Dear Reader,

For the third consecutive week, the Indian market closed on a high note, with broader indices outperforming the benchmark index, signalling a robust overall market performance. The Nifty50 ended with a gain of 0.85 percent, while the mid-cap index rose by one percent, and the small-cap index experienced an impressive jump of two percent.

This upward trend occurred despite continued selling by foreign institutional investors (FIIs) for the twelfth week in a row, with a total outflow of Rs 1,327.38 crore in the cash market. Notably, several sectors showcased strong performances, with PSU banks gaining five percent, real estate stocks climbing four percent, and defence stocks increasing by 3.4 percent.

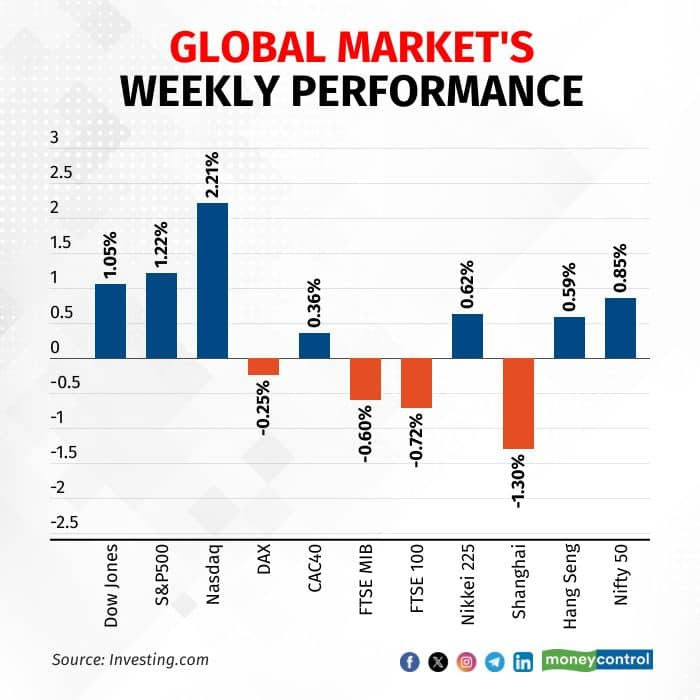

Meanwhile, major US indices reached record highs over the week, buoyed by the Federal Reserve's decision to lower short-term interest rates for the first time in nine months. However, this sense of optimism did not extend globally, as indicated by contrasting trends in other markets.

Source: Investing.com

Although technical and quantitative data suggest a strong market, the announcement by US President Donald Trump regarding a $100,000 annual fee on H-1B visas has introduced an element of surprise. Reports indicate that this fee may only apply to new issuances, yet analysts have varying opinions on the potential impact of this development. As a result, this uncertainty is expected to add to market volatility in the upcoming week.

Positive outlook

The Nifty index has been on an upward trajectory for three consecutive weeks, remaining above the crucial 20-week moving average. Currently, it has established itself above the significant level of 25,162, which coincides with the 61.8% retracement level. This technical movement indicates a bullish outlook for the market, with the next major resistance point identified at 25,669, a level last observed in late June 2025.

Conversely, the lower threshold to keep an eye on is 24,400.

From a technical perspective, the market is exhibiting a cup-and-saucer pattern, a formation often associated with bullish trends that could lead to a strong rally if the previous peak is surpassed.

Additionally, market breadth has shown consistent improvement, as indicated by the advance-decline ratio, which points to a potential rebound. Since reaching a low in mid-August, the breadth has significantly strengthened and is currently on an upward path. However, it still has some distance to cover before reaching levels typically considered overbought.

Source: web.strike.money

Since July 2025, the Client Net Index futures position has remained in an overbought state. Throughout the fall, clients have consistently rolled over their futures positions, anticipating a market rally. Historically, their approach has been to unwind their positions as the market climbs and enters oversold territory, typically at the market's peak.

However, recent data indicate that, despite a rally over the past three weeks, clients have retained mainly their positions, liquidating only a minimal amount. They remain far from reaching the oversold zone, which suggests that this rally is still in its early stages.

Source: web.strike.money

Foreign Institutional Investors (FIIs) are maintaining their short positions in the market. Although there has been some short covering amid a market rally, their overall stance remains in the oversold territory. Notably, the second-highest short position recorded by FIIs was on September 5, 2025, when it reached 191,415 contracts, but it has since decreased to 146,773 contracts.

In contrast to the net future positions held by retail clients, FIIs' net future positions tend to signal a market bottom when they are found in the oversold regions. Conversely, a market peak often occurs as they unwind their positions and shift into the overbought zone. Given the current data, it appears that there is still ample room for the market to grow before we can confidently declare it has reached its peak.

Source: web.strike.money

Stocks to watch

Among the stocks expected to perform better during the week are JSW Steel, Eicher Motors, Grasim, Polycab, Tata Steel, Unominda, Eternal, HDFC AMC, Maruti, Ashok Leyland, Laurus Labs and Amber.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!