It's been over a year since the outbreak of COVID-19 rattled the universe. The pandemic caught the world by surprise, forcing governments to take unprecedented measures such as lockdowns.

On March 23, 2020, Prime Minister Narendra Modi announced a nationwide 21-day lockdown, which triggered a strong selloff in the equity market as economic indicators fell to negatives.

In subsequent months, the unlock phase started and due to massive liquidity infusion and low rates globally, the equity market started to build up gains.

The market has come a long distance since then. Its principle barometer, Sensex, has gained over 86 percent and Nifty over 88 percent since March 23, 2020.

Said Gaurav Garg, Head of Research, CapitalVia Global Research: "In financial year 2021-22, we can expect the market to continue its upward trend, because since October 2020, all economy-related sectors like banks, NBFCs, capital goods, metal & mining and real estate have been performing well."

Read more: India among top performing markets in FY21; investors’ wealth swell by Rs 94 lakh crore

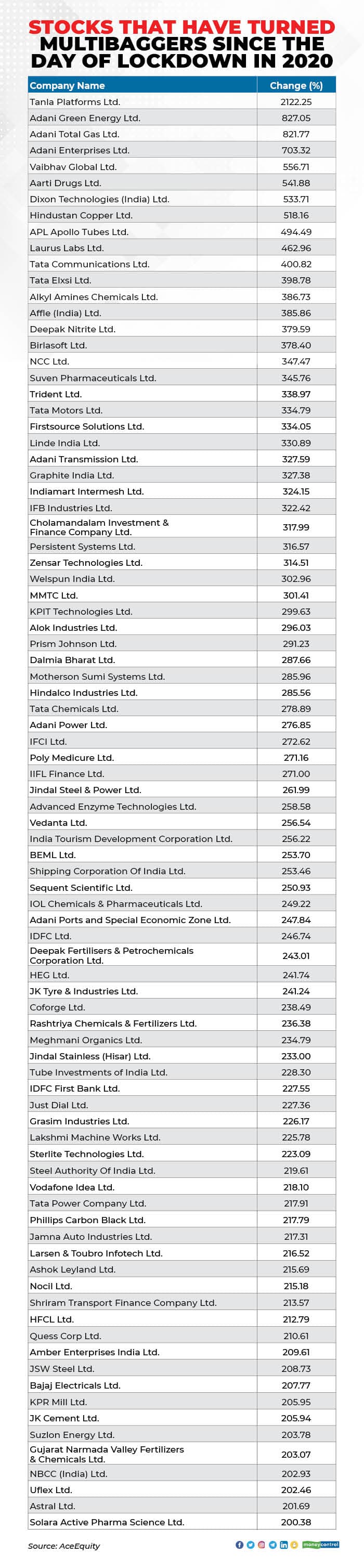

More than 250 stocks have turned multibaggers, data from Ace Equity shows. Tanla Platforms has surged more than 2,000 percent while Adani Green Energy, Adani Total Gas, Adani Enterprises, Vaibhav Global, Aarti Drugs, Dixon Technologies (India) and Hindustan Copper have jumped between 500 and 800 percent.

Table: Top stocks that jumped over 200 percent since March 23, 2020

Sectors like metal, auto and IT have gained the most in this period while FMCG, pharma and PSU banks have underperformed.

The road ahead

The market is witnessing correction at present and analysts believe it may witness bouts of volatility in the short-term. However, the long-term outlook of the market remains positive.

With economic indicators picking pace, the ongoing vaccination and central bank's comments of keeping rates low in the year 2021, the days ahead for the market looks bright.

Adds Garg: "If we do not get expected earnings growth for the last quarter of FY21, the market may witness some correction from the higher level. The market is also witnessing some selling pressure at the current levels, as the bond yields are getting higher. However, the long term story is intact and we expect to get double digit returns from the market in next FY as well."

Another expert, Gaurav Dua, SVP, Head - Capital Market Strategy, Sharekhan by BNP Paribas, is slightly more conservative. He pointed out that the benchmark indices have given up bulk of the gains from the post-Budget rally.

"The resurgence of COVID-19 and volatility in bond yields have created uncertainty related to the pace of economic recovery going ahead. However, the market positioning is quite light and valuations are turning more reasonable after the correction. We expect the market to find support around the current level," he said.

Since the long-term outlook of the market is positive, analysts advise usage of current correction to buy quality stocks.

“Any sort of knee-jerk reaction is going to be an interesting opportunity for investors to buy in,” Pramod Gubbi, Co-founder of Marcellus Investment Managers, said in an interview with CNBC-TV18.

He predicts that “there are a lot of investors, who feel that they have been left out in this rally in the past 12 months. They have been waiting for the correction to get in and if we see a meaningful correction, a lot of those investors will jump in as well.”

Read more: Use this opportunity to buy, say experts

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.