Dear Reader,

With the ceasefire now in effect between Israel and Iran, Indian markets experienced modest gains. The broader indices outperformed the main indices, supported by positive global cues, including falling crude oil prices following the ceasefire in the Middle East and hopes for an extension of the Trump tariff deadline. Domestic factors, including a favourable monsoon forecast and moderating inflation, also contributed to the market rally.

For the week, the Nifty50 gained 2.09 percent, while it achieved a gain of 3 percent for the month. During this week, both the Large and Midcap indices increased by more than 2 percent each, while the Small-Cap index surged by 3.5 percent.

Foreign Institutional Investors (FIIs) continued their buying spree for the second consecutive week, purchasing Rs 4,423 crore, which brings the total for the month to Rs 8,320.48 crore.

On the sectoral front, the metal index rose by nearly 4 percent, while media stocks increased by 4.3 percent. The oil and gas index gained 3.2 percent, while PSU banks saw a rise of 2.5 percent. However, real estate stocks declined by 2 percent, and defence stocks fell by 1 percent during the week.

Global markets also rallied, driven by de-escalation in the Middle East, dovish comments from several Federal Reserve officials, and reports of a new trade deal signed between the US and China.

Technically, the market appears strong, and if the Middle East does not experience any more missile launches, we may see the rally resume.

Breakout markets

Nifty closed the second week positive. In doing so, it broke out of the five-week congestion zone and has started a rally to new highs. The move may pause for consolidation in the near term, but the overall trend should continue to be higher. We are heading into July, which has proven to be the best month in recent years from a performance perspective.

FIIs reduced their shorts considerably on expiry day this week by almost 70,000 contracts, and their net short in index futures ended at -33,518 contracts. From the lower red line, we are again witnessing short covering. The short covering should end with a long addition as well, so we have a long way to go.

Source: web.strike.money

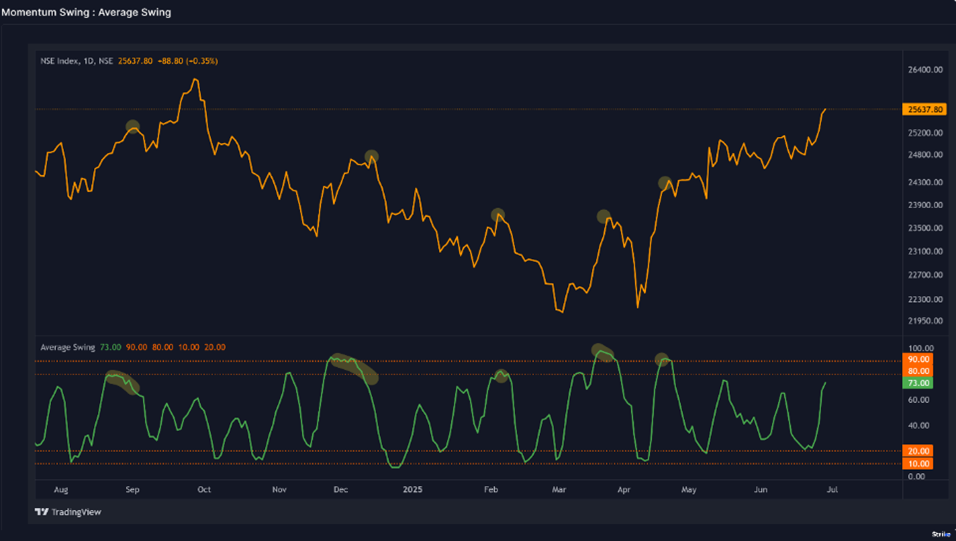

The average swing reads at 73. The reading is not above 80, and as seen during previous bullish phases, there is usually a negative divergence before the move ends. There are no signs of a divergence yet.

Source: web.strike.money

This chart is a histogram and shows the total open interest of calls minus puts in the market. If more calls are outstanding, you see green bars, and when there are more puts, you see red. Recent history shows that when a significant amount of short covering occurs (option writers covering calls they sold earlier), the Put Open Interest (OI) exceeds the Call OI.

The red readings below are associated with market tops or, at the very least, a point where the market needs to consolidate before continuing higher. The last two days were red bars. When the red turns green, it means the market has reversed from its bullish extreme. Keep an eye out for this change.

Source: web.strike.money

Sector Rotation

Nifty 50 – The Benchmark Index rose higher by 2.09 percent this week and closed at 25637.80.

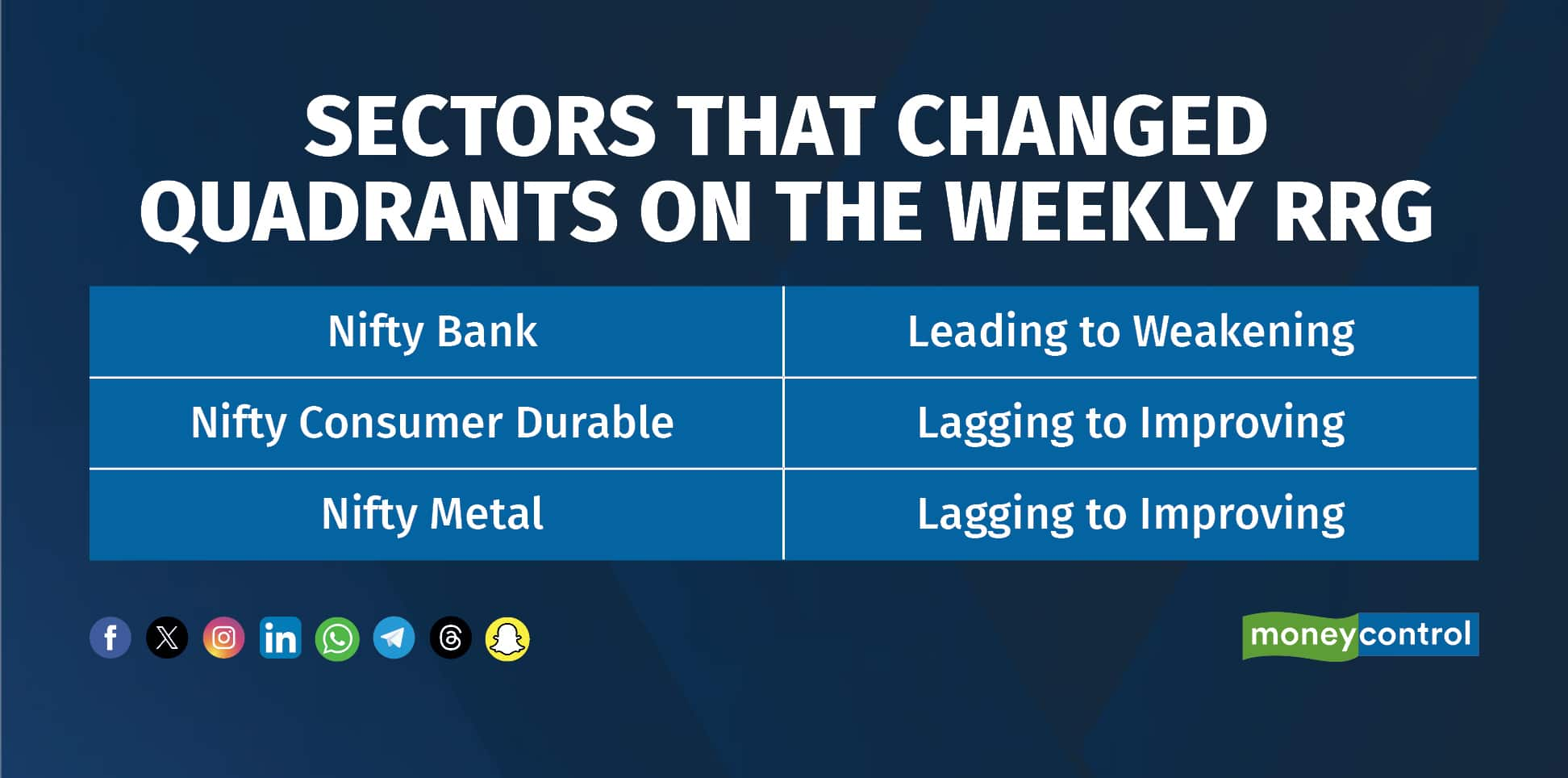

Indices positioning on Weekly Timeframe

Weakening Quadrant: Nifty Financial Services and Nifty Private Bank continue to see deteriorating momentum and relative strength. This week, the Nifty index has entered the weakening quadrant due to deteriorating momentum and relative strength.

Lagging Quadrant: Nifty Pharma and Nifty FMCG continue to exhibit deteriorating momentum and relative strength, with no signs of a turnaround yet. Their underperformance is likely to continue in the near future.

Improving Quadrant: Nifty Realty, Nifty Auto, and IT index continue to gain momentum and relative strength. The relative strength of the Nifty Media and MNC indices continues to improve. The momentum of the Nifty Energy index continues to weaken. Nifty Metal has seen a strong increase in momentum and relative strength, making it an interesting sector to watch out for in the short to medium term.

Leading Quadrant: Nifty PSE, PSU Banks, Infra, and Oil & Gas indices' momentum continues to weaken. While the relative strength of all these indices is improving, falling momentum can eventually drag them into the weakening quadrant. Watch how the momentum behaves for these indices in the coming weeks.

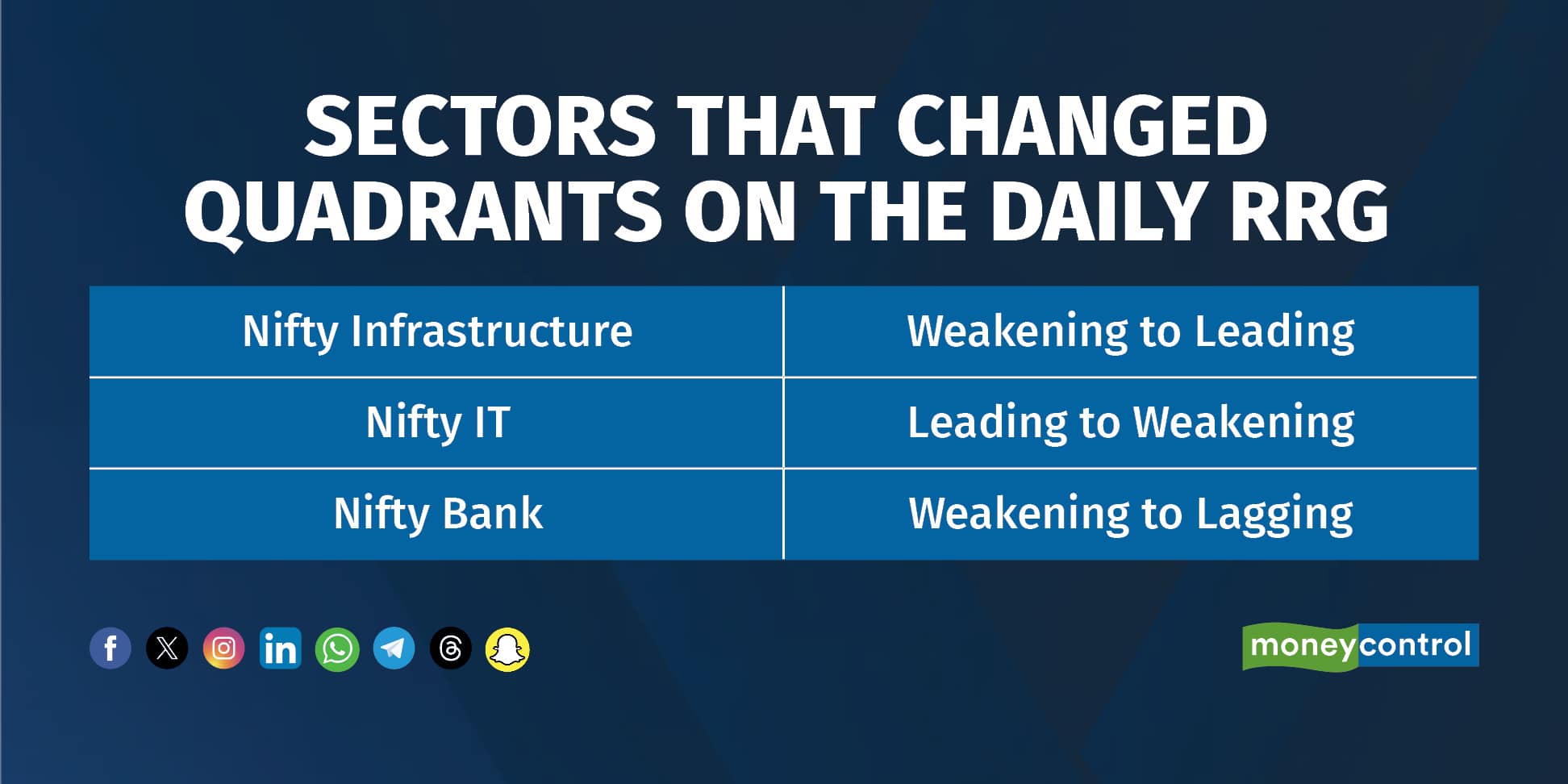

Indices positioning on Daily Timeframe

Weakening Quadrant: Nifty IT has gone into the weakening quadrant due to a loss of momentum and relative strength against the benchmark index. The Nifty Media and Nifty Private Bank Indexes are also showing weakening momentum and relative weakness. If this trend persists, they may soon enter the lagging quadrant.

Lagging Quadrant: Many indices, such as Nifty Auto, Nifty Oil & Gas, Nifty Financial Services, Nifty MNC, Nifty Metal, Nifty Energy, and Nifty PSE, are in the lagging quadrant but are seeing some pickup in momentum. The Nifty Pharma index’s momentum and relative strength have deteriorated significantly this week, with no signs of a turnaround yet. The Nifty Bank index has entered this lagging quadrant this week.

Improving Quadrant: Nifty Consumer Durables is in the improving quadrant, with continued momentum and relative strength.

Leading Quadrant: Only Nifty Infrastructure is in the leading quadrant, and it is seeing a pickup in momentum and relative strength.

Stocks to watch

Among the stocks expected to perform better during the week are BEL, MFSL, AB Capital, AU Bank, Poonawalla, ICICI Bank, HDFC Bank, Kotak Bank, LTF, Federal Bank and M&M.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.