Dhaval KapadiaMorningstar Investment Adviser

International gold prices recently crossed the USD 1300 per ounce mark. The last time it had been above this level was between June’16 and Sept’16, and prior to that between June’14 and Aug’14.

In the Indian context, gold prices have been close to Rs 30,000 per 10 grams since the beginning of the month of September. So, the question now is that is it a good time to invest in gold or is it a good time to exit?

To answer this question, we would need to understand some of the important factors that drive gold prices. Domestic gold prices mainly track international gold prices.

International gold prices are denominated in US dollar and hence share an inverse relation with US dollar i.e. its prices move up when the dollar weakens and vice-versa.

Historically, gold prices have also shared an inverse relation with US Federal Reserve rate. As interest rates increase, income (interest) generating assets like US Treasuries, become more attractive as compared to gold, which does not generate any income.

Another important factor that impacts the price of gold is its safe-haven appeal, as it has traditionally been viewed as a store of value.

Whenever markets go into a risk-off mode, demand for gold goes up, as its safe-haven appeal increases, while its demand goes down when markets go into a risk-on mode (indicated by volatility in financial markets).

Gold is also considered as a hedge against inflation, and in the Indian context, a hedge against depreciation of Rupee as well.

Gold prices have risen recently amidst escalating geopolitical tensions, ratcheted up due to hostile statements by North Korea, its testing of Intercontinental Ballistic Missiles (ICBM) which can reach the USA and the latest trigger being the nuclear test conducted by it.

US President Donald Trump as well has taken an aggressive posture. Moreover, US dollar has been weakening against a basket of major currencies (Dollar Index) since the beginning of 2017; it has weakened by 9.5%, as of 13th Sept’17.

Doubts over Trump administration’s ability to push through the economic reforms, that he had promised during his election campaign, has put pressure on the dollar.

Reports of somewhat subdued economic data in the US as well has led to a weakening of the dollar. Also, US Federal Reserve officials are increasingly sounding dovish in their view about the interest rate hike.

Where will gold prices go from here, in some measure depends on how the above-mentioned factors pan out in the future.

Additionally, to sight a few, it also depends on how the global economy grows, if and when does European Central Bank and Bank of Japan start easing their asset purchase programs, etc.

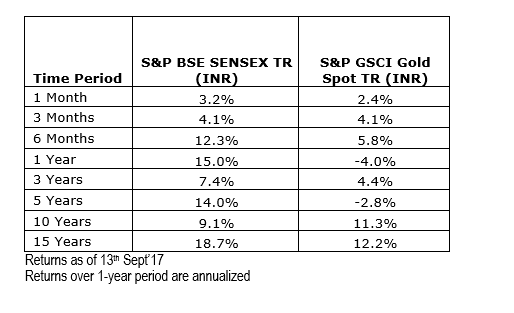

Obviously, there are no certain answers to these questions, and hence, like equities, timing investments in gold is very difficult. Moreover, historical performance of gold has been negatively correlated to that of equities.

This provides diversification benefit and ultimately results in lower volatility in the performance of the portfolio. A long-term analysis of the performance indicates that gold has typically underperformed equity.

Hence, allocation to gold could be strategic in nature i.e. around 5% to 10% of the total portfolio; depending on one’s risk appetite.

Gold Exchange Traded Funds (ETF) could be the preferred vehicle of investment; as compared to physical gold. The underlying asset of all the Gold ETFs is gold of 99.5% purity, thus the performance of most of the ETFs is quite similar.

The minor difference in their performance is on account of tracking error ( the difference between ETF’s returns and gold’s returns) and expense ratio.

Gold ETFs are easy to hold as they are in a dematerialized form. This helps in saving on the storage cost and avoid security risk. Also, their pricing is transparent and are listed on the exchange and their purity is guaranteed by the asset management company.

Disclaimer: The author is Director, Portfolio Strategist, Morningstar Investment Adviser (I) Pvt. Ltd. The views and investment tips expressed by investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!