One two percent of finfluencers are SEBI registered, but 33 percent of them are openly giving stock recommendations flouting the regulatory norms, according to a report by CFA Institute.

The market regulator Securities and Exchange Board of India (SEBI) defines finfluencers as individuals who provide information on financial topics such as stock investment, personal finance, banking, insurance, and real estate through social media platforms. The report estimated that there are over 3.5 million social media influencers with a significant portion focussing on financial content.

The report, titled Clicks and Credibility-Understanding Finfluencers' Role in Investment Decisions and issued on March 20 report, surveyed 1,615 investors.

Investors' blind spot

The report showed how more than half of the survey participants failed to check the SEBI registration status of finfluencers even though they believed it was "extremely or very important".

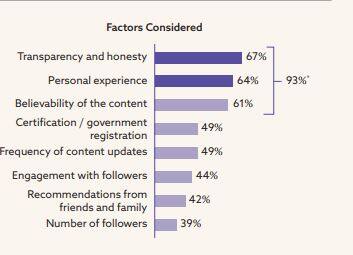

The study said, sixty seven percent believe it is extremely or very important for finfluencers to be SEBI-registered.

Among investors who mentioned an influencer’s registration status as being extremely important, more than half (53%) were unaware of their registration status.

Thirty five percent of those who follow financial influencers do not verify whether their preferred influencers are registered. This indicates a serious dichotomy and a critical flaw on the part of investors. It implies that we must go a long way to achieve the required level of investor maturity and their ability to take correct investment decisions as required according to their circumstances.

Other interesting findings:

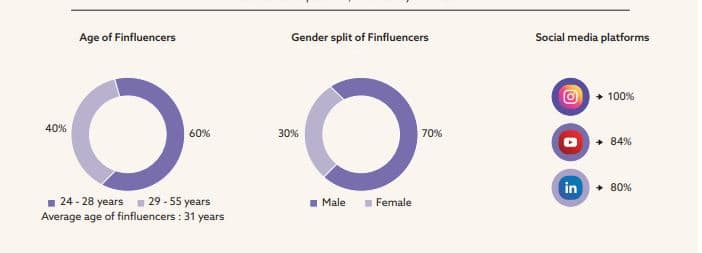

1. Young influencers: While influencers span age groups from as young as 24 years up to 55 years, most influencers are predominantly young (average age: 31 years), with 60% under 29 and a majority being male. Instagram is the most popular platform.

2. Emotional pull: Among those who said influencers had a serious influence on their decision making, emotional aspects like honesty, personal experience & believability of content are seen to be more important compared to registration.

3. Huge influence: Among respondents who follow financial influencers, 82% reported making investments based on their recommendations. Of these investors, 72% stated they made profits, but 14% of those aged 40+ experienced fraud or misleading advice. On this, investors who made profits from following influencers' advice, the report added that this may have been "heavily influenced by recent market performance over the last few years, where broader market indices have performed well, and trends such as the superior performance of small- and mid-cap stocks compared to large caps".

4. Hiding is common: 63% of influencers fail to disclose sponsorships or financial affiliations adequately. This is a concern and reflects poorly on whether sufficient disclosure is made regarding conflicts of interest. Those who do give disclosures, give these only in the captions or hashtags and do not give that information in the video.

5. The deciding factor: Investors prioritize higher returns (51%), followed by risk level (39%) and past performance (37%) when selecting an investment instrument.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.