Dear Reader,

US President Donald Trump finally announced the dreaded reciprocal tariffs. Global markets started falling on the news, and the fall accelerated by the end of the week when China decided to respond and announced a tariff on imports from the US.

The table below shows the performance of global markets during the week.

Indian markets declined during the week, although the impact was not as severe as that seen in Europe and the US. Benchmark indices dropped by approximately 2.62 percent, while mid-cap indices decreased by 2.5 percent. In contrast, small-cap indices fared better, losing only 1.6 percent during the same period.

Markets back in the bearish zone

Nifty closed below the weekly averages, placing us back in bearish territory. The market's attempt to recover at the end of the week was unsuccessful. The decline may persist in the coming weeks until we observe extreme oversold readings from the main indices.

Foreign Institutional Investors (FIIs), short nearly 200,000 contracts, reduced their positions to about 30,000. However, as the markets began to fall, they increased their short positions again. In hindsight, the short-covering rally ended without FIIs taking long positions, and it seems the market may continue to decline as they add to their shorts with every move. This week concluded with FIIs holding -86592 contracts short.

Source: web.strike.money

The 40-day A/D ratio reached levels closer to the 2022 bottom in early March 2025. From there, the markets have bounced back but are now selling off sharply again. If the market falls to new lows, we will have to wait and see if the A/D ratio makes a reading similar to those seen during the COVID low.

Source: web.strike.money

The short-term swing indicators are at 10 for the daily swing and 32 for the average swing. If markets open lower next week, the swing could fall far below 10 and become extremely oversold, creating a condition for a possible bounce ahead of RBI's MPC meeting. However, that may only result in a few days of bounce until the average swing also falls to oversold territory.

Source: web.strike.money

Sector Rotation

Nifty 50 – The Benchmark Index, corrected down by 2.61% to close at 22904.45.

Indices positioning on Weekly Timeframe

Weakening Quadrant: None of the sectorial indices are in this quadrant.

Lagging Quadrant: Nifty Pharma kept its momentum steady but underperformed the benchmark. Nifty IT lost a lot of strength and momentum.

Improving Quadrant: Nifty Energy and Nifty Infrastructure maintained their positive momentum while Nifty Oil and Gas remained steady. Nifty Metal could not gain strength and momentum and lift itself to the Leading quadrant.

Leading Quadrant: Nifty Private Bank, Nifty Bank, and Nifty Financial Services continued to outperform the benchmark and gain momentum.

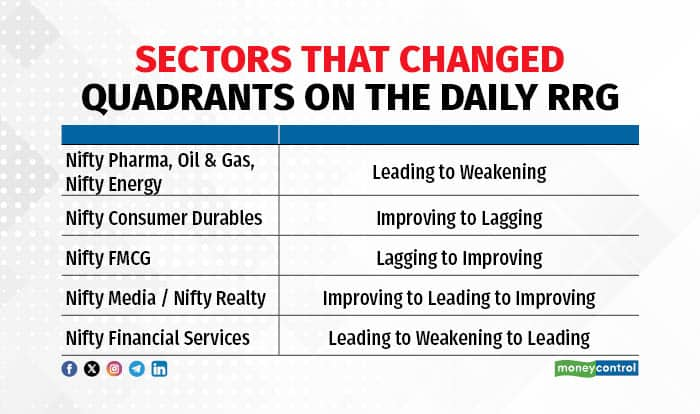

Indices position on the daily timeframe

Weakening Quadrant: Nifty Metal slowed down on its momentum last week, and this week, it underperformed the benchmark. Nifty Metal can enter the Lagging Quadrant.

Lagging Quadrant: Nifty Consumer Durables lost momentum throughout the week.

Improving Quadrant: Last week, Nifty IT entered this quadrant by showing some improvement in momentum. At the beginning of this week, it continued its positive momentum, but towards the end it fell. Nifty Auto also lost momentum; a further loss can take it to the Lagging quadrant. Nifty FMCG, the so-called defensive sector, gained momentum and entered this quadrant. Nifty Media and Nifty Realty lost momentum this week.

Leading Quadrant: Nifty Bank, Nifty Private Bank and PSU Bank, these indices were the market saviours this week. They continued their positive momentum and outperformed the benchmark. Nifty Infra lost momentum on the last day of the week and is headed towards the Weakening quadrant. Finally, Nifty Financial Services gained significant momentum on the last day of the week to re-enter this quadrant from the Weakening. This index needs to be kept on the radar.

Stocks to watch

Among the stocks expected to perform better during the week are JSW Steel, Bajaj Finserv, Kotak Bank, Indigo, ICICI Bank, Muthoot Finance and Bharti Airtel.

Among the stocks that can witness further weakness are BSoft, Tata Elxsi, Colgate Palmolive, JSL, Titan, HFCL, Idea, Zydus Life and TCS.

Cheers, Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.