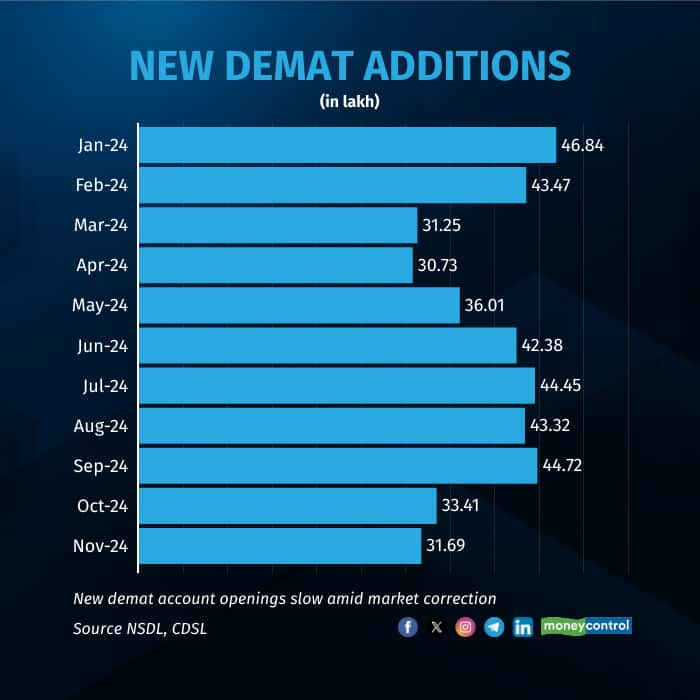

The growth momentum in new demat account openings appears to be losing steam. According to November data from depositories, while the overall demat account count continues to climb, the incremental addition of new accounts is witnessing a decline when compared to the recent months.

November saw 31.7 lakh new demat accounts being opened, the lowest in seven months. In October, a total of 33.4 lakh new demat accounts were opened. The latest number is also below the monthly average of 39.7 lakh recorded between January and October this year.

On an overall basis, a total of 182.1 million demat accounts were registered with NSDL and CDSL as on November end, up from 178.9 million the previous month.

Rajesh Palviya of Axis Securities attributed the slowdown to the market correction in October and November, which dampened enthusiasm for equity markets. Historically, periods of market growth tend to see surges in demat account openings, as investors are attracted by rising stock prices and the success of peers, he says while adding that when markets face correction, new account registrations typically slow down.

Another factor contributing to the decline is reduced activity in the derivatives market, partly due to new SEBI regulations. These changes have led to decreased opportunities in the options market, say market participants.

Moreover, the average daily turnover in both the cash and futures & options segments also hit multi-month lows in November. The combined average daily turnover on BSE and NSE in the cash market dropped to Rs 1.06 lakh crore, a 7.3% decrease from the previous month, marking the fifth consecutive month of declining turnover.

Similarly, the F&O segment saw a 16% month-on-month decline, reaching a seven-month low of Rs 334.69 lakh crore.

Despite this, analysts anticipate a recovery, with Indian markets showing signs of an upswing in recent sessions. This could lead to an uptick in demat account openings and trading volumes in the coming months, they say. Experts also point out that there is still significant potential for growth in demat accounts, given the relatively low penetration of equity markets.

Kranthi Bathini, Director of Equity Strategy at WealthMills Securities said while retail investor interest often spikes during bull markets, the recent slowdown is expected to be temporary, with robust growth in both demat accounts and trading volumes projected in the quarters ahead.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.