The market had a spectacular run in 2020-21 with the benchmark indices rising about 70 percent, the best performance in a decade. The market recovered from the sharp downturn of March 2020 and soared above the record levels seen in January 2020.

Large FII inflow following stimulus plans announced by global central banks to revive pandemic-hit economies, signs of improving economic growth because of steps taken by the government and the Reserve Bank of India, better-than-expected corporate earnings in FY21 and lower interest rates were key drivers for the rally, though there was some volatility in recent weeks because of the second wave of COVID-19, higher commodity prices, rising US bond yields and dollar index.

"In FY21, we saw most businesses going through lot of turbulence while others especially the technology backed ones got the kick to take their business to new heights. Amidst all challenges, margins of many companies have improved and balance sheets have deleveraged in a structural sense," Vineeta Sharma, Head of Research at Narnolia Financial Advisors told Moneycontrol.

Indian equities received more than Rs 2.7 lakh crore of funds from foreign investors in the year FY21.

Experts feel the second wave of COVID-19 may impact market in short term, but remain optimistic about economic and earnings growth which could continue supporting the market.

"FY22 which was being expected to start on a healthier note is getting a bit shaky as commodity prices are up and exports / imports scenario isn't smooth too. These are the cyclical issues at the threshold of FY22. However, we are optimistic on growth of India Inc. via Chinese import reduction and Production linked Incentive scheme and feel this can give impetus to good revenue growth in FY22 and thereafter," Vineeta Sharma said.

Also, she believes financial companies should see an earning normalization as NPA remains under control.

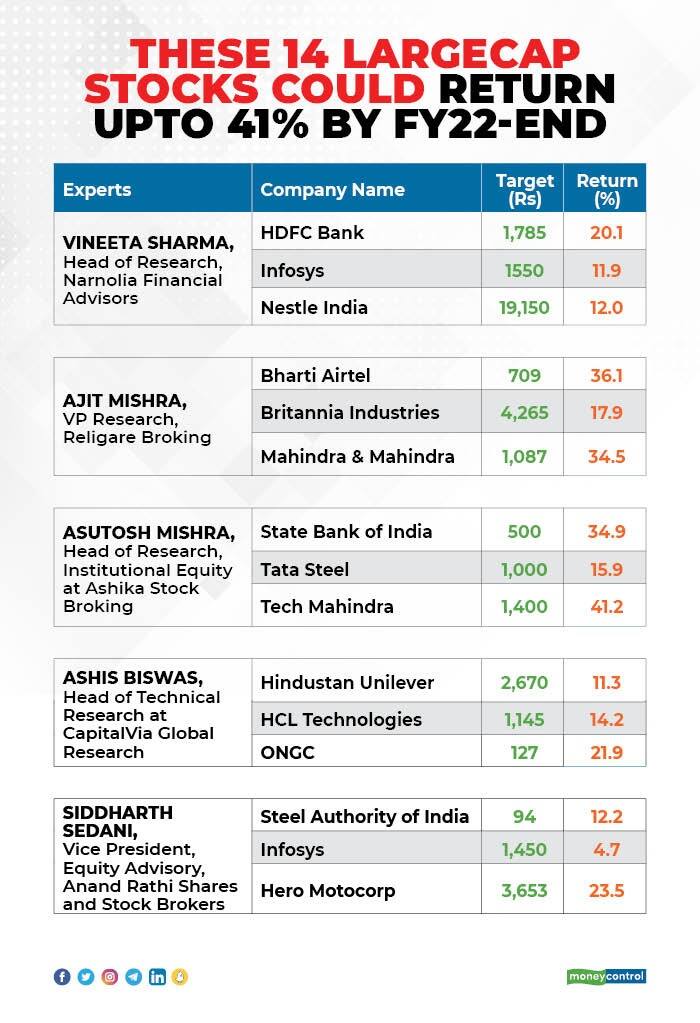

Here is a list of 14 stocks recommended by experts on Moneycontrol's demand for FY22:

Value migration from PSU to private banks is expected to continue out of which HDFC bank is expected to have a larger share as credit growth continues on the back of personal loan, credit card, business banking and wholesale segment. HDFC Bank is well placed to capture the growth in wholesale segment with better rated client.

Infosys: Buy | Target: Rs 1,550Company is having healthy TCV every quarter. Large deal wins in Q3 is $7.1 billion. Net new deals signed in 3Q were more than 1.5 times of what was signed in entire fiscal year 2020. We expect strong growth momentum in its business, market share gain, and increase in the speed of digital transformation. Balance sheet remain solid with cash and investments at $4.5 billion.

Nestle India: Buy | Target: Rs 19,150Market leadership in nearly 85 percent of the portfolio. During the current year, e-commerce channels contributed to the extent of 3.7 percent of domestic sales with 111 percent YoY growth and expect the trend to continue. The company has also planned an investment of Rs 2,600 crore. over the next 3-4 years which will give further impetus to Revenues.

Analyst - Ajit Mishra, VP Research, Religare BrokingBharti Airtel: Buy | Target: Rs 709Bharti Airtel is well placed to benefit from increased traction received in digital services during COVID times, which we believe is likely to continue. After a steady addition of customers, we believe Bharti can continue to gain market share in the mobile services business. In our view, the tariff hike would continue from here on, to reduce the financial stress on telecom companies which would benefit Bharti Airtel due to its strong customer base and healthy addition in 4G customers. Further, strong cash flow generation would also help in deleveraging of balance sheet.

Britannia Industries: Buy | Target: Rs 4,265Britannia Industries has posted strong growth numbers during the first wave of COVID as its large part of the product portfolio is present in the non-discretionary segment. Going forward, growth is expected to continue as the company’s strategy is to launch new and innovative products, focus on brand building and strengthening distribution reach. Besides, its efforts on improving margins via cost efficiency would be its core agenda. Apart from this, strong growth momentum from rural and international businesses will continue to support and lead to market share gains. Further, along with the optimistic management plan, the company has a strong balance sheet and decent cash flow which would aid growth.

Mahindra & Mahindra: Buy | Target: Rs 1,087We like M&M given its strong rural presence through farm equipment and automotive business. The domestic tractor industry has witnessed a healthy growth recovery from Dec-19 (volumes were impacted due to lockdown in March and April) led by the increase in the Kharif sowing area, thereby indicating a bumper harvest, good monsoons, higher government spending and favourable base effect.

We believe the trend is expected to continue on the back of expected normal monsoons, a good Rabi crop season and increase in MSP. Further, the supply side issues faced recently due to restrictions have eased considerably. The positive tractor industry growth prospect bodes well for M&M given its market leadership (41.2 percent market share), strong product portfolio, wide distribution network and new launches. Further, farm equipment being a major contributor to its operational profits (68.7 percent as on FY20), we believe it to be a key driver to M&M's earnings growth.

Expert - Asutosh Mishra, Head of Research, Institutional Equity at Ashika Stock BrokingState Bank of India: Buy | Target: Rs 500We expect an encouraging trend on asset quality to continue along with a strong recovery in loan growth in the coming quarters, which will put the bank firmly on the profitability path from FY22 onwards.

SBI continues to demonstrate strong performance on liability franchises despite the sharp cut in both savings as well as FD rates. The decline in cost of fund due to rationalization of deposit, the rate will give much-needed cushion to NIM’s of the Bank, and it in turn will keep operating profit at a healthy level.

This along with the strong performance of its financial subsidiaries make its one of the best bets in the banking space

Thus, we continue to maintain buy recommendation with target of Rs 500.

Tata Steel: Buy | Target: Rs 1,000Tata Steel is integrated across a steel value chain with 100 percent captive iron ore mines and 30 percent captive coking coal mines. Royalty premium is also at nominal level and thus making it one of the most efficient players in terms of sourcing of raw materials.

Recent rise in iron ore prices is leading to extra margin spread for the company and right now, it is making best EBITDA/t in the Industry for its India’s business which is well above Rs 25,000 per tonne.

Borrowings have seen sharp reduction on bumper profits during Q3FY21 and Q4FY21 is expected to end on a stronger note. We are expecting further reduction in debt levels. Thus, we continue to maintain buy recommendation with target price of Rs 1,000.

Tech Mahindra: Buy | Target: Rs 1,400Leadership position of Tech Mahindra in Telecom gives it a huge opportunity from Global rollout of 5G by non-Chinese players. This gives us a long-term revenue visibility.

Further, higher synergies between enterprise and telecom business are expected to support business growth. Thus, we remain positive from a long term perspective.

Expert - Ashis Biswas, Head of Technical Research at CapitalVia Global ResearchHindustan Unilever: Buy | Target: Rs 2,670We have witnessed the overall recovery in the FMCG Sector, led by smaller urban centres. Over the past three months, the metro and modern trade centre sales have witnessed an upward trend. We expect the company's EBITDA margins to improve YoY from both a standalone and consolidated basis.

The inclusion of the GSK Consumer Healthcare business is positive for the company. Earnings growth has gained momentum in recent years (17 percent EPS CAGR in the three years ended FY20 versus around 12 percent CAGR over the last 10 years).

HUL demonstrated capabilities of implementing cost-saving plans based on best-of-breed analytics and execution. Introduction of herbals range of product is key factors that will drive the earnings growth.

HCL Technologies: Buy | Target: Rs 1,145HCL Technologies remains one of the most lucrative stocks, trading at 15x FY23E P/E (38 percent /26 percent discount to TCS/Infosys) while delivering 20 percent earnings growth in FY21 YTD.

In Q3FY21, revenue rose by 6.4 percent year-on-year to Rs 19,302 crore (1.1 percent YoY, 3.5 percent QoQ on constant currency basis). Media and Telecom announced a significant sales increase due to one-time contract operation (12.1 percent QoQ in constant currency terms).

Manufacturing rebounded with a strong 5.6 percent year-over-year growth, while tech services rose 6.8 percent YoY (in constant currency terms). In FY22, higher IMS exposure (over 30 percent of sales) coupled with strong demand for Cloud services could help drive revenue growth of over 14 percent.

Oil and Natural Gas Corporation: Buy | Target: Rs 127We expect increasing gas prices and Brent crude oil prices (currently at $67 a barrel, up 50 percent from Q3FY21) will help ONGC achieve a 9–14 percent CAGR from FY21 to FY23.

The fertilizer and power industries use the most natural gas, accounting for half of the overall usable gas in India (155mmscmd). City gas distribution (CGD) accounted for 21 percent of global gas demand, with mining responsible for 10 percent and other industries accounting for the remaining 19 percent. This should be considered as positive for the stock.

We anticipate a 10 percent CAGR increase in Indian natural gas demand between FY21 and FY23, resulting in earnings growth of up to 25 percent CAGR (FY21–FY23).

Expert - Siddharth Sedani, Vice President, Equity Advisory, Anand Rathi Shares and Stock Brokers.Steel Authority of India: Buy | Target: Rs 94During the latest quarterly results, Steel Authority of India (SAIL) has reported a growth of 19.6 percent in sales in Q3FY20. The company's operating profit margins stood at 27 percent for the quarter against 7.2 percent YoY, one of the highest operating margins. The improvement in operating performance was mainly due to higher realization. In terms of volume, the company's steel sales rose 1.5 percent YoY to 4.15 million tonnes. For the nine-month period the company's sales stood at 10.6 million tonnes. In terms of guidance, the company expects to maintain its current run rate of sales volume of about 4.2 million tonnes and achieve about 17 million tonnes in FY22.

We believe the company to continue to benefit from better realisations in medium term, the expected increase in employee costs should be absorbed by improved realisations and increased share of value added products. Also, the stronger balance sheet due to lower debt augurs well for the company. We initiate coverage on SAIL with buy recommendation and a target price of Rs 94 per share.

Infosys: Buy | Target: Rs 1,450Infosys achieved the reported PAT of Rs 5,197 crore in Q3FY21, a growth of 16.8 percent year-on-year with a net margin of 20.1 percent translating into EPS of Rs 12.23 per share for the quarter. Infosys further enhanced its digital investments in Infosys Cobalt - the cloud services, platforms and solutions portfolio launched last quarter. The company has increased the revenue and margin guidance band to 4.5 percent-5.0 percent and 24.0 percent-24.5 percent respectively on the back of continued strong performance. The company achieved record large deals of $7.13 billion in Q3 with 73 percent being net new and revenues from digital offerings.

Hero Motocorp: Buy | Target: Rs 3,653Hero Motocorp is currently operating at nearly 100 percent production capacity with almost all customer touch points open. Further, with the peak festival season coming up in the months of October and November, the company's management is positive of achieving high sales number with the help of positive consumer sentiments.

With improvement in demand and improving macro-economic data especially from rural areas, we believe auto 2-wheeler industry is set to bounce back faster and Hero being a market leader in its segment should also benefit in medium term. We re-iterate our buy rating on the stock with a revised target price of Rs 3,653.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.