Dear Reader,

The benchmark indices experienced a rally for the second consecutive week, with broader indices notably outperforming. The BSE Sensex increased by 0.86%, while the Nifty50 rose 0.93%. In contrast, the Midcap, Smallcap, and Largecap indices recorded gains of 2.3%, 5%, and 1.6%, respectively, indicating a significant rally across the market.

This rise in market indices occurred despite selling pressure from Foreign Institutional Investors (FIIs), who divested equities worth Rs 5,026.77 crore during the week. However, they were net buyers on three separate days, breaking their longest-ever selling streak. For November as a whole, FIIs sold equities totalling Rs 45,974.12 crore.

While the market appears to stabilise, a recent government report poses a potential threat to further gains. The second quarter's GDP growth was reported at 5.4%, significantly below the expected 6.5%. This disappointing figure reinforces concerns about an economic slowdown that had begun to surface during the previous quarter's results. Nevertheless, there is a glimmer of hope that these poor economic indicators may prompt the Reserve Bank of India (RBI) to consider a rate cut.

As Indian markets faced challenges, U.S. markets reached new highs during the week. The S&P 500 and the small-cap Russell 2000 achieved intraday highs, buoyed by news of a potential truce between Israel and Hezbollah that improved market sentiment. President-elect Donald Trump's nomination of veteran hedge fund manager Scott Bessent as Treasury Secretary added to the bullish outlook. Traders anticipate that Bessent will bring a Wall Street perspective to the role; following this news, 10-year Treasury yields fell by about 15 basis points, reaching their lowest level since October 24.

The European STOXX 600 closed 0.32% higher in Europe, overcoming uncertainties regarding U.S. trade tariffs. Germany's DAX rose by 1.57%, Italy's FTSE MIB declined by 0.7%, France's CAC 40 lost 0.29%, and the UK's FTSE 100 gained 0.24%.

Annual inflation in the Eurozone accelerated for a second consecutive month in November, rising to 2.3% from

2.0% in October, primarily due to base effects. Japan's Nikkei 225 fell by 0.2% as the yen strengthened against the dollar, posing risks to Japan's export-driven industries; it traded around JPY 150 compared to JPY 154 in the previous week.

Despite ongoing concerns about potential U.S. tariff hikes, Chinese equities saw an uptick as optimism for increased government support bolstered market sentiment. The Shanghai Composite Index rose by 1.81%, while the Hang Seng Index increased by 1.01%.

Structural strength

The Nifty index has recorded a second consecutive week of gains amidst significant volatility. The week began positively, buoyed by domestic election results. The gap zone, which was filled during the week, remains a crucial support level; as long as the market trades above it, we can consider the short-term outlook stable. However, we need to surpass the 24,350 mark for further upward movement.

Client positioning indicates a net long position of 181,775 contracts. While this figure is lower than its peak, it suggests that not all positions have been unwound, leaving room for potential upside until these trades are closed. Historically, similar positioning has led to new all-time highs, although this outcome is not guaranteed. At a minimum, we should expect a reasonable retracement of recent declines, potentially bringing us close to 25,000.

Source: web.strike.money

The 20-day Advance-Decline (A/D) ratio has pulled out from the oversold zone after a positive divergence we discussed in the last two weeks, but it is not overbought yet. The broad market has held out better than the Nifty, as the Small-cap index has already retraced 61.8% of the losses over the last two months. This trend should continue if breadth remains positive.

Source: web.strike.money

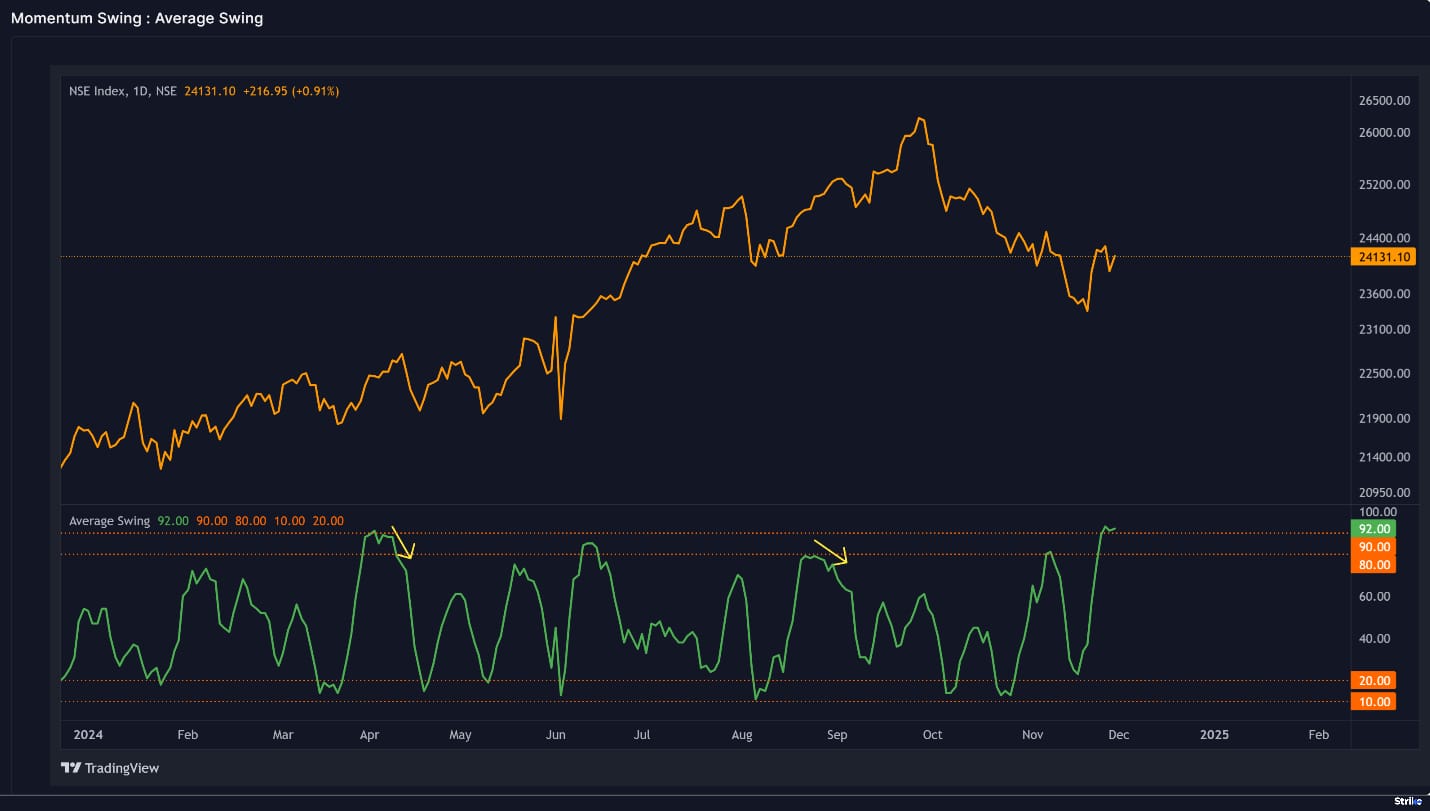

The average swing remains elevated at 93. This average swing is a smoothed representation of market fluctuations and can stay high even as prices rise. A genuine sign of weakness will occur if the swing shows a negative divergence from the underlying price. However, at this point, no such divergence is evident.

Source: web.strike.money

Sector Rotation

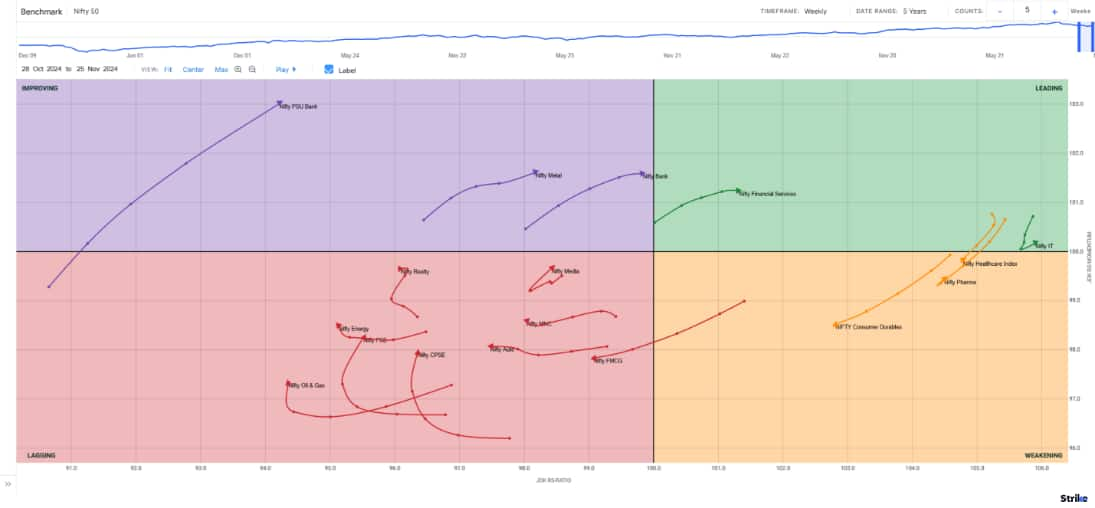

The Weekly Relative Rotation Graph (RRG) from India Charts shows Nifty Financial Services and Nifty IT in the leading quadrant, while relative momentum is increasing for Nifty PSU Bank.

Source: web.strike.money

Weekly RRG

It was a positive week for the markets, which saw an uptick in relative momentum for Nifty Bank, Financial Services, and PSU Banks. Nifty IT continued to be in the leading quadrant, while Nifty Realty and Consumer Durables showed improvement in relative strength and entered the leading quadrant.

Source: web.strike.money

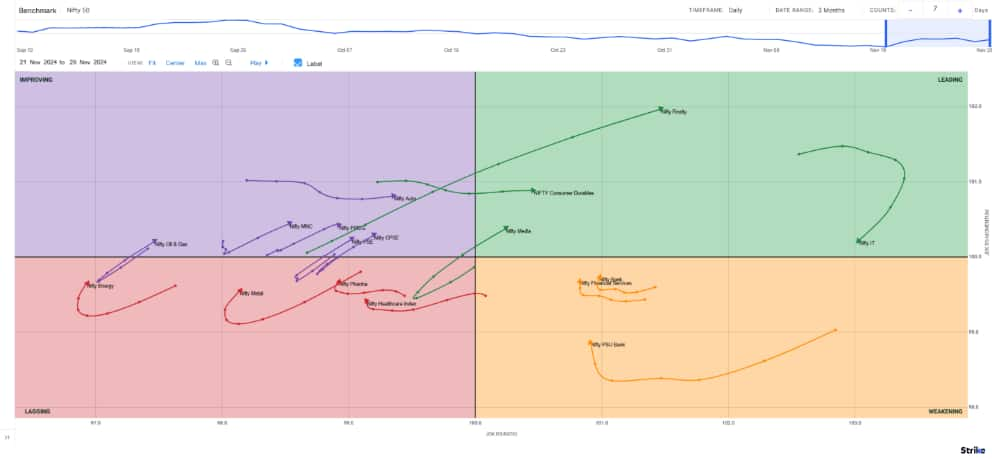

Daily RRG

Stocks to watch

Among the stocks expected to perform better during the week are Syngene, Coforge, City Union Bank, Divis Lab, Federal Bank, Indian Hotel, HDFC Bank and Persistent.

Among the stocks that can witness further weakness are RBL Bank, Asian Paints, Nestle India, IndusInd Bank, Delhivery, Bandhan Bank and DMart.

Cheers, Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.