Promoters of as many as nearly 600 companies – 597 to be precise – reduced their holdings in their companies, as per the shareholding data for the September quarter. This was significantly higher than only around 210 firms where promoters increased their stake during the quarter.

Data from Ace Equities shows that till date around 3,300 companies have reported their shareholding patterns for the September quarter and the promoter holding has remained unchanged for as many as around 2,500 firms. But as mentioned earlier, among those that saw a change, number of firms with a fall in holding outnumbered instances of rise by a huge margin.

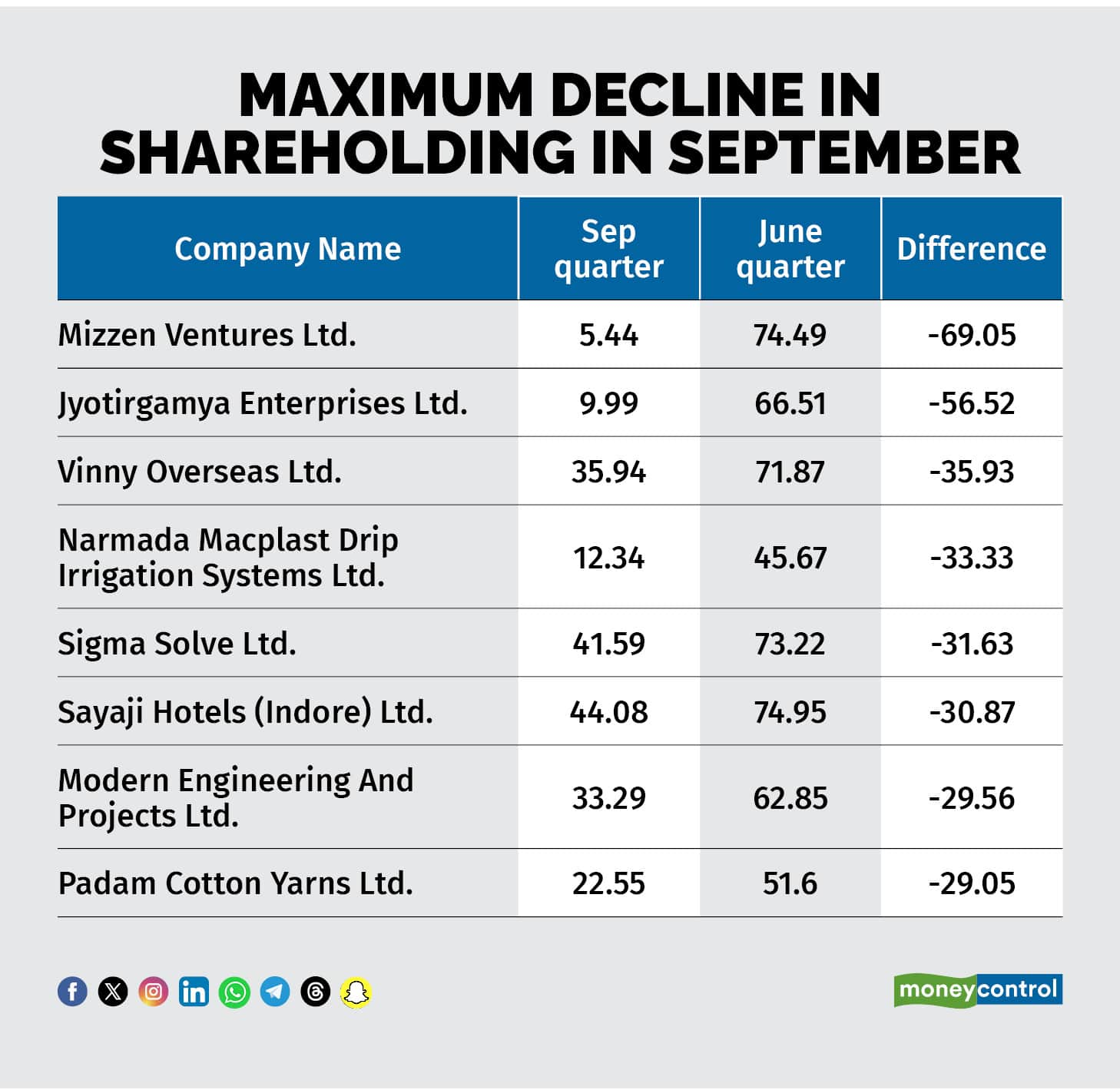

(All figures in percentage)

(All figures in percentage)

Analysts attribute the trend to the rise in stock prices, though they are advising investors to be cautious in such instances and check the reasons behind the stake sale. Experts further add that concerns around promoter selling should be focused on the cause and specific stocks, rather than the overall trend.

Satish Menon, Executive Director of Geojit Financial Services, explained that there are multiple reasons why promoters may choose to sell their stakes. “Promoters may sell stakes in their companies for several reasons, ranging from personal financial management to strategic business moves,” he says.

“Common motivations include the need for diversification of wealth, staying competitive, repaying debt, or funding new ventures,” he adds

Menon, however, believes that these sales should not necessarily be viewed as a cause for concern. “As long as these sales are accompanied by strong valuations and business fundamentals, they can be seen as a sign of a healthy company and should not automatically trigger investor alarm.”

Siddarth Bhamre, Head of Institutional Research, Asit C Mehta concurred that current valuation levels act as a motivating factor. “Markets are trading at quite a premium valuation, and that is the reason promoters are finding it easy to dilute their stake,” Bhambre says.

Some of the well-known companies that saw the maximum fall in promoter holding in the September quarter include: Tata Motors, Prestige Estates Projects, Adani Energy Solutions, Interglobe Aviation, Kamat Hotels (India), Glenmark Life Sciences, Route Mobile, Bajaj Healthcare, Easy Trip Planners, and SpiceJet among others

“First, they might be feeling quite pleased with the current market valuation. In such cases, selling their stake allows them to lock in their returns,” says Trivesh D, COO of Tradejini while adding that this could lead to short-term market fluctuations. “This can sometimes lead to a decline in the company’s valuation, which may cause a temporary pullback in the markets,” he says.

Another reason for selling, according to Trivesh, is capital generation for new ventures. “Promoters might be gearing up for a new venture that requires capital. While it may seem like a loss for the current company, the reinvestment of these funds into new ideas can stimulate further economic growth, leading to the emergence of innovative companies or even future IPOs,” he explains.

“While stake sales can lead to short-term fluctuations, they often serve as a stepping stone for longer-term opportunities and growth in the market,” says Trivesh.

However, Bhamre adds that investors need to scrutinise the reasons behind these sales. “It’s important to see why promoters are diluting their stake. If they are doing it to raise funds for expansion or reduce debt, it’s a good sign. But if they’re selling to capitalise for personal purposes, like buying property, then that’s a negative signal,” he says.

At the recent Morningstar Investment Conference, experts noted that the perception of promoter stake sales in India is shifting. Hiren Dasani, Managing Director at Goldman Sachs Asset Management, noted that while these sales were once viewed negatively, there’s now an understanding that promoters may sell to diversify their wealth, not necessarily because the business has peaked.

"It’s not always a signal that the business is at its peak," he said. Similarly, Naren Gorthy from FSSA Investment Managers said, “There are many reasons why promoters sell, but only one reason they buy.” Investors are now focusing on why the sale occurs, rather than assuming it signals trouble for the company.

Experts suggest that from an investor point of view, going ahead there is a need for a cautious approach and while promoter stake sales can create opportunities, they should be evaluated on a case-by-case basis.

“Investors should also see why the promoter has been selling stake and what they are doing with that money. If promoters are selling purely for personal reasons, investors should be wary. But if the money is being used for capacity expansion or debt reduction, it signals future growth,” said Bhamre.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.