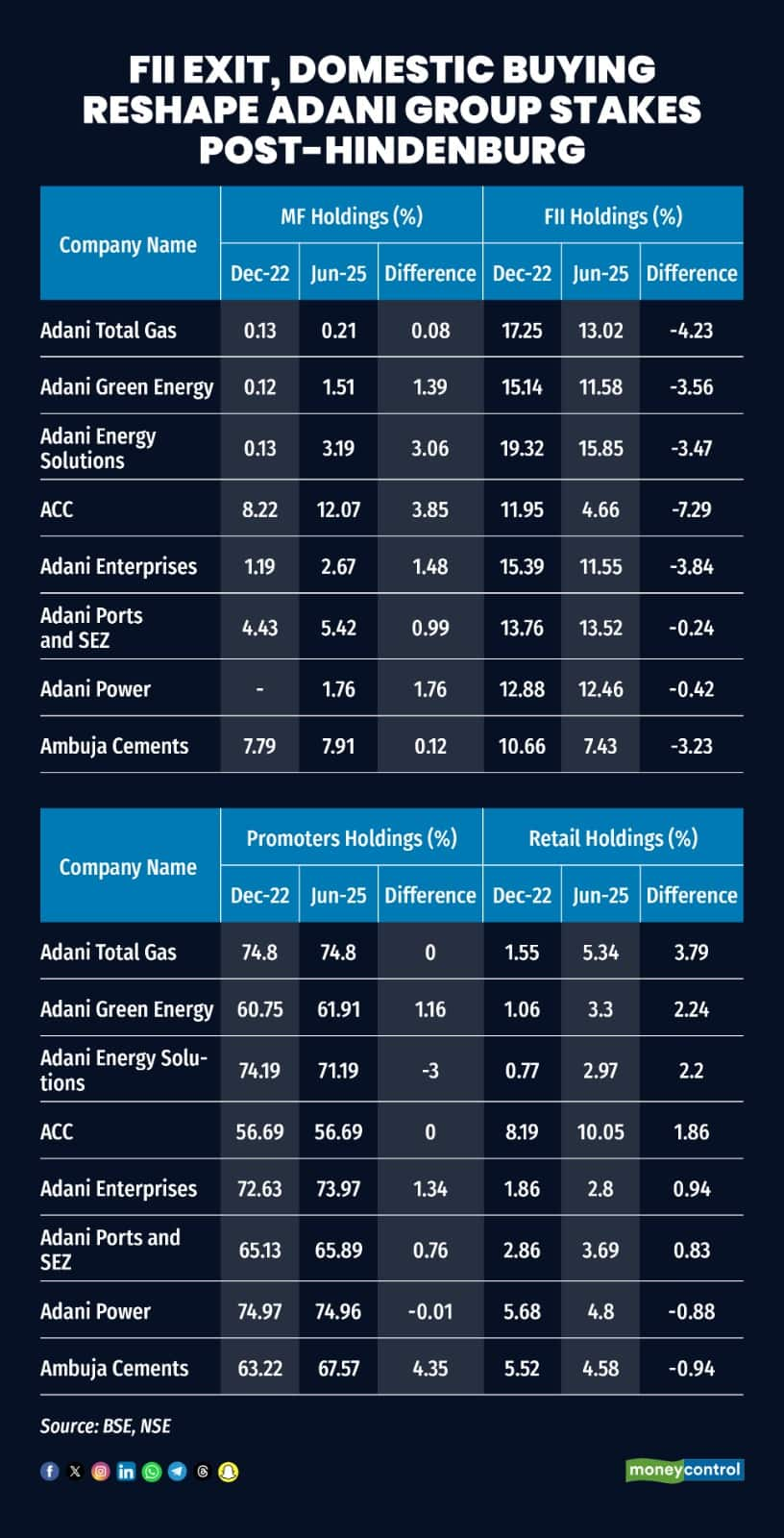

Foreign institutional investors (FIIs) have pared holdings in Adani Group companies since the January 2023 Hindenburg Research report, even as domestic investors—mutual funds and retail players—absorbed much of the selling.

Adani Enterprises saw the sharpest pullback, with FII stakes falling to 11.55% in the June 2025 quarter from 15.39% in December 2022. Adani Total Gas and Adani Green Energy also saw exits, with holdings cut to 13% and 11.58% from 17.25% and 15.14%, respectively. ACC recorded the steepest reduction, with FII ownership dropping to 4.66% from 11.95%. Adani Energy Solutions and Ambuja Cement also saw cuts of nearly 350 basis points, while Adani Power and Adani Ports & SEZ witnessed relatively smaller trims of 25–40 bps.

Domestic institutions moved in aggressively. Mutual funds lifted stakes in Adani Enterprises and Adani Green Energy by 150 bps and 140 bps, respectively. Inflows also went into Adani Ports & SEZ and Ambuja Cement, though the biggest MF additions were in ACC (385 bps), Adani Energy Solutions (300 bps), and Adani Power (175 bps).

Retail investors mirrored the trend, with the sharpest increases in Adani Total Gas (380 bps), Adani Green Energy (225 bps), Adani Energy Solutions (220 bps), and ACC (186 bps). Adani Enterprises and Adani Ports & SEZ saw smaller additions of around 100 bps, while Adani Power and Ambuja Cement bucked the trend, witnessing retail stake reductions of 90 bps.

The shake-up followed Hindenburg’s allegations that the group routed funds via offshore shell entities to inflate stock prices, triggering a rout that at its trough wiped out over ₹8.3 lakh crore in market value.

Relief came on September 19 when SEBI cleared Gautam Adani and the group, saying it found no evidence of stock manipulation, insider trading, or related-party misuse. The orders align with a Supreme Court-appointed expert panel’s earlier findings of no prima facie wrongdoing. The clean chit marks a step forward as the ports-to-power conglomerate seeks to restore investor confidence after months of regulatory scrutiny and speculation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.