meet expectations. While India remains strong on macroeconomic fundamentals — with a robust base in GDP and personal consumption expenditure — weakness in private capital expenditure and heavy reliance on government spending continue to constrain corporate earnings momentum and consumer spending power, he said while adding that elevated valuations have made Indian markets less attractive relative to global peers, offering foreign investors more compelling alternatives.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.