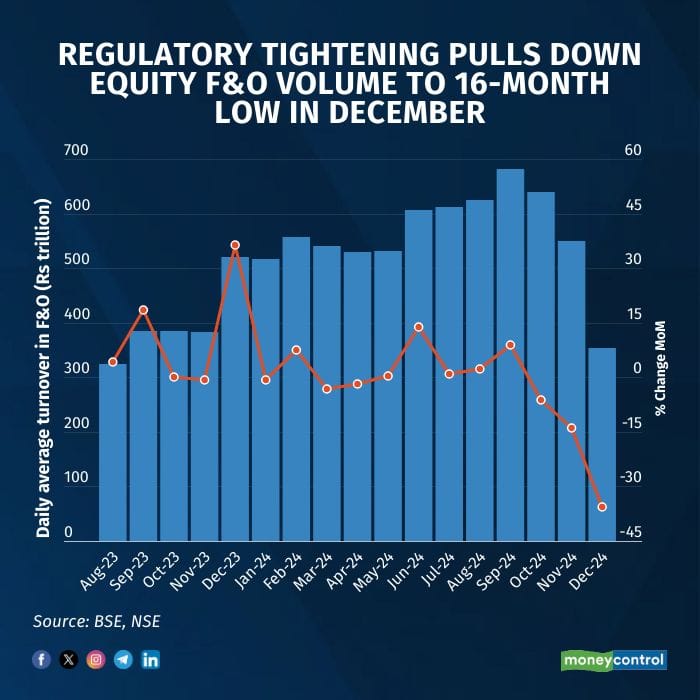

The average daily turnover (ADTV) in the equity derivatives segment fell to a 16-months low in December following regulatory tightening aimed at curbing speculative trading and reducing retail participation. In contrast, cash market turnover, which has been declining for five consecutive months, saw a slight month-on-month increase of 4.4 percent in December.

The BSE and NSE combined ADTV for the F&O segment reached Rs 280 trillion in December, the lowest since August 2023, marking a 36.56 percent decrease from Rs 442 trillion in November.

More importantly, the decline is as high as 48 percent if the December volumes are compared with that of September. Index futures turnover dropped for the second consecutive month, while turnover in stock futures, index options, and stock options has declined for three months in a row.

Experts attribute the continued contraction in derivatives volumes to stricter regulations that have curtailed the factors fuelling speculative activity among retail traders. Measures such as larger contract sizes, increased margins, and a reduction in the number of tradable products have been put in place to address market froth and the persistent issue of retail traders suffering consistent losses.

Additionally, global economic uncertainties and domestic market volatility have prompted traders to adopt a more cautious approach, leading to lower participation in the derivatives market.

According to Shrey Jain, Founder & CEO of SAS Online, a deep discount broker, recent measures announced by the Securities and Exchange Board of India (SEBI) have led traders to adopt a more cautious stance when entering new positions. As a result, turnover in the derivatives segment has significantly dropped in recent months. Looking ahead, Jain noted that the introduction of larger contract sizes for weekly derivatives, effective January 1, may further reduce trading volumes.

In contrast, cash market turnover, which has been declining for five consecutive months, saw a slight month-on-month increase of 4.4 percent in December. Akshay Chinchalkar, Head of Research at Axis Securities, explained this uptick by pointing to two key factors: a busy IPO quarter, with notable listings such as Swiggy and Hyundai, which fuelled investor interest, and SEBI's new same-day settlement regulation for the top 500 stocks, set to take effect on January 31, 2025. These developments signal the regulator's intent to encourage long-term equity investment.

Narinder Wadhwa, Managing Director & CEO of SKI Capital, believes that the modest rise in cash market turnover reflects a strategic shift by investors seeking safer options amid increased market volatility. He also mentioned that the festive season, including the period from Thanksgiving to New Year, typically sees lower trading volumes due to foreign portfolio investors (FPIs) taking extended breaks.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.