Global brokerage house Citi said there are some signs of a rebound in the real estate sector, but it is still a long way to go.

"Residential new launches appear to be bottoming and demand conditions remain weak. On top of that, tightening interest rate environment could take a further toll," the research house said.

So the recovery in realty space is likely to be protracted & gradual, it feels.

Phoenix Mills remains its top pick in the sector and maintain Sell call on DLF, Citi said.

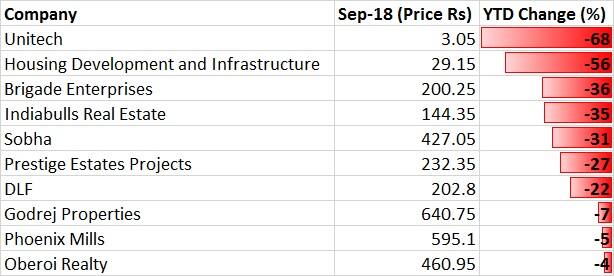

The realty space is the biggest loser among sectoral indices as the Nifty Realty index dropped nearly 25 percent year-to-date against 7 percent upside in Nifty50.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.