Veteran value investor and ex-CIO of HDFC AMC Prashant Jain continues to make contrarian bets, the portfolio of his alternative investment fund 3P Investment Managers reveals. Moneycontrol accessed 3P India Equity Fund's September factsheet to find Jain still betting on NTPC, REC and Coal India.

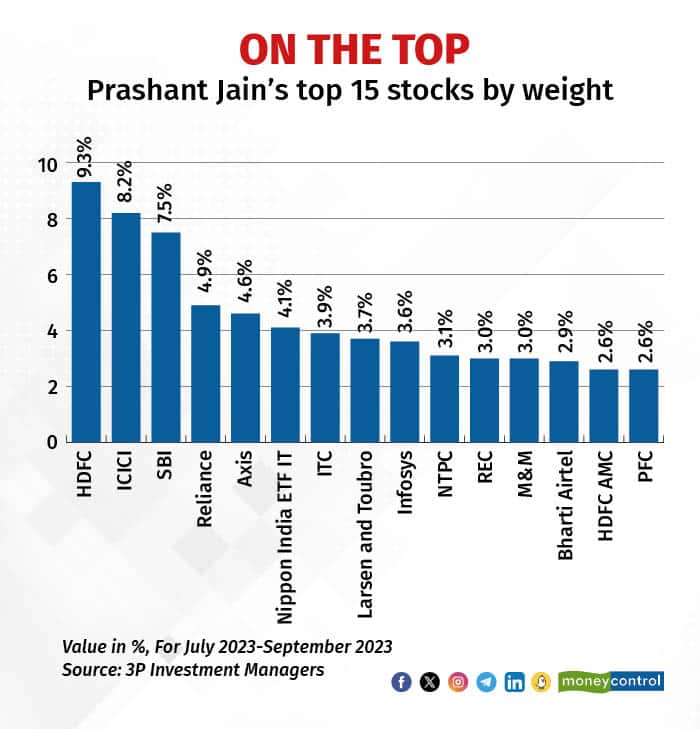

The fund size is about Rs 5,800 crore with 3.1 percent weightage in NTPC, 3 percent in REC and 0.5 percent in Coal India. Energy and utilities, sectors where Jain sees a steady growth and attractive valuations, make for 13.4 percent of the fund weightage.

Consumer discretionary and industrials/capex are the two sectors Jain's fund is overweight on. For consumer discretionary, his reasoning lies in per capita income rising above $2,000 and, for industrials, it is the supportive government policies.

"The medium to long-term growth outlook of the Indian economy is extremely strong. Everyone is very positive on the India story," Jain said in a recent interview to Moneycontrol.

Watch: Have value stocks gone overboard right now? | Prashant Jain of 3P Investment Managers answers

Jain's top bets in these sectors include Mahindra & Mahindra (3 percent), Maruti Suzuki (2 percent), Zomato (2 percent), IndiGo (1.8 percent), Larsen & Toubro (3.7 percent), 3M India (1.5 percent) and Kalpataru Projects (1.1 percent).

Jain has also assigned small weightages to Landmark Cars, Wonderla Holidays, Senco Gold, Anup Engineering, RR Kable, Dynamatic Technologies and Centum Electronics.

Betting on biggies

When it comes to banks, Jain, too, is bullish on the biggest of them all — HDFC Bank. The fund has a 9.3 percent weight assigned to the stock. Jain expects the bank to continue gaining market share though at a somewhat slower pace due to increased competition, but he believes valuations remain reasonable.

Regarding the management changes and the recent merger of HDFC and HDFC Bank, Jain said, "Management change is inevitable in all companies, and mergers can have a significant impact on near-term results. However, it is well understood by the markets now, and there are several long-term positives in that merger."

Jain's portfolio also has 8.2 percent weight in ICICI Bank and 7.5 percent in State Bank of India.

Jain is also betting big on his ex-workplace HDFC AMC, with a 2.6 percent weightage. Low penetration of financial products, good growth prospects and reasonable valuations make him bullish on the space. The fund also has an exposure to SBI Life, with 1.3 percent weightage.

In healthcare, the fund is equalweight to the index, with bets in Cipla, Sun Pharma, IPCA Laboratories and Aurobindo Pharma. "These are good businesses and 10-year underperformance relative to Nifty makes it a ripe time for stock picking," Jain said.

Among miscellaneous bets, the 3P India Equity Fund has 0.4 percent allocation to Time Technoplast and 0.1 percent to Vardhaman Textiles.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.