Market intermediaries will now have a unique Unified Payments Interface (UPI) address to collect funds from clients, as regulator Sebi unveiled the mechanism - named as 'Valid' - on June 11 after incorporating industry feedback following a consultations, and after assessing the readiness of market participants.

The unique UPI payment mechanism will go live from October 1, 2025 said, Tuhin Kanta Pandey, Chairman, SEBI.

Pandey said, "This innovative mechanism is set to significantly improve the safety and accessibility of financial transactions within the securities market by providing a verified and secure payment channel,"

Sebi’s unique and safer payment mechanism for investors, named ‘Valid’, can be used by market intermediaries to collect funds from clients such as payments to brokers, mutual funds, research analysts, investment advisers, and others.

The Sebi also issued a circular for the same, which noted, " While the use of this structured UPI mechanism by investors shall remain optional, it is mandatory for intermediaries to obtain and make availablethis structured UPI address to their investors. Additionally, intermediaries are advised and encouraged to actively promote and facilitate the adoption of this mechanism among their investors".

‘Valid’ is a unique, Unified Payments Interface (UPI)-based payment ID issued by banks only to Sebi-registered entities.

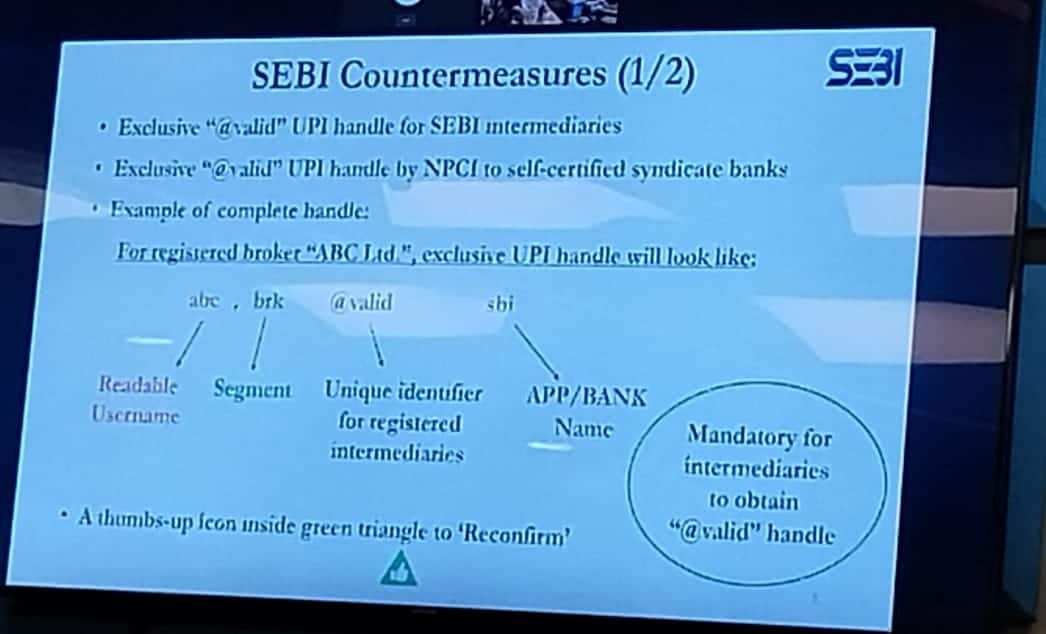

The UPI IDs of the regulated entities will include the handle name ‘@valid’ combined with the bank name, to ensure easy identification by investors. A green thumbs up icon in a triangle will also be marked, to show the legitimacy of the transaction.

For example, if it is for a broker ABC, and money is to be collected through the UPI platform of HDFC Bank, then the handle will be abc.brk@validhdfc. Similarly, for a mutual fund, it will be abc.mf@validhdfc.

The regulator has developed 'Valid' payment method after consultation with National Payments Corporation of India (NPCI), banks, and market intermediaries like brokers and others.

The mechanism ensures that investors pay only to genuine Sebi-registered entities and are safeguarded from fraudsters. This will be beneficial for investors as well as registered entities, as there will be no fraud. Investors will know that they are paying a genuine regulated entity, while the intermediaries will receive faster payments.

The market regulator has fixed an upper limit of up to Rs 5 lakh per day for capital market transactions done through UPI, which may be reviewed from time to time in consultation with NPCI.

Sebi had introduced the usage of the Unified Payments Interface (UPI) as a mode of payment in the market for the first time in 2019. The successful experience and efficiency brought by UPI resulted in its inclusion in various other processes as well.

The regulator said in its consultation paper that over the years, many unregistered entities have misled investors by unauthorized collection of money, which is mostly siphoned off for their personal gains.

Hence, it felt a need to proactively restrict proliferation of unregistered entities, thereby enabling investors to identify a Sebi-registered intermediary and make requisite payments to them in a more convenient and efficient as well as legitimate way.

Sebi also announced the “SEBI Check” tool to further empower investors. Sebi developing a new functionality called “SEBI Check”. This upcoming tool will allow investors to, verify the authenticity of UPI IDs either by scanning a QR code or by entering the UPI ID manually, confirm the bank details such as bank account number and IFSC of a registered intermediary. This new mechanism is expected to deliver crucial benefits like, enhanced Investor Protection, vital layer of security, allowing investors to verify an entity's authenticity before any financial transaction.

SEBI had launched Centralized Fee Collection Mechanism (CeFCoM), for Investment Advisors and Research Analysts. Which is a secure and closed ecosystem to pay fees payments Investment Advisors and Research Analysts. CeFCoM, a secure and closed ecosystem enhances the transparency and security in fee payments for Investment Advisors and Research Analysts. The CeFCoM helps investors to ensure that they are availing the services and making the payment of fees only to registered Investment Advisors and Research Analysts. In CeFCoM, investors are able to make payment of fees through multiple payment modes such as Net Banking, Debit Card, UPI/UPI Autopay, IMPS/NEFT/RTGS, eNACH and even through Cheque and Credit Card.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.