The mutual fund distribution sector continued its strong momentum in FY25, with top distributors reporting significant gains in both commissions and assets under management (AUM). Collectively, the top 10 distributors recorded a 39 percent increase in commissions, rising by Rs 2,584 crore to Rs 9,265 crore in FY25 when compared with FY24.

Commission growth

NJ Indiainvest retained the top position, with gross commissions rising 62 percent from Rs 1,610 crore in FY24 to Rs 2,608 crore in FY25. State Bank of India held the second spot with commission increasing 32.6 percent to Rs 1,514 crore, while HDFC Bank grew 29.5 percent to Rs 1,038 crore.

Boutique and advisory distributors also showed steady growth. Prudent Corporate Advisory Services climbed two ranks to fourth, posting a 42.3 percent increase in commission to Rs 1,058 crore, while Anand Rathi Wealth registered the highest percentage growth at 46.9 percent, reaching Rs 454 crore. ICICI Securities, despite a 17.9 percent increase to Rs 679 crore, fell two ranks from fourth to sixth.

Banks also posted strong gains in commissions. Axis Bank’s gross commissions rose 26.1 percent to Rs 766 crore, ICICI Bank’s rose 29 percent to Rs 512 crore, Kotak Mahindra Bank increased 29.9 percent to Rs 417 crore, and 360 ONE Distribution Services grew 25.5 percent to Rs 219 crore.

AUM expansion

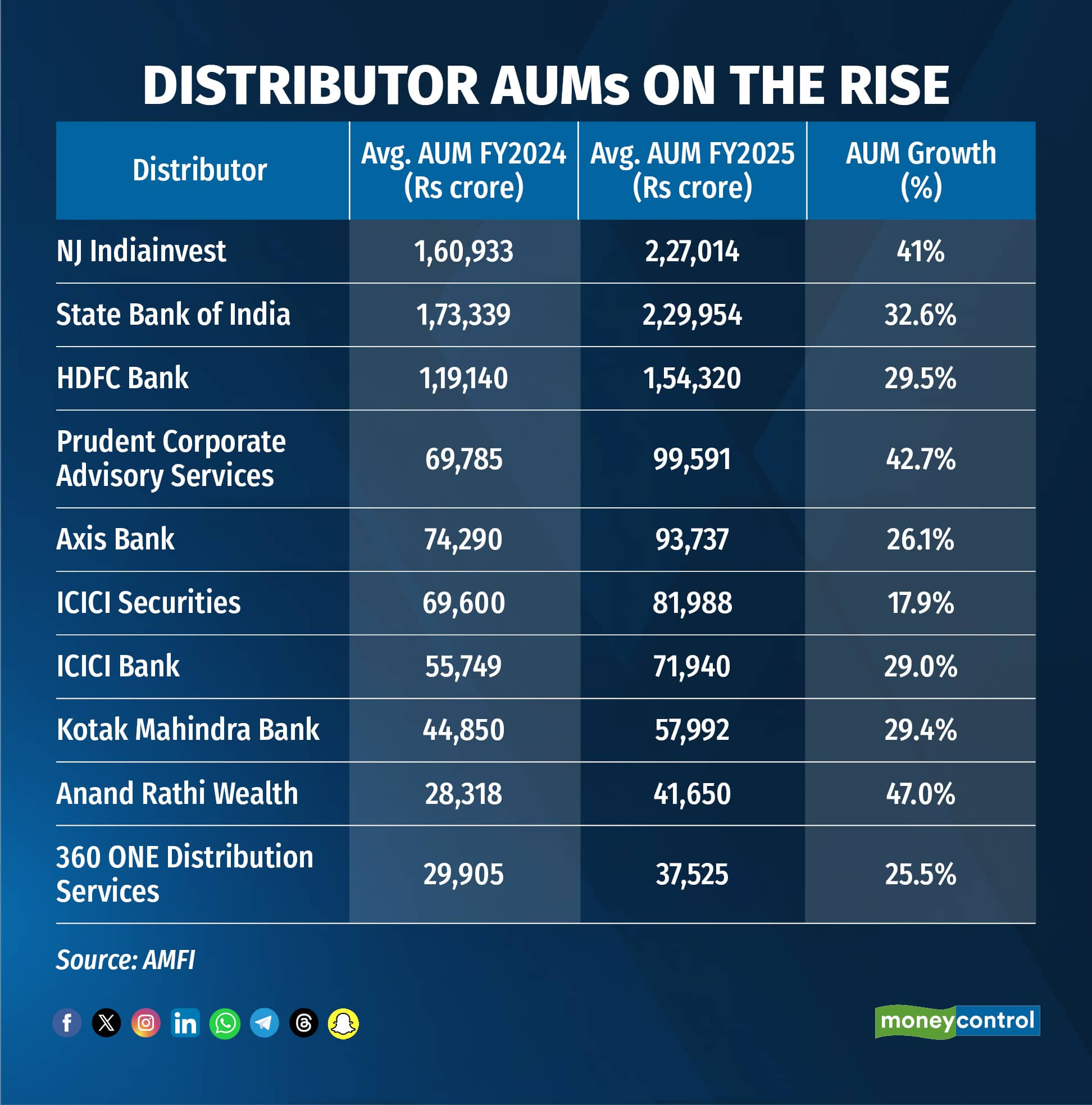

Growth in commissions was mirrored by AUM increases as well. NJ Indiainvest’s AUM rose 41 percent to Rs 2,27,014 crore, while SBI’s AUM increased 32.6 percent to Rs 2,29,954 crore making it the largest distributor in terms of AUM. HDFC Bank’s AUM grew 29.5 percent to Rs 1,54,320 crore.

Boutique distributors showed even higher relative AUM growth, with Prudent Corporate Advisory Services’ AUM climbing 42.7 percent to Rs 99,591 crore and Anand Rathi Wealth’s AUM jumping 47 percent to Rs 41,650 crore. Mid-sized banks also contributed, with Axis Bank’s AUM rising 26.1 percent to Rs 93,737 crore, ICICI Bank to Rs 71,940 crore (29 percent), Kotak Mahindra Bank to Rs 57,992 crore (29.9 percent), and 360 ONE Distribution Services to Rs 37,525 crore (25.5 percent).

Yield, the ratio of commission to average AUM, reflects how efficiently a distributor converts managed assets into revenue. Boutique distributors like Anand Rathi Wealth and Prudent Corporate Advisory Services have higher yields (1.09 percent and 1.06 percent) compared with banks (0.58–0.82 percent).

Mutual fund industry sees momentum

The mutual fund industry saw continued growth in FY25. As of July 31, total AUM reached Rs 75.36 lakh crore, up 21.6 percent from Rs 61.98 lakh crore in July 2024. Individual investors held Rs 43.91 lakh crore, with institutional holdings at Rs 31.45 lakh crore.

SIP contributions hit a record Rs 28,464 crore, a 12.4 percent increase from Rs 25,320 crore a year earlier, with 9.11 crore active SIP accounts. Equity inflows totalled Rs 42,702 crore, while debt mutual funds recorded Rs 1.06 lakh crore in net inflows. New fund offers continued steadily, with 30 schemes raising Rs 30,416 crore.

Meanwhile, recent regulatory measures impacted distributor operations. In August, SEBI eliminated the provision allowing AMCs to pay transaction charges to distributors for investments above a threshold, prompting revisions in payout norms. Additionally, AMFI introduced a 12-month cooling-off period for trail commissions: if an investor switches distributors, the new distributor does not earn commission on those assets for a full year. Investors also have 11 calendar days to approve or reject distributor change requests.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.