The market regulator is preparing to land another punch at unregistered entities/finfluencers' business.

It has proposed a system through which investors can be sure that they are paying regulated or registered entities. It suggested the use of UPI IDs that will be generated by a particular software and will include the name if the intermediary and the segment in which it operates.

In a consultation paper issued on January 31, the Securities and Exchange Board of India (SEBI) has also suggested increasing the upper limit placed on daily transactions done through UPI to Rs 5 lakh from the current Rs 2 lakh per day, but only for capital market transactions.

Also read: Insider trading in Infosys leads to ban on two, Rs 2.6 crore of illegal gains impounded

The paper said, "over the years, many unregistered entities have misled investors by unauthorized collection of money, which is mostly siphoned-off for their personal gains. There is a need to proactively restrict their proliferation and thereby enable investors to identify SEBI registered market intermediaries and make requisite payments to them in a more legitimate, convenient, and efficient way".

The UPI IDs, the regulator hopes, will help investors ensure that their payments are reaching only SEBI-registered intermediaries and that investors can therefore steer clear of unregistered entities.

A UPI address (UPI ID) is typically made up of a username and a handle, separated by an “@” symbol.

In the proposed mechanism, username will be an alphanumeric ID that will be generated for the user while the handle used will be a unique identifier linked to the bank of the registered intermediaries.

Username will be readable, relatable and carry the segment in which the intermediary is operating. For example, abc.bkr for a broker and abc.mf for mutual funds.

The UPI handle will combine "@payright" with the name of the intermediary's bank of choice. For example abc.bkr@payrighthdfc or abc.mf@payrighthdfc.

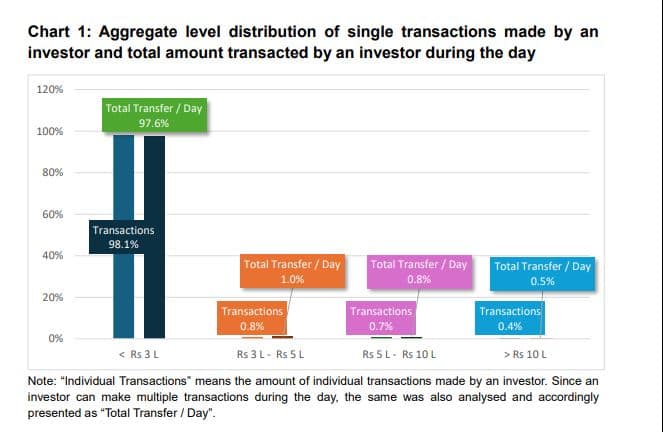

On raising the daily limitTo understand if there was a need to raise the upper limit set on daily transactions through UPI, the regulator studied the UPI transactions done by clients of top brokers.

It was analysed from two perspectives: Trends in fund transfer done by investors to their members; and Trends in number of clients w.r.t fund transfer done during the day.

Source: SEBI

Source: SEBIThe consultation paper said that individual transactions below 1 lakh accounted for 92.9 percent of total transactions, transactions between 1 lakh to less than 2 lakh constituted 3.9 percent and transactions between 2 lakh to below 3 lakh constituted 1.3 percent. For total transactions during the day by an investor, these figures were 91.5, 4.6 and 1.6 percent respectively.

Based this analysis, the regulator has suggested an upper limit of Rs 5 lakh per day, for capital market transactions done through UPI.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.